Last month, rumors began circulating that online international payment giant PayPal Holdings Inc. (NASDAQ:PYPL) had plans to enter the cryptocurrency industry, and will soon begin offering cryptocurrency buying and selling functionality.

These rumors appear to have been confirmed by a recently published letter, which clearly describes PayPal’s intent to develop its capabilities in the cryptocurrency space. Once these plans are brought to fruition, this will make PayPal the largest traditional finance platform to support digital assets.

This new feature is likely to have a significant positive impact on the cryptocurrency industry as a whole, but the cryptocurrency trading space looks set to benefit the most.

Making Cryptocurrency More Accessible Than Ever

Right now, the only way to purchase most cryptocurrencies with PayPal is to use peer to peer marketplaces like Local Bitcoins and Paxful, or one of the handful of cryptocurrency brokers that accept PayPal deposits.

www.BillionPhotos.com / Shutterstock.com

Unfortunately, this is frequently an expensive and time-consuming process, since accepting PayPal payments can be riskier for the vendor, due to the possibility of chargebacks and fraud. This risk is usually passed on to the consumer, in the form of higher fees and more extensive identity verification requirements.

But with PayPal’s direct entry into the cryptocurrency brokerage market, there is a good chance that these obstacles to buying cryptocurrencies with PayPal will vanish once and for all. Since most PayPal users have already completed identity verification, and PayPal already has strict fraud detection practices in place, PayPal should be able to offer cheaper, faster access to cryptocurrency than many current vendors.

With over 300 million active users worldwide, this could become a pivotal turning point for an industry that has been previously described as “niche”, “complicated”, and “inaccessible” allowing anybody from PayPal’s diverse userbase demographic to gain exposure to the cryptocurrency boom.

Trading Education Platforms Are Gearing Up

Though the cryptocurrency trading industry is set to benefit from PayPal’s impending cryptocurrency on-ramp, there is a strong possibility that cryptocurrency trading and market analytics platforms will also experience a concomitant explosion in interest.

In the current competitive cryptocurrency climate, both new and established traders looking for an edge typically turn to the numerous market tracking and technical analysis tools available for use. These tools are generally used to either spot opportunities traders might otherwise miss, improve the profitability of trades, or improve the user’s understanding of market structure.

However, just a fraction of these platforms currently accepts direct PayPal payments for membership plans. But like cryptocurrencies, these platforms too will become more accessible with the advent of PayPal’s cryptocurrency purchase feature.

https://twitter.com/NwcPublic/status/1279011729230499840

Instead of waiting, some platforms have already begun making moves to accommodate PayPal users ahead of the feature launch. This includes the popular cryptocurrency market analysis and trading education platform, NewsCrypto, which recently began accepting PayPal and Mastercard (NYSE:MA) payments for its NWC tokens.

With more traders equipped to profitably trade cryptocurrencies, it might not be long until cryptocurrency investments become as popular as bank savings accounts are today.

Cryptocurrency Trading Will Continue to Blossom

Despite emerging barely a decade ago, the cryptocurrency trading industry has exploded in popularity in recent years, as digital assets have emerged as one of the most profitable financial instruments in the 21st century.

Since Bitcoin’s inception in 2009, it has gone on to experience meteoric growth, climbing from a value of practically zero, up to a peak of more than $20,000 in December 2017.

Other cryptocurrencies have also demonstrated a similar trajectory, including Nxt, which generated a more than 1 million percent ROI for initial coin offering (ICO) investors, and Ethereum, which has gained more than 80% in 2020 alone. These numbers completely blow away even the best performing shares, including the 989% gained by Amazon.com Inc. (NASDAQ: AMZN) since 2013, and 14% gained by Alphabet Inc. (NASDAQ:GOOG) YTD.

This potential for profit led to massive demand for cryptocurrency trading platforms that can allow everyday investors to easily speculate on the price of digital assets. In response to this growing demand, the cryptocurrency trading sector experienced a Cambrian explosion of sorts between 2017 and 2020, as new spot, margin, and derivatives trading platforms were launched.

According to a 2019 report by consulting firm Chappuis Halder, there are now around 43 million cryptocurrency traders worldwide—compared to approximately 70-80 million each for foreign exchange and equities trading. Though this number is already considerable, it’s important to note that this number is still largely comprised of early adopters and traditional investors.

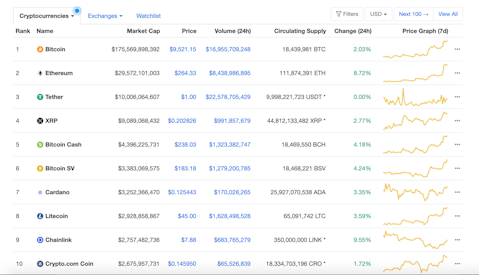

Nonetheless, though far less than 1% of the world’s population currently trades cryptocurrencies, more than $40 billion in cryptocurrency trades are completed each day, demonstrating the staggering size of the industry.

Disclosure: No positions.