Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Omnicom Group Inc. (NYSE:OMC) from the perspective of those elite funds.

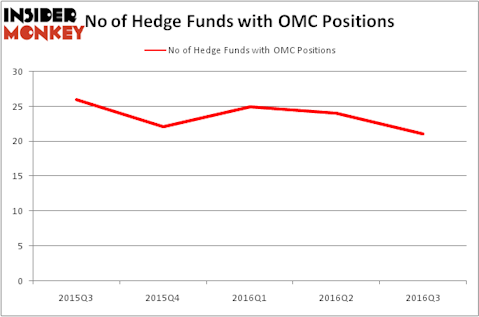

Omnicom Group Inc. (NYSE:OMC) investors should pay attention to a decrease in hedge fund sentiment of late. OMC was in 21 hedge funds’ portfolios at the end of the third quarter of 2016. There were 24 hedge funds in our database with OMC positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as L Brands Inc (NYSE:LB), JD.Com Inc (ADR) (NASDAQ:JD), and Cummins Inc. (NYSE:CMI) to gather more data points.

Follow Omnicom Group Inc. (NYSE:OMC)

Follow Omnicom Group Inc. (NYSE:OMC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

What does the smart money think about Omnicom Group Inc. (NYSE:OMC)?

Heading into the fourth quarter of 2016, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a decline of 13% from the second quarter of 2016. Hedge fund ownership has dropped by nearly 20% over the last year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Pzena Investment Management, managed by Richard S. Pzena, holds the most valuable position in Omnicom Group Inc. (NYSE:OMC). Pzena Investment Management has a $382.8 million position in the stock, comprising 2.3% of its 13F portfolio. Coming in second is Ariel Investments, led by John W. Rogers, holding a $102.7 million position; the fund has 1.2% of its 13F portfolio invested in the stock. Remaining peers that are bullish contain David Harding’s Winton Capital Management, Cliff Asness’ AQR Capital Management and Joel Greenblatt’s Gotham Asset Management.

Seeing as Omnicom Group Inc. (NYSE:OMC) has faced bearish sentiment from hedge fund managers, it’s safe to say that there is a sect of hedgies who were dropping their positions entirely in the third quarter. It’s worth mentioning that First Eagle Investment Management dumped the largest position of all the hedgies tracked by Insider Monkey, totaling close to $1.05 billion in stock, and Jim Simons’ Renaissance Technologies was right behind this move, as the fund sold off about $52.3 million worth. These moves are interesting, as total hedge fund interest fell by 3 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Omnicom Group Inc. (NYSE:OMC) but similarly valued. These stocks are L Brands Inc (NYSE:LB), JD.Com Inc (ADR) (NASDAQ:JD), Cummins Inc. (NYSE:CMI), and TELUS Corporation (USA) (NYSE:TU). This group of stocks’ market valuations match OMC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LB | 32 | 1319885 | 3 |

| JD | 44 | 7410928 | -7 |

| CMI | 29 | 510425 | 1 |

| TU | 9 | 224564 | -3 |

As you can see these stocks had an average of 28.5 hedge funds with bullish positions and the average amount invested in these stocks was $2.37 billion. That figure was $733 million in OMC’s case. JD.Com Inc (ADR) (NASDAQ:JD) is the most popular stock in this table. On the other hand TELUS Corporation (USA) (NYSE:TU) is the least popular one with only 9 bullish hedge fund positions. Omnicom Group Inc. (NYSE:OMC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are pouring money into. In this regard JD might be a better candidate to consider a long position in.

Disclosure: None