With political turmoil in the past week, Turkish stock prices fell sharply. The index for the Istanbul Stock Exchange fell from 93,300 points to 76,900 points between May 22 and June 3. Turkey might offer a good investment from here. Despite all the bad events occurring recently, the country continues to be one of the safest and most stable countries in the Middle East. Even the National Bank of Greece (ADR) (NYSE:NBG), which may face a government takeover in the coming weeks, said that its Turkish units were the best performing units because of the good economic environment in the country. Finansbank, which is owned by National Bank of Greece, continues to drive its parent to profitability by posting 20% revenue and profit growth year over year. Keep in mind that National Bank of Greece (ADR) (NYSE:NBG) may not be a safe bet until it collects the amount it is required to collect from private investors in order to avoid nationalization. On the other hand, Turkish economy continues to present investors with good investment opportunities.

Funds

Thankfully, there are several other ways to invest in the Turkish economy than buying shares of National Bank of Greece (ADR) (NYSE:NBG). For Americans, one of the best and easiest ways is to buy the Turkish Investment Fund Inc (NYSE:TKF). The fund attempts to track the performance of some of the largest companies in Turkey and it performs similarly to the Istanbul Stock Exchange. In the last year, the share price of the ETF has appreciated by 36% despite the recent plunge. Those who want to follow a Turkish index more closely can also invest in iShares MSCI Turkey Investment Market Index Fund. This fund attempts to track the performance of the MSCI Turkey Index. In the last year, this fund performed a little better than the Turkish Investment Fund Inc (NYSE:TKF) as it appreciated by 40%. A third of these ETFs consist of companies in the financial industries, while the rest of the portfolio is pretty diversified.

Equities

Not many Turkish shares trade directly on American exchanges. One exception to this rule is Turkcell Iletisim Hizmetleri A.S. (ADR) (NYSE:TKC), which is the largest mobile phone operator in the country. In the last year, the stock price of the company has appreciated by 34%.

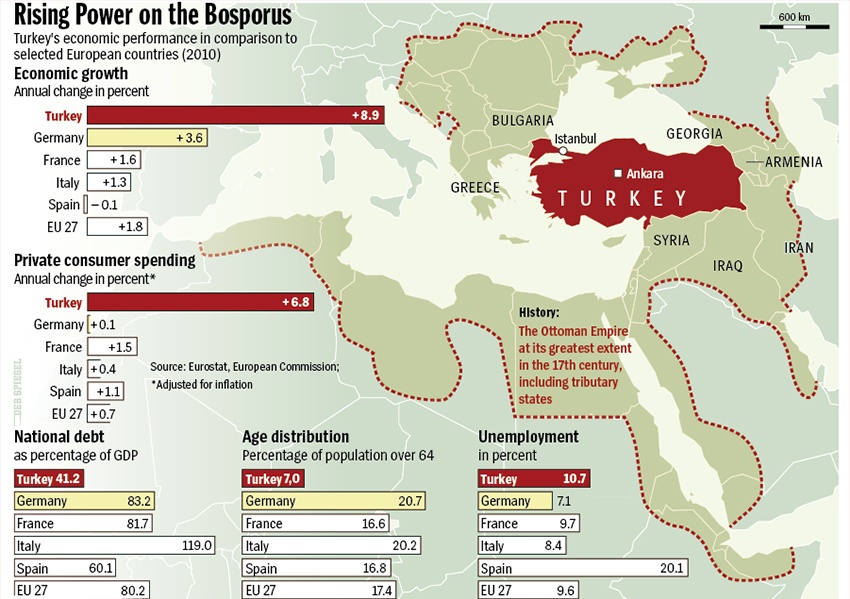

As European economies fight hard to get out of recession, the Turkish economy has grown rapidly. In 2000, Turkey’s GDP was $266 billion, but today, the country’s GDP is above $800 billion and it is expected to pass $1 trillion before the decade ends. This is highly impressive compared to Turkey’s neighbor Greece, whose GDP shrinks year after year. Turkish currency is particularly low compared to dollar, which makes Turkish stocks even cheaper.

Of course, the Turkish economy is not risk-free. Even though it is relatively stable, it still won’t be as stable as the American or German economies. Furthermore, even though Turkish economy has outperformed the European Union in the last few years, the growth in the country might be slowing down. In the last few years, Turkish economy depended heavily on loans, privatization and foreign investments. In particular, a lot of wealthy investors from countries like Kuwait and Saudi Arabia invested large amounts of money in Turkey because the economical and political conditions are more stable in Turkey than most Middle Eastern countries.

In the near term, Turkish stocks may continue to fall. Once the stability returns to the country, the stock prices should start to recover. At the moment, Turkish stocks may not be as safe bet as American stocks but they surely are much safer than stocks in countries like Spain, Italy and Greece.

Source: Der Spiegel, via istanbul notes

Conclusion

After going through what Greece was currently going through in 2001, Turkey implemented many changes in its banking system in order to build one of the healthiest economies in Europe. This also gives me hopes about the Greek economy. Investors sold Turkish stocks out of fear and the country’s stock market is currently in the oversold territory. Those looking for stable growth with relatively low risk can find a great entry point to the Turkish stocks at the moment.

Jacob Steinberg has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Jacob is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

The article It May Be Time to Invest in Turkey originally appeared on Fool.com and is written by Jacob Steinberg.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.