The top weighted stock, as May 2, 1013, is NPS Pharmaceuticals, Inc. (NASDAQ:NPSP). This stock posted an impressive one-year return of 91.42%. Looking at the price chart below, this appears to have taken place with the last 60 days. NPS Pharmaceuticals, Inc. (NASDAQ:NPSP) seeks to develop treatment options for rare gastrointestinal and endocrine disorders. Serious unmet medical needs are included in the business strategy.

NPS Pharmaceuticals, Inc. (NASDAQ:NPSP)’ first quarter 2013 earnings will be released on Thursday May 9, 2013. The last quarter of 2012 reports diluted earnings of $0.14 per share. The same quarter in 2011 was $0.10 per share. The one eye-catching note is that NPS Pharmaceuticals, Inc. (NASDAQ:NPSP) secured FDA approval on its first proprietary product, Gattex. This drug was released as the first and only long-term treatment for adult bowel syndrome. Based on this, this stock follows the pattern of this sector. The success of this company, as well as any investment success, is hinged on the release and expected market acceptance of one drug. In my opinion, this is speculation based on all known facts. Staying within the SPDR Biotech ETF instead of this specific company may prove to be prudent should this fall on its face.

The second largest position, with a weighting of 3.2%, is Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX). This stock has returned $32.85 in the past year. Take a look at the price chart below and take notice of the huge gap to the upside that took place in mid-April of this year. What I see is that on April 18, 2013 a press release regarding “Treatment with VX-661 and Ivacraftor…” in a Phase 2 study showed significant improvements in lung function of patients with cystic fibrosis. The first quarter earnings of 2013 were reported to be a diluted $0.03 per share, with net losses due to impairment of intangible assets charges, compared to the $0.43 per share in the first quarter of 2012. This is a good example of how hopes fuel price performance on biotech stocks. I consider this is to be another speculative play.

Continuing in descending order of holdings in the SPDR S&P Biotech ETF, Regeneron Pharmaceuticals Inc (NASDAQ:REGN) makes up 3.1% of the ETF. Regeneron Pharmaceuticals Inc (NASDAQ:REGN) has given a one-year return of 101.05% (see the chart below). The current price range supports the perceived value of this stock. In the fourth quarter of 2012 earnings were reported at $1.47 per share (diluted). The same quarter of 2011 reported $0.37 per share, diluted. The main driver of this growth appears to be sales from EYLEA, which was recently approved by the FDA, for the treatment of macular edema, an eye condition. This is a far more stable biotechnology company than those I’ve previously mentioned. There are 11 programs that are in clinical studies, and some of these are in partnership with Sanofi SA (ADR) (NYSE:SNY). I like the prospects of this stock since there are multiple drugs in development.

Rounding out the top four stocks in the SPDR S&P Biotech ETF is Theravance Inc (NASDAQ:THRX), with a weighting of 3.0%. See the chart below and some of the very recent price action has been the driver of the one-year return of 55.25%. “Theravance Inc (NASDAQ:THRX) is off to a strong start in 2013 highlighted by the recent FDA Advisory Committee meeting which recommended approval of BREO ELLIPTA for the treatment of COPD,” said Rick E Winningham, Chief Executive Officer. In the Q1 2013 earnings report the company announced a net loss of $0.39 per share, versus a loss of $0.93 per share in the same quarter of 2012. There a numerous products in the developmental stage, and the above comments appear to be the driver of the share price movement, making this another stock moving on positive yet unrealized expectations.

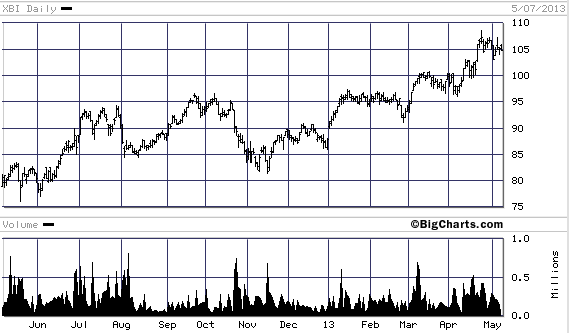

Biotechnology has always been a tough sector to follow. The SPDR S&P Biotech ETF makes it easy through the use of a passive index in the expectation that some of the stocks contained within will be the driver of the ETF’s overall performance. Without researching each and every stock held in this ETF, I believe that I will find quite a few of non-contributing stocks. If only a handful out of the entire 53 drive this strategy, the simple odds of finding the right stocks to pick makes it seem harder.

The article Double-Digit Returns from the Biotechnology Strategy originally appeared on Fool.com and is written by Jeff Stouffer.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.