In an article last December, I wrote that the most likely scenario for Office Depot Inc (NYSE:ODP) was a merger with OfficeMax Incorporated (NYSE:OMX). Tuesday’s edition of the Wall Street Journal ran an article saying that a merger between the second- and third-largest office supply stores is imminent.

However, in that same December article, I also said a merger would not be enough to save the two companies; they would simply become the second-best company in an industry suited for one. I still hold that to be the case. Here is why:

In a commodity business like office supply retailing, the advantage goes to the low-cost retailer. The unquestionable victory in this category goes to Staples, Inc. (NASDAQ:SPLS), which has higher revenue and far better margins than its lowly competitors.

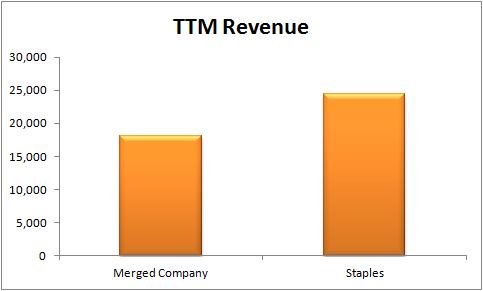

However, Office Depot and Office Max (henceforth, “the merged company”) will go a long way toward overcoming their deficit by becoming North America’s largest office supply retailer by number of stores. Unfortunately, the merged company still falls short of Staples on revenue and margins.

Even a post-merger company significantly lags Staples in revenue — a key variable in achieving superior economies of scale.

But the merged company will inevitably find hundreds of millions in synergies. Synergies will come from eliminating redundancies in SG&A, increased leverage with suppliers, and other similar advantages. The consensus estimate seems to be synergies of $400 million to $600 million.

However, even $600 million in synergies will not be enough to catch up with Staples. If you add $600 million to Office Max and Office Depot’s combined 2011 EBITDA and divide it by their combined 2011 revenue, you get a post-synergy margin of 5.52%. Staples, on the other hand, earned a 6.77% EBITDA margin in 2011 and has routinely earned 7% to 8% in the past.

So, while the merger allows the two companies to extend their life in the industry, it is unlikely that they will ever gain a permanent competitive foothold on Staples.

Online Competition

What’s more, even Staples is at a competitive disadvantage against online retail giant Amazon.com, Inc. (NASDAQ:AMZN). The traditional model of retailing is to open a massive store and fill it with large quantities of inventory. This worked in the past — before online shopping became more convenient. The way people shop has changed, but the office supply chains haven’t.

Well, Office Depot and Office Max haven’t. Staples, on the other hand, has invested heavily in its online presence and has positioned itself as the number two online retailer behind only Amazon. According to Compete.com, Staples received 11.8 million unique visitors to its website in January, while Office Depot received 5.7 million unique visitors and Office Max only 3.6 million unique visitors. So not only is the merged company still behind in brick-and-mortar profitability, it is also behind on the rush to establish an online presence. None of this sounds good for the merged entity.

Move on to Another Investment

Investing in a declining company that resides in a declining industry is a recipe for sub-par returns. It is becoming more apparent that Amazon and Staples will eventually become the only big players in the office supply market, with possible competition from Wal-Mart Stores, Inc. (NYSE:WMT)‘s Sam’s Club and Costco Wholesale Corporation (NASDAQ:COST). But whatever the industry looks like 10 years from now, I’m almost positive neither Office Depot nor Office Max will be a meaningful part of it.

The article Office Supplies Merger Is Last Desperate Attempt at Survival originally appeared on Fool.com and is written by Ted Cooper.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.