As we approach Apple Inc. (NASDAQ:AAPL)’s earnings report on July 23, the steady stream of negative pronouncements, downgrades, and forbodings of imminent demise reaches a crescendo of despair. But Apple’s fate is not written in the stars.

The list of negative articles in the tech business media is already too extensive for me to summarize here, so I’ll only touch on the most egregious:

1) Rocco Pendola’s “There’s No Question Now: Apple is Dead” which made the Mac Observer’s Apple Inc. (NASDAQ:AAPL) Death Knell Counter list as the 62nd and most recent entry.

2) Adam Lashinsky’s “Are Apple Inc. (NASDAQ:AAPL)’s Best Days Behind it?” in money.cnn.com. Although Lashinsky never quite answers his rhetorical question, he makes it clear what he thinks the answer is.

3) Trip Chowdhry of Global Equities (as reported by Philip Elmer-Dewitt): “The current executive team led by Tim Cook and Peter Oppenheimer have destroyed the shareholder value at Apple Inc. (NASDAQ:AAPL).”

However, just as the doomsayers often base their predictions on some kernel of truth, there is a core of concern about Apple Inc. (NASDAQ:AAPL)’s competitiveness which is legitimate, based on Apple’s Q1 performance and prospects for Q2.

Although total revenue had grown in Q1 by 11% to $43.6 billion year over year, operating income suffered a steep decline by 18.4% to $12.6 billion as gross margin declined about 10 percentage points to 37.5%.

As can be seen in the above table, Apple Inc. (NASDAQ:AAPL)’s operating margin had already plummeted past Microsoft Corporation (NASDAQ:MSFT) as of Q1, and was converging on that of Google Inc (NASDAQ:GOOG).

At the time I counseled patience and argued that Apple’s margins should come down further in order to protect market share without cheapening the Apple Inc. (NASDAQ:AAPL) brand. Based on Apple’s most optimistic combination of revenue and gross margin guidance ($35.5 billion, 37% respectively), there will be an even steeper year-over-year decline of 19.8% in operating income to $9.285 billion.

Prospects for Q2

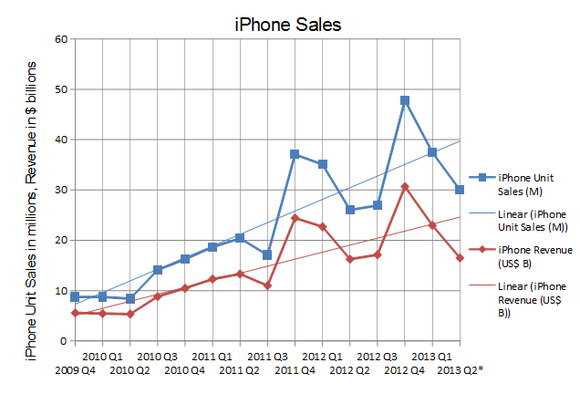

Apple Inc. (NASDAQ:AAPL)’s prospects for Q2 are unlikely to break out of the guidance range of the Q1 earnings report. With the new Haswell-equipped MacBook Airs as almost the only new Apple products that consumers can buy, Apple doesn’t have much to move the earnings needle. As the charts below show, my model predicts a continuing steep sequential decline in both iPhone and iPad sales volume and revenue.

I expect Mac unit sales to escape the brunt of the worldwide PC sales decline of 10.9% recently reported by Gartner, but I still expect a year-over-year decline of roughly 5% to 3.8 million units. My model predicts total revenue of $35.2 billion, which is essentially flat year over year, and an operating income of $8.73 billion, an almost 25% decline year over year. As can be seen in the chart below, operating income is predicted to be at its lowest point since Q3 2011, and the operating margin at 24.8% may even be below Google Inc (NASDAQ:GOOG)’s.

Hope for a turnaround

While I concur with Apple Inc. (NASDAQ:AAPL)’s move to lower margins, of concern is the indication that this isn’t doing much to arrest market share declines in Apple’s major product groups. Apple may exceed my expectation in this regard, but I consider the model predictions realistic given the dearth of new iOS products or new product categories.

Assuming a worst case scenario in which worldwide smartphone sales for Q2 are about the same as Q1, 210 million, Apple Inc. (NASDAQ:AAPL)’s iPhone market share will have declined to 14.3% from 18.2% last quarter and 18.8% a year ago. This decline assumes a relatively optimistic 30 million iPhone unit sales for the quarter. Google Inc (NASDAQ:GOOG)’s Android will probably hold on to roughly a 75% share. Microsoft Corporation (NASDAQ:MSFT)Windows Phone will probably pick up a percentage point in market share from 3 to 4%, mostly at the expense of Research In Motion Ltd (NASDAQ:BBRY).

Until Apple Inc. (NASDAQ:AAPL) begins to roll out new products in the fall, I don’t see much hope for a turnaround in Apple’s market share decline, and I don’t expect Apple’s share price to do more than tread water somewhere in the $400-425 range.

Apple Inc. (NASDAQ:AAPL) is seeming increasingly tortoise-like next to its hare competitors. Steve Ballmer recently emphasized “rapid release” at the Microsoft Corporation (NASDAQ:MSFT) BUILD developers conference, in reference to the previewed Windows 8.1 but also as a general approach to new products. Meanwhile, Samsung has already rolled out the S4 worldwide and Google Inc (NASDAQ:GOOG) is prepping the Moto X.

What to look for in the report

Investors, lacking better news, should look for signs that Apple Inc. (NASDAQ:AAPL) is making tangible progress to diversify and expand its product lines. One of these is boosting R&D spending above the roughly 3% of revenue that is the Apple historical norm. Boosting R&D is a necessary and probably sufficient condition in order for Apple to bring new products and product updates to market faster. My model predicts R&D spending of 3.4% of revenue. I consider a percentage of 5% the bare minimum for Apple to keep up with its competitors, as both Microsoft Corporation (NASDAQ:MSFT) and Google Inc (NASDAQ:GOOG) outspend Apple both in absolute and percentage terms.

Other signs include a boost in Marketing expenditures as an indirect indicator of impending new product rollouts. And of course, Apple Inc. (NASDAQ:AAPL) may drop some hints about new products.

Most importantly, Apple’s gross margin should continue to come down. I expect a gross margin of 36% and look for Apple Inc. (NASDAQ:AAPL) to guide to 35% for Q3.

So far I’ve seen little progress in the product diversification and R&D spending, but I’m willing to hang in there until the Fall product rollouts. Really new products can take many months, even years to develop, so I’m not one of those calling for regime change at Apple Inc. (NASDAQ:AAPL) just yet, even though Cook does seem less and less like the leader Apple needs.

In the end, I’m still an Apple investor because even if the current leadership proves itself unworthy, better leadership can and will be found.

Mark Hibben has a position in Apple. The Motley Fool recommends Apple and Google. The Motley Fool owns shares of Apple, Google, and Microsoft.

The article Of Course Apple Is Doomed: It’s Earnings Season originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.