World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

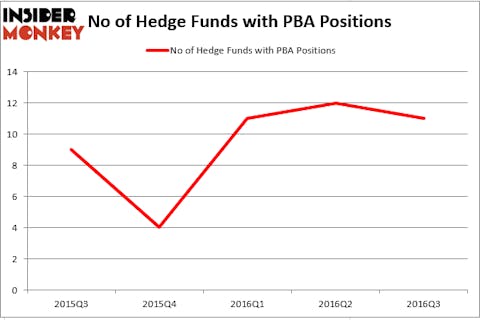

Pembina Pipeline Corp (NYSE:PBA) has seen a decrease in enthusiasm from smart money in recent months. PBA was in 11 hedge funds’ portfolios at the end of September. There were 12 hedge funds in our database with PBA holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Ameren Corp (NYSE:AEE), Santander Mexico Fincl Gp SAB deCV (ADR) (NYSE:BSMX), and Silver Wheaton Corp. (USA) (NYSE:SLW) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

QiuJu Song/Shutterstock.com

Now, we’re going to review the latest action regarding Pembina Pipeline Corp (NYSE:PBA).

What have hedge funds been doing with Pembina Pipeline Corp (NYSE:PBA)?

Heading into the fourth quarter of 2016, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a decline of 8% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in PBA over the last 5 quarters. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, one of the biggest hedge funds in the world, has the biggest position in Pembina Pipeline Corp (NYSE:PBA), worth close to $11.7 million, corresponding to less than 0.1% of its total 13F portfolio. On Renaissance Technologies’ heels is Luminus Management, led by Jonathan Barrett and Paul Segal, holding a $11.1 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism include Ken Griffin’s Citadel Investment Group, Steve Cohen’s Point72 Asset Management and Israel Englander’s Millennium Management. We should note that Luminus Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.