We came across a bullish thesis on Power Solutions International, Inc. on X.com by TheValueist. In this article, we will summarize the bulls’ thesis on PSIX. Power Solutions International, Inc.’s share was trading at $54.48 as of December 2nd. PSIX’s trailing P/E was 10.28 according to Yahoo Finance.

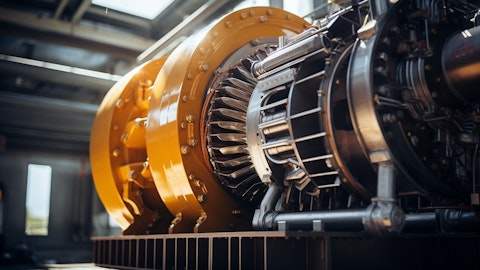

Christian Lagerek/Shutterstock.com

Power Solutions International, Inc. (PSIX) designs, integrates, and manufactures emission-certified engines and turnkey power systems for standby and prime-power applications across industrial, transportation, and power-generation markets. Its offerings include bare engines, fully packaged generator sets, and custom enclosures, addressing mission-critical applications such as data centers, oil & gas, and other fast-deployment power needs.

Manufacturing and engineering are concentrated in seven U.S. facilities totaling roughly 1 million square feet, with an expansion underway in Wisconsin, and a strategic partnership with Weichai supports global supply-chain access and additional capacity.

The company has pivoted toward higher-growth power systems, which represented 68% of 2024 revenue, while industrial and transportation sales declined due to sector-specific pressures. FY2024 revenue was $476 million with net income of $69 million, and warranty costs fell sharply, reflecting a reduction in legacy transportation exposure.

Momentum accelerated in 2025, with Q2 net sales up 74% year-over-year to $192 million and net income of $51 million, supported by a revised $135 million revolving credit facility and a $29 million deferred-tax asset release that eliminated prior going-concern uncertainty. Consensus forecasts indicate 2025–2026 revenue of $606–$678 million and EBITDA of $104–$115 million, reflecting a 19% CAGR with modest gross-margin compression and strong operating leverage. Free cash flow is projected at $56–$89 million, supporting a mid-single-digit FCF yield.

Demand is increasingly driven by AI and data-center on-site generation, where fast-start, site-integrated solutions are valued. Competitive pressure remains high from global incumbents, and PSIX faces customer concentration and supply-chain risks. Governance dynamics and Weichai’s share sales remain material variables. Nevertheless, the company has transitioned into a cash-generative integrator with a tangible growth runway, attractive free cash flow, and potential for rerating if data-center power demand sustains and execution across scale, margin, and governance variables remains disciplined.

Previously we covered a bullish thesis on Power Solutions International, Inc. (PSIX) by LongTermValue Research in April 2025, which highlighted the company’s pivot toward high-growth datacenter power, margin expansion, and strong free cash flow. The company’s stock price has appreciated approximately by 110.18% since our coverage. The thesis still stands as PSIX remains well-positioned. TheValueist shares a similar perspective but emphasizes 2025–2026 financial momentum and governance risks.

Power Solutions International, Inc. is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 10 hedge fund portfolios held PSIX at the end of the second quarter which was 13 in the previous quarter. While we acknowledge the risk and potential of PSIX as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than PSIX and that has 10,000% upside potential, check out our report about this cheapest AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy NOW

Disclosure: None.