NVIDIA Corporation (NASDAQ:NVDA) is one of the Best Monopoly Stocks to Buy Now. On October 31, Bloomberg reported that NVIDIA Corporation (NASDAQ:NVDA) plans to invest as much as $1 billion in the AI company, Poolside.

Poolside continues to discuss garnering $2 billion at a valuation of $12 billion, which doesn’t include the dollars raised. Notably, NVIDIA Corporation (NASDAQ:NVDA)’s investment in the round, which was not previously reported, would start at $500 million. There is a potential to reach $1 billion if this startup meets the fundraising targets, noted Bloomberg.

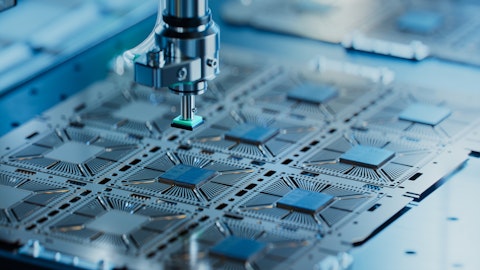

NVIDIA Corporation (NASDAQ:NVDA)’s participation reflects how the AI giant has been fueling an ecosystem of AI startups. As per Bloomberg, Poolside intends to utilise a portion of the new capital to buy Nvidia’s GB300 chips. Notably, NVIDIA Corporation (NASDAQ:NVDA) happens to be a prior investor in Poolside.

In a separate release dated October 31, NVIDIA Corporation (NASDAQ:NVDA) announced that it is deepening its collaboration with Hyundai Motor Group to ramp up innovation in autonomous vehicles, smart factories, and robotics with the new NVIDIA Blackwell-powered AI factory.

Polen Capital, an investment management company, released its Q3 2025 investor letter. Here is what the fund said:

“In early August we initiated positions in both NVIDIA Corporation (NASDAQ:NVDA) and Broadcom, after having not owned either company over the past 2½ years following the initial wave of enthusiasm around Gen AI. While we have long admired both companies, their highly cyclical business models have made it extremely difficult to forecast future earnings growth with any degree of conviction. Given our approach of seeking durable and persistent earnings growth that compounds over long holding periods, our concern in holding either was that we would be forced to endure a punishing downcycle within our typical holding period – there is very little room that in a concentrated portfolio of 20-30 companies. In fact, pre ChatGPT, NVIDIA had two punishing down cycles over the preceding five years.

That is specifically what has occurred for NVIDIA and Broadcom. While the sheer magnitude of demand for AI chips, servers and networking equipment was something that we clearly underappreciated, new incremental data points over the past few months lead us to conclude the current boom in AI chips and related hardware will likely continue for the foreseeable future giving us greater conviction over the trajectory of future earnings for both NVIDIA and Broadcom.

NVIDIA produces the fastest chips that are able to process compute intensive tasks like Gen AI training models extremely efficiently, are very flexible so can be used for any type of workload, and as a result are the chips in highest demand as the hyperscalers build out their Gen AI infrastructure (NVIDIA currently receiving 90c of every dollar spent on AI accelerated semiconductors). Their business has a very strong competitive moat, which is partly about the speed of their chips, but also the entire ecosystem they have built around them (programing language, training models and associated network effects)…” (Click here to read the full text)

While we acknowledge the potential of NVDA to grow, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than NVDA and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: 13 Cheap AI Stocks to Buy According to Analysts and 11 Unstoppable Growth Stocks to Invest in Now

Disclosure: None. This article is originally published at Insider Monkey.