Investing in emerging markets can be risky, but these countries also offer some truly amazing long term buying opportunities for entrepreneurial investors with an adventurous spirit and the will to move beyond national borders when it comes to looking for the best investment alternatives.

A high quality Buisness

After the 2008 merger of Itau and Unibanco, Itau Unibanco Holding SA (ADR) (NYSE:ITUB) became the biggest nongovernment bank in Latin America, it owns an undisputed leadership position in its home country Brazil, and it also has presence in neighboring countries like Chile, Argentina, Paraguay and Uruguay.

Source: Itau Unibanco istitutional pesentation

This size advantage means lower financing costs versus its competitors, and it also a puts the company in a position of strength when it comes to servicing global corporations and businesses with operations in different Latin American countries.

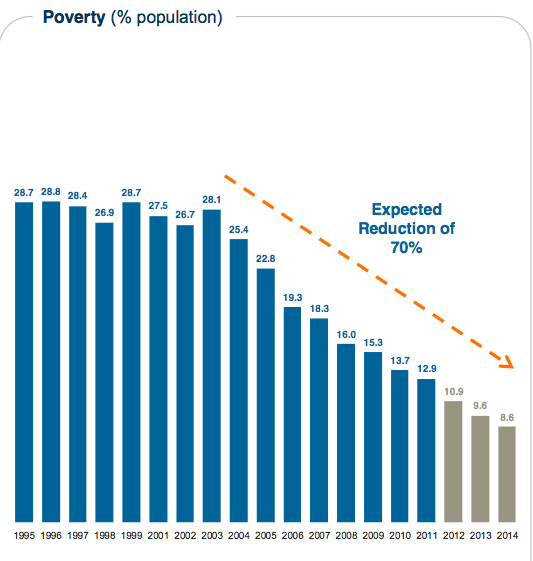

The Brazilian banking industry is supported by strong secular tailwinds, falling poverty levels and an expanding middle class bode particularly well for the sector. Credit and all kinds of financial services tend to move in tandem with disposable income, so economic development in Brazil translates into booming demand for the financial industry, and Itau Unibanco Holding SA (ADR) (NYSE:ITUB) is benefitting from this trend and delivering double digit growth rates.

Source: Itau Unibanco istitutional pesentation

Although economic indicators like credit/GDP and mortgage/GDP have been growing rapidly over the last years, they are still well below levels observed in developed countries. Macroeconomic tailwinds will continue producing above average growth opportunities for Itau Unibanco Holding SA (ADR) (NYSE:ITUB) for years to come.

Source: Itau Unibanco istitutional pesentation

Blame it on Rio

The Brazilian economy has been decelerating over the last years, GDP growth has come down from 7.5% in 2010 to 2.7% in 2011 and 0.9% in 2012. This comes as a consequence of a combination of factors, both external and internal.

Strong currency appreciation, global uncertainty and the slowdown in China are part of the problem, but also is loss of competitiveness due to a record low jobless rate and rising salaries over the last years. Taxes in Brazil are also high in comparison to other countries, and there are some infrastructure bottlenecks too.

The government has been implementing measures to reduce internal costs and cut expenses in areas like energy and telecommunications with a combination of reduced taxes and more aggressive measures aimed at forcing companies to reduce their prices. These interventionist measures have backlashed to some degree, as they have increased uncertainty and generated some criticism from economists and business leaders.

The sun will rise again

But things seem to be turning for the better as the Brazilian government seems to be taking a more business friendly approach to the problem lately. Authorities have reduced taxes on staples goods and duties on cars and appliances in a move to put some money back into of consumers´s pockets while at the same time reducing inflation. In March, the Brazilian government unexpectedly allowed the state-controlled oil company Petroleo Brasileiro Petrobras SA (ADR) (NYSE:PBR) to increase diesel prices. This decision was a big positive for investors in the company, as Petroleo Brasileiro Petrobras SA (ADR) (NYSE:PBR) has been forced to sell fuel at below international prices to help control inflation in the last years.

This decision may be targeted at signaling a change in direction, Petroleo Brasileiro Petrobras SA (ADR) (NYSE:PBR) needs to invest $236.7 billion in the 2013-2016 period in order to develop its massive offshore oil fields. The company can certainly benefit from improved profitability and better internal cash flow generation and, perhaps more importantly, it marks a shift away from government interference and towards market oriented economic policies.

Most analysts are expecting better growth rates in Brazil during this year, and 2014 should be even better as the country increases infrastructure spending in preparation for the 2014 soccer world cup and the 2016 olympics. Even if the era of ultra high growth fueled by booming commodity prices is in the past, there is no reason to believe Brazil cannot deliver growth rates in line with other emerging countries in the area of 3%-4% over the next years.

If – or when – that happens, Itau Unibanco Holding SA (ADR) (NYSE:ITUB) looks ready for appreciation since the stock is trading at historically attractive valuation levels both in terms of P/E and Price to Book Value due to the economic uncertainty surrounding the country and the company.

Bottom line

Itau Unibanco Holding SA (ADR) (NYSE:ITUB) is a unique company in a privileged position to capitalize strong secular tailwinds over the next years. Now that the stock is cheap due to economic concerns, maybe its a good tome to grab some shares and bank on a Brazilian recovery.

The article This Brazilian Giant Is Undervalued originally appeared on Fool.com is written by Andrés Cardenal.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.