The summer of 1999 was hot and long. Words like “dot com” or “web” sounded the way “3D printers” or “e-cigarettes” sound today. The web was the next big thing, and online traveling sites were regarded as gold mines by many. In this context, online travel booking company Priceline.com Inc (NASDAQ:PCLN) saw its share price reach almost $1000.

The aftermath was terrible. Priceline.com Inc (NASDAQ:PCLN)’s shares dropped all the way down to $10. The company kept growing its revenue patiently, but its stock kept trading at levels well below the historic maximum price.

Surprisingly, the recent revenue figures and earnings beat caused the stock price to reach levels similar to 1999 again. However, the question most investors ask themselves nowadays is: How long will Priceline.com Inc (NASDAQ:PCLN) be able to keep its current price level, considering it is already trading at around 30 times earnings, well above the standard 17 times for the Standard & Poor’s average?

The latest earnings call

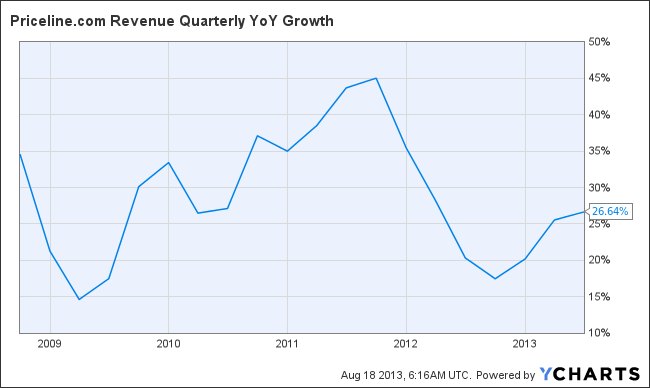

Judging from the latest earnings call, there are plenty of reasons that justify Priceline.com Inc (NASDAQ:PCLN)’s current stock price. Investors are valuing Priceline as a growth stock because even after 14 years in the same business, it can increase its total gross travel bookings by approximately 27%-34%.These are amazing growth figures for a commercial site that has been online since 1998!

Net earnings also rose by 24% to $437.3 million, resulting in GAAP earnings per share of $8.39.

The secret of such success probably relies on the increase in international bookings (44%), well above the 12% increase in U.S. bookings, where Priceline already has a strong market share.

Both hotel room nights and rental car days coming from Rentalcars.com were also growth drivers. Rentalcars.com is an early star in Priceline’s websites portfolio, which confirms the fact that the giant is capable of building successful new websites. It seems Priceline.com Inc (NASDAQ:PCLN) is taking advantage of the huge traffic its hotel reservation websites get to convert hotel booking into car rentals using cross promotion campaigns.

Why I’m a careful bull

The ability of building successful new websites in segments other than hotel bookings and the fact that Priceline currently accounts for only a fraction of international hotel bookings indicates the company’s amazing growth period will not be over any time soon. But the company faces some important challenges.

One of these bearish factors is, ironically, the relatively high margin that Priceline.com Inc (NASDAQ:PCLN) enjoys. Gross bookings made up 16.6% of total revenues.. In other words, for a $100 hotel room that is booked, Priceline.com will get a $16.60 commission. This seems too high to be sustainable in the long run, considering the current levels of competition.

Another risk involves the increasing relevance of meta-search websites. Meta-search sites, like Adioso.com or Cheapflights.com, aggregate travel search results from hundreds of travel service providers. When compared to traditional booking sites, meta-search sites offer more search results simply because they can have access to wider databases to fetch more info. This could, according to the latest 10-Q, potentially reduce the traffic to Priceline’s websites and increase user acquisition costs.