And again, I still think that’s cyclical. The nice thing that we see is cyclical end markets do rebound and the discipline we’re imposing on our operations in our commercial aspects, in the trough side of the cycle, it’s going to benefit and we will recover faster as these things come off the trough. Christian, I’m not terribly bullish on RV and Marine for 2024, but I do think again, that’s a fine business to be in and have a strong competitive position like we do. Grant, would you like to add any color?

Grant Fitz: Sure, I think you covered it well with Marine and RV. I would say just on a couple of things, for the consumer piece with our gas can business, this last year we had virtually no storm activity, which typically will drive some significant revenue in the back half of the year. And so, I would anticipate just given historical measures that we would see some storm activity this year for our consumer business that would certainly see an increase organically from the gas can business. Also, as we talked about in our military business, we continue to see that as an end market that we will see probably further growth, particularly with the 155 shell casing that we produce. We’re now in a position to be able to produce that ultimately for the U.S. military, and that gives us what we would see as a longer term headway for our military business for the company.

So that we see as they replenish those arms globally, that certainly will give us some tailwind as well too. And then the other piece that we don’t talk about, specifically by end market, but just our e-commerce business continues to grow quite well. Year-over-year, we had strong growth in our e-commerce business. And that does impact all of our different end markets, but we continue to work on expanding that and we’ll see some growth in that area as well. And then in general, I do think that the auto tire repair area, we’ll continue to see some tailwinds, although that certainly is more of a little bit of a lumpiness depending on what happens with just some of the general cyclicality with tire sales. But overall, I think we see that as a longer-term tailwind for our business.

Michael McGaugh: Yeah, and just Christian, if I can add in one final piece is we’re three weeks into owning Signature. But that business is, again, doesn’t have the cyclical characteristics. It’s an infrastructure play. You’ve got $1 trillion of infrastructure spending that’s being deployed by the federal government over the next 10 years. Signature has a very strong competitive position and a very attractive profit margin. And we’re seeing that business start off very strong. So we continue to have strong expectations for that business over the next two and three years. And we’re seeing those initial trends, again, three, four weeks into owning the company.

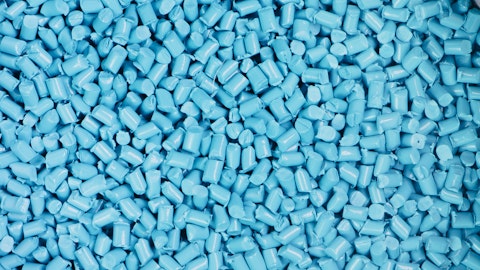

Christian Zyla: Thank you guys so much. Really appreciate all the information there. Last question from me. Can you just quantify the benefit of lower raw materials worth to material handling margins, if I just look at polyethylene prices, for example, those have come down quite a bit in the last year. Any colors to why that hasn’t flown through to gross margins, is there something else we should be thinking about there? Thank you so much.

Michael McGaugh: Yeah, and thanks, Christian again for your questions. Overall, as I mentioned, in terms of the revenue prices, we do see benefits with our purchasing team. We’ve got a really, what I would say, just a very strong purchasing team, one of the best I’ve seen in my career, certainly. And so we do leverage the lower raw material costs, certainly with resin prices. But I would say that, as I mentioned earlier, we are seeing some pricing pressure, particularly in the agricultural end market that has been offsetting some of that. So that’s kind of the hydraulic I would think about as we look at that business. And then also with the other parts of our end markets, though we’ve talked about agriculture, we do continue to see some pricing in general across the material handling business that is providing some additional pressure on margins that we’re offsetting with material and other operational savings.

Meghan Beringer: Thank you, Chris. Oh yeah, I believe we have one more caller. Thank you.

Operator: Yes, our next question is from the line of Anna C. Jolly of Gabelli and Company. Anna, your line is now open. Please go ahead.

Unidentified Analyst : Hi, guys. Thanks for taking my questions, Carolina. Two questions, one, are you just able to quantify the impact of the lack of the hurricane season?