If you own an animal companion you know you would move heaven and earth to keep it healthy. Pet ownership of dogs and cats has almost tripled from 67 million in 1970 to 164 million in 2013 according to the Humane Society of the United States. Consumer research company Packaged Facts found Americans spend $41 billion annually on pets. That figure has doubled in the last decade.

Based on these numbers, having a pet stock is a good idea for a portfolio. Pet health stocks, like dogs or cats, come in different sizes with different characteristics. Bloomberg Business Week noted that after consumer electronics, pet care is the fastest growing retail segment.

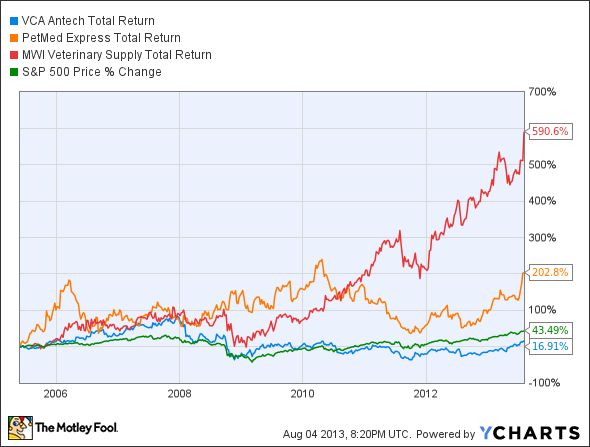

WOOF Total Return Price data by YCharts

The small-cap breed

You can screen for small caps with yield over 3.5% and find maybe a hundred or so. But when you further refine it for gross margins over 25% and no debt you are left with only a few names.

One is Petmed Express Inc (NASDAQ:PETS), a direct to consumer pet pharmacy better known as 1-800-PET-MEDS. It trades at a trailing P/E of 18.81 with a 4.00% yield. The company has raised the dividend for over five years, announcing a 13% increase on July 25. Its trailing gross margin is 33.80%.

The stock is up 74.07% over the last year. However, the stock could bite back with a short interest at 36.70% and has grown from 26.70% in the spring.

On July 22 Petmed Express Inc (NASDAQ:PETS) reported earnings that surprised the Street with sales up 7.6% yoy and an increase in order size as well as gains in reorders. The company also reported an increase of 22% to EPS at $0.24 and an acquisition of 10,000 new customers. The company has increased its television advertising to continue its new customer momentum and take share away from Wal-Mart’s nascent prescription pet medication business.

A direct competitor is MWI Veterinary Supply, Inc. (NASDAQ:MWIV), another small cap but at $1.9 billion three times the market cap of Petmed Express Inc (NASDAQ:PETS). This company sells animal health products direct to veterinarians in the US and UK and offers thousands of products to the trade. The stock is up 58.21% over the last year.

MWI Veterinary Supply, Inc. (NASDAQ:MWIV) trades at a higher trailing P/E of 30.51 with no yield but earns a five star CAPS rating. The company reported Q3 earnings on July 29, guiding higher, beating EPS expectations by $0.12 with $1.24 in EPS and reporting revenues $1 million lower than expectations but still bringing in $606.4 million.

The company is growing by acquisition, acquiring PCI Animal Health last December and mentioning on the call they are keeping cash on hand for other possible accretive purchases.

This one has a short interest of only 3.90% but its debt/equity ratio is a growing 16.44. These two companies are trading at similar price/book of 4.83 for MWI Veterinary Supply, Inc. (NASDAQ:MWIV) and 5.09 for Petmed Express Inc (NASDAQ:PETS).

One advantage Petmed Express Inc (NASDAQ:PETS) has is a lean workforce of only 206 employees while MWI Veterinary Supply, Inc. (NASDAQ:MWIV) has a workforce close to eight times larger at 1,629 with a sales force of some 331 sales reps in the field and another 176 telephone sales reps.

However, MWI Veterinary Supply, Inc. (NASDAQ:MWIV) has them beat on growth with 14.67% EPS growth expected per annum. It competes with mid cap Henry Schein which sells supplies and equipment to veterinary, dental, and medical practices.

A mid-cap breed

VCA Antech Inc (NASDAQ:WOOF) has a market cap of $2.60 billion and runs in two separate divisions, Animal Hospital and Laboratory. VCA Antech operates 609 animal hospitals and 55 veterinary diagnostics laboratories in the US and Canada.

VCA Antech Inc (NASDAQ:WOOF) reported Q2 earnings on July 25 announcing revenues of $465.3 million, a 6.1% increase yoy and adjusted diluted EPS of $0.46, 13.6% increase. Best of all CFO Thomas Fuller said,”Our consolidated operating margins were up 130 basis points to 16.0%, which — this second quarter is our second consecutive quarter of actually increasing consolidated operating margins, so that’s a great sign.” (source)

Margin expansion was the first topic of the analyst Q&A and CEO Robert L. Antin answered they were able to expand margins by better labor and supply-side management and reductions in animal hospital expenses.

The stock, while expensive at a 40.84 trailing P/E, is trading near its 52 week high of $29.38, up 55% over the last year. The forward P/E comes down to 16.37 with a PEG of 1.40. The company bought back $4.6 million worth of shares in the quarter, keeping cash at the ready for opportunistic acquisitions and more share repurchases.

Although VCA Antech competes with Idexx Laboratories in the animal diagnostics space, VCA Antech has the advantage; its dignostic tests are referrals from its own animal hospitals, thus creating a defensible moat.

The big dog in the room

Zoetis, formerly the Animal Health Unit of Pfizer, debuted on February 4 as one of the biggest IPOs since Facebook. As the biggest global animal health company, Zoetis added revenues of $4.3 billion to Pfizer’s coffers in 2012 alone. The trailing P/E is high at 33.27.

Although big-cap Zoetis has a yield of .90% it attracts a sizable short interest of 22.90%. Zoetis has several big pharma competitors in the space like Merck, Sanofi, Eli Lilly and Bayer but with an ever-expanding addressable market growth looks good. It has a PEG of 1.45.

Going forward things look bright for Zoetis as agricultural demand continues for livestock products that accelerate growth, such as antibiotics and products that reduce the need for water for livestock.

The company reports on August 6. Zoetis’ stock temporarily dived after a stock for stock deal in which Pfizer sold its 80% stake in Zoetis but earnings as a standalone should be a clue as to whether to buy or sell this company.

But they’re all so cute!

It’s hard to pick one pet stock from the litter but one is all you need to diversify a portfolio with such a growing global market. Whether you go small with yield in PetMed Express, for growth with MWI Veterinary Supply, big with Zoetis and its dual advantage as a global and agricultural play, or mid-cap VCA Antech for margin expansion, you should find a pet stock to keep you warm at night.

AnnaLisa Kraft has no position in any stocks mentioned. The Motley Fool recommends VCA Antech.

The article Wagging the Tailwinds With Pet Stocks originally appeared on Fool.com and is written by AnnaLisa Kraft.

AnnaLisa is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.