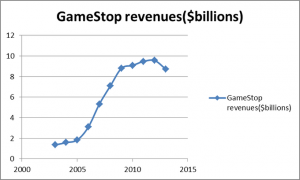

The world’s largest retailer of video games and their accessories, GameStop Corp. (NYSE:GME), has grown its revenues incredibly over the last decade (see below). Shareholders have been rewarded nicely, with shares rising from a low of $3.75 in 2004, to the current level of around $25. However, after several years of slow growth, followed by a decline in revenues during the current fiscal year, is the time right to buy GameStop, or should investors run away?

GameStop Corp. (NYSE:GME) operates almost 7,000 stores worldwide under the brand names GameStop, EB Games, and Micromania. The company sells new and used video game hardware (like consoles, controllers, etc.) and software. The company also publishes Game Informer magazine, which is the largest video game magazine in the U.S. with about 5.7 million subscribers.

In my opinion, it is their used equipment business that allows GameStop to be competitive with online retailers such as Amazon.com (NASDAQ:AMZN). While GameStop will never be able to completely price-match on new equipment (this has been the thorn in the side of physical retailers over the past decade or so), they will still sell a sufficient amount of new equipment through the traffic in their stores generated by used video games and accessories.

I know what you’re thinking: Amazon sells used video games too! That is true, and often times the pricing is less than at a GameStop store. When buying a new PlayStation 3, consumers know that they are getting the exact same thing whether they buy online or at the store. With used video games (or anything used for that matter), the quality of the product varies tremendously. For that reason, being able to physically see the condition of the items in the store is a huge advantage.

The used business is what has kept GameStop growing in the changing retail environment, but why do I think the company will again be able to grow its revenues going forward? The simple answer: The current consoles are getting old. The two most popular video game consoles right now are the PlayStation 3, made by Sony (NYSE:SNE) and the Xbox 360, made by Microsoft (NASDAQ:MSFT).

Sony recently revealed their next console, the PlayStation 4, which it plans to have ready for the holiday season. Updates will include vastly improved graphics capability, enhanced social media capabilities, and a new sensor in the controller that will allow the PS4 to read where the player is. Also just announced is that the company is planning on making the PS4 fully backward-compatible, meaning that games from previous versions will work. This should keep GameStop’s used game business thriving, while adding in the new revenue stream from the new console and software.

As far as Microsoft goes, the rumors are flying, however I would be willing to bet a large sum of money that they will fire back with an update of their own, most likely in time for the holiday season also. The new system, which is rumored to be called the Xbox 720, is also expected to have incredible graphics capability and to be built around motion detection. It also is very likely that the new system will be Blu-ray based.

Regardless of what features the new consoles have, this is good news for the entire industry, retailers and manufacturers alike. All of the PlayStation consoles have been released 6 years apart (1994, 2000, and 2006). With the current version more than 6 years old, the market will welcome the updates. The Entertainment Software Association (ESA) estimates that 65% of American heads of households play video games regularly.

With an expanding user base, video games should increase in popularity for some time. As a relatively new industry, video games are constantly adding more customers than they are losing. Without revealing my age too much, the first video game system I owned was the original Nintendo, which I started playing around the time I was 7 or 8 years old. As my generation ages, we simply move up to the newer hardware, while the new crop of 7 or 8 year olds are added in as new gamers.

There are several ways to play the video game sector. Any of the names mentioned here, other than Amazon, work very well as investments. I love Amazon as a company; I just think their stock is ridiculously valued right now. If you want to play the manufacturers, Sony is my recommendation, since they got the jump on Microsoft with the next-gen consoles, plus Microsoft is so enormous that video game consoles have a much smaller effect on the company’s bottom line.

As far as physical brick-and-mortar stores go, GameStop is one of the retailers that can still thrive in the new environment due to their used equipment draw and convenient locations such as near mall food courts. With a little patience as the new hardware enters the market, investors could be handsomely rewarded this holiday season, which most analysts forecast will be better than the last.

The article New Hardware Should Lead This Retailer Back to Growth originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.