After several tireless days we have finished crunching the numbers from the more than 700 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards M&T Bank Corporation (NYSE:MTB).

M&T Bank Corporation (NYSE:MTB) investors should be aware of an increase in enthusiasm from smart money in recent months. Our calculations also showed that MTB isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are viewed as worthless, outdated financial vehicles of yesteryear. While there are greater than 8000 funds trading today, Our researchers choose to focus on the elite of this group, around 700 funds. It is estimated that this group of investors manage bulk of all hedge funds’ total asset base, and by keeping an eye on their matchless investments, Insider Monkey has formulated many investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Warren Buffett of Berkshire Hathaway

Let’s take a glance at the fresh hedge fund action surrounding M&T Bank Corporation (NYSE:MTB).

Hedge fund activity in M&T Bank Corporation (NYSE:MTB)

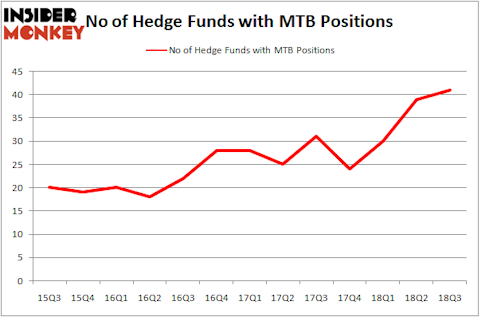

At the end of the third quarter, a total of 41 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in MTB over the last 13 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Among these funds, Berkshire Hathaway held the most valuable stake in M&T Bank Corporation (NYSE:MTB), which was worth $885.6 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $394.2 million worth of shares. Moreover, Balyasny Asset Management, D E Shaw, and Two Sigma Advisors were also bullish on M&T Bank Corporation (NYSE:MTB), allocating a large percentage of their portfolios to this stock.

Now, key money managers were leading the bulls’ herd. Point72 Asset Management, managed by Steve Cohen, created the biggest position in M&T Bank Corporation (NYSE:MTB). Point72 Asset Management had $58.3 million invested in the company at the end of the quarter. David Rodriguez-Fraile’s BlueMar Capital Management also made a $3.8 million investment in the stock during the quarter. The other funds with brand new MTB positions are Matthew Tewksbury’s Stevens Capital Management, Jeffrey Talpins’s Element Capital Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks similar to M&T Bank Corporation (NYSE:MTB). These stocks are Republic Services, Inc. (NYSE:RSG), Wipro Limited (NYSE:WIT), Deutsche Bank Aktiengesellschaft (NYSE:DB), and The Kroger Co. (NYSE:KR). This group of stocks’ market values are closest to MTB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RSG | 26 | 610706 | 4 |

| WIT | 8 | 67451 | 2 |

| DB | 9 | 1416896 | 0 |

| KR | 30 | 185318 | 1 |

| Average | 18.25 | 570 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $570 million. That figure was $2338 million in MTB’s case. The Kroger Co. (NYSE:KR) is the most popular stock in this table. On the other hand Wipro Limited (NYSE:WIT) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks M&T Bank Corporation (NYSE:MTB) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.