NVE Corporation (NASDAQ:NVEC) Q4 2024 Earnings Call Transcript May 1, 2024

NVE Corporation isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here).

Operator: Good day and thank you for standing by. Welcome to the NVE Corporation Conference Call on Fourth Quarter Results. At this time, all participants are in a listen-only mode. After the speaker’s presentation, there will be a question-and-answer session. [Operator Instructions] Please note that today’s conference is being recorded. I would now like to hand the conference over to Mr. Dan Baker, President and CEO. Please go ahead sir.

Daniel Baker: Good afternoon, and welcome to our conference call for the quarter and fiscal year ended March 31st, 2024. This call is being webcast live and recorded. A replay will be available through our website nve.com. I’m joined by Controller and Principal Financial Officer, Daniel Nelson. After my opening comments, Daniel will present our financial results. I’ll cover products, and marketing and we will open the call to questions. We issued our press release with financial results and filed our annual report on Form 10-K in the past hour following the close of market. Links to the press release and 10-K are available through the SEC’s website, our website, and on X formerly known as Twitter. Comments we may make that relate to future plans, events, financial results or performance are forward-looking statements that are subject to certain risks and uncertainties, including, among others, such factors as uncertainties related to the economic environments in the industries we serve, and risks and uncertainties related to future sales and revenue as well as the risks factors listed from time to time in our filings with the SEC, including our just filed annual report on Form 10-K.

Actual results could differ materially from the information provided and we undertake no obligation to update forward-looking statements we may make. We’re pleased to report strong earnings despite the decreased revenues from a record shattering quarter a year ago. Daniel Nelson will cover the details of our financials. Daniel?

Daniel Nelson: Thanks, Dan. Total revenue for the fourth quarter ended March 31, 2024 decrease 45% compared to our record prior year quarter. The decrease was due to a 43% decrease in product sales and an 88% decrease in contract research and development revenue with a tough comparison. The decrease in product sales was primarily due to a semiconductor industry downturn. The good news is that the industry is gaining strength and forecasts are for a strong industry recovery in calendar 2024, where semiconductor trade statistics is forecast in the global semiconductor market to grow 13% in 2024 after plummeting 8% in 2023. Our product sales for the most recent quarter increased 11% sequentially from the immediately prior quarter.

As we expected, our product sales to defense market recovered in the past quarter. These sales can fluctuate and were especially weak in the first three quarters of the fiscal year due to procurement cycle timing. Total expenses decreased 6% for the fourth quarter of fiscal 2024 compared to the fourth quarter of fiscal 2023 due to a 37% decrease in SG&A partially offset by a 33% increase in R&D. The decrease in R&D expense was primarily due to an increase in new product development. The decrease in SG&A was primarily due to decrease performance-based compensation accruals. Interest income for the fourth quarter of fiscal 2024 increased 25% due to higher interest rates. Our effective tax rate, which is the provision for income taxes as a percentage of income before taxes increased to 17% for the fourth quarter of fiscal 2024 compared to 12% for the fourth quarter of fiscal 2023.

See also 15 Most Conservative States in the US and 24 Profitable Outdoor Business Ideas to Start In 2024.

Q&A Session

Follow Nve Corp W (NASDAQ:NVEC)

Follow Nve Corp W (NASDAQ:NVEC)

Receive real-time insider trading and news alerts

The lower rate in the prior year quarter was primarily due to the CHIPS Act federal tax credits related to the expansion of our production space and new production equipment deployed in the prior year quarter. The 54% decrease in net income for the fourth quarter of fiscal 2024 compared to the prior year quarter was primarily due to decreased revenue and a high effective tax rate partially offset by increased interest income and decreased expenses. It was a solidly profitable quarter with earnings of $0.79 per share. High-value products have allowed us to weather the industry downturn. Gross margin was 75% and net margin was 54%. For the fiscal year revenue decreased 22% primarily due to decrease product sales. Net income was $17.1 million for fiscal 2024 and operating cash flows was $18.2 million for fiscal 2024.

Net income was down 25% but still a solid $3.54 per share. Purchases of fixed assets were only $17,000 in last fiscal year, but we hope to deploy over $200,000 in equipment this quarter, the June quarter. We’re planning $4 million to $5 million in capital investment in the next two fiscal years, fiscal 2025 and 2026 and we’ve already made some equipment down payments this quarter, the first quarter of fiscal 2025. This will represent some of our largest capital investments ever. Dan we’ll provide details of the plan expansion in a few minutes. Now I’ll turn a call back over to Dan Baker to cover the business. Over to you, Dan.

Daniel Baker: Thanks Dan, I’ll cover products, marketing and CapEx. In the past quarter we expanded our line of tunneling magneto-resistance magnetometers. The new version expands the range of magnetic fields we cover which opens more potential applications in the industrial internet of things and other areas. We’ve had a major initiative to broaden our lines of product evaluation boards. These boards promote our products and allow prospective customers to easily try out our unique products. There are several recent videos on our website and YouTube channel that highlight the new boards. The boards serve as both products and marketing vehicles. On marketing we’re planning to exhibit at two major trade shows this quarter including the SENSOR+ TEST Show, which is billed as the leading international trade fair for sensing, measuring and testing technology.

The show is in June in Nuremberg, Germany. We’ve typically relied on distributors to represent us at international trade shows, but this year we’ll also have our own booth which will give us more space to promote our products. Later in June we will be at Sensors Converge in Silicon Valley which is billed as North America’s largest electronics event. We believe these investments and shows will pay off in future sales. Daniel mentioned plans for a multi-million dollar expansion during the next two fiscal years. The investments will increase our capacity and capabilities including the capability to manufacture wafer level chip scale packages in-house. These parts will be smaller, higher performance and allow us to be more self-sufficient and capture more value.

Most of our products are currently packaged in Asia by Outsourced Semiconductor Assembly and Test or OSAT subcontractors using conventional plastic over molding. Wafer level chip scale parts can be even smaller than these encapsulated components. We provided customers with wafer level chip scale prototypes and there has been solid customer interest. We hope to begin some production this fiscal year. The planned investments will also reduce our supply chain risks. The COVID-19 pandemic exposed the vulnerabilities of the OSAT supply chain. There have been shortages of raw materials OSATs need for their processes. OSATs have also had government lockdown restrictions, labor shortages and raw material shortages. As we begin fiscal 2025 I’d like to review some highlights of fiscal 2024.

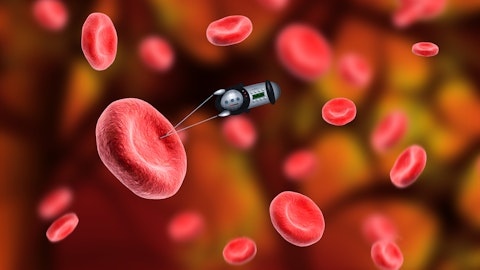

We extended our Abbott partnering agreement. We supported a number of distributor exhibitions and exhibited under our own banner. We introduced extended temperature isolated network transceivers and ultra high isolation data couplers. We earned the prestigious CE mark for a line of the world’s smallest DC to DC converter products and related power conversion products. We launched more products combining data couplers with isolated DC to DC converters to transmit power as well as data. We also invested in R&D initiatives with the potential to drive future growth. Medium-term development programs in the past year included next generation MRAM for anti-tamper applications, next generation sensors for hearing aids and implanted medical devices, extremely sensitive TMR sensors and wafer level chip scale sensors.

Long-term programs included technology that could provide the energy efficiency needed to accelerate the use of magnetic tunnel junctions in memory, logic and neuromorphic computing. Highlights of this research were published in the past year and the link to the paper is on our website. Now I’d like to open the call for questions. Livia?

Operator: Thank you. [Operator Instructions] And we have a question coming from the line of Jeffrey Bernstein with Silverberg Bernstein Capital Management. Your line is open.

Jeffrey Bernstein: Hi, guys.

Daniel Baker: Hi, Jeff.

Jeffrey Bernstein: So, big announcement here. I tend to think of you, Dan, as a conservative guy and I think if anyone’s had anything to complain about over the years with the company it’s been that maybe you weren’t spending enough money to grow the revenue as opposed to being incredibly profitable. So here I see in the quarter, the R&D as a percentage of revenue is up, SG&A is up and you’re planning a big capital plan. And so, I just get the feeling that that’s not done willy-nilly, that you must be having some pretty strong indications that there’s demand out there for this capacity and capability you’re going to be adding. So could you just give us a little bit more color on that on what you have in terms of commitment or interest levels that got you and the board to be willing to make these commitments?

Daniel Baker: Right. Well, thanks, Jeff. And as you say, we try to make sure that when we spend our shareholders money that it’s going to get a return for them. And we treat that obligation seriously and we hold investments to a high standard. But we’re excited about this capital investment with this expansion and the opportunities that it presents. We really see them as historic opportunities to dramatically improve our capabilities and to make our products smaller and more sensitive and extend our advantages. And so that’s the reason for the large investment. What we talked about was one of the major things that the investment will give us is the capability to do wafer level chip scale packages, which I talked about a bit in the prepared remarks.

So these are significantly smaller than our current products and our current products are significantly smaller than most conventional electronics. So it’ll be a dramatic step forward, the miniaturization is important in another number of markets. Obviously in implanted medical devices, smaller is better. It allows for smaller devices, smaller incisions, less risks of complications. And it will allow more precise industrial sensors as well, because they’re smaller. So that’s one of the areas that we’re investing in. As I mentioned again, in the prepared remarks, we’ve been able to, our team has been able to make prototypes of those devices. And we’ve shared them with customers and the interest has been very strong. So that’s part of the — you mentioned two sets of investments.