Palantir Technologies Inc. (NASDAQ:PLTR), with an 82% YTD rally, is the best-performing tech stock (trailing only TransMedics Group) on our list of the 10 best growth stocks to buy according to billionaires.

This rally, which has taken the stock to record highs, is fueled by investors’ belief in its AI-driven growth story. However, according to Bloomberg’s analysis in its June 4 report, the stock is now trading at over 200 times its 12-month forward earnings, one of the highest multiples in the S&P 500, and significantly above the market average of 22 times. Many analysts consider this valuation to be stretched and choose to be on the sidelines.

An engineer using the latest predictive analytics software to formulate solutions.

Ted Mortonson, managing director at Robert W. Baird, believes that expectations are now high after the stock’s steep run-up, and any earnings disappointment could put pressure on shares. This means that the company would need to exhibit consistent execution. According to its latest guidance, management projects 36% revenue growth in 2025, to $3.9 billion, and over $1.5 billion in free cash flow.

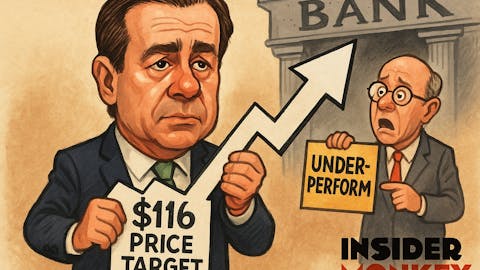

Interestingly, the Bloomberg report notes that the stock is one of the lowest-rated S&P 500 stocks, with fewer than one-third of analysts covering it having a Buy equivalent rating.

So, what’s causing the stock to continue rising? The report notes that while Wall Street remains cautious, supporters of the stock believe Wall Street is overlooking a company uniquely poised to thrive amid today’s shifting geopolitical and economic conditions. Investors appear more focused on Palantir’s exposure to key defense, intelligence, and AI opportunities. The company’s recent wins include deeper engagements with the U.S. military, NATO, and Fannie Mae, as well as ongoing expansion of its commercial client base.

Support from the retail investor base has also been notable, keeping trading volumes elevated.

Despite the caution elsewhere, Mark Schappel from Loop Capital is among the analysts who have a positive view on the stock. On June 12, he raised his price target on Palantir to $155 from $130 while maintaining a Buy rating. His conviction on the stock is based on a recent investor session that featured a demonstration of Palantir’s AIP platform and a discussion on broader trends in enterprise AI. Schappel highlights Palantir’s strong position as an early leader in enterprise AI, noting that the technology is shifting from limited trials to full-scale deployment. He also pointed to growing real-world use cases across industries, despite slower AI adoption in Europe.

Palantir Technologies Inc. (NASDAQ:PLTR) is a software company that builds and deploys data integration and analytics platforms for both government and commercial clients.

While we acknowledge the potential of PLTR as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None.