Hedge funds have been buying shares of Motorola Solutions Inc (NYSE:MSI), despite it trading at high multiples of traditional value measures. The stock currently trades at 20x earnings, 21x free cash flow, 9.5x EV/EBITDA, and 10x tangible book.

However, traditional value measures are only a starting point for finding real value in the market. In fact, most good investment opportunities are not obvious upon first glance. Therefore, it is worth taking a closer look to discover why hedge funds like Motorola Solutions so much.

Government Work

Motorola Solutions Inc (NYSE:MSI) has two divisions, but the most important one is its government segment. The company is the overwhelming leader in supplying the government with public safety radios, software, and other technologies. And its advantage is only going to grow as it moves further out on the experience curve.

One of the most exciting things about the company is that it has excess debt capacity — and it is using that excess capacity to borrow money to repurchase shares. Borrowing money to buy back stock is a terrific way to unlock shareholder value as long as debt remains at a sustainable level. The company currently has less than 2x debt to EBITDA — a level that is not only sustainable, but extremely low for a company with Motorola Solutions’ stability.

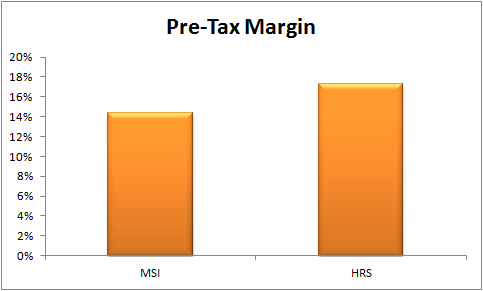

In addition to stability, the company earns high margins. It posted a pre-tax margin of nearly 14% in its last fiscal year and is expected to continue earning a similar margin in the future.

The only concern with Motorola Solutions Inc (NYSE:MSI) is that it has cut back significantly on research and development, which could hurt results down the line. It is also subject to the whims of government budgets, which could be axed at any time.

Partial Competitors

Motorola Solutions stands on its own, particularly in government work. But a few companies can give it headaches at times.

For instance, Honeywell International Inc. (NYSE:HON) is a much more diversified contractor than Motorola Solutions. Its recent major contract awards in aviation and its market leadership in aerospace control and safety systems will help it produce ample free cash flow for research and development in the coming years.

In addition, Honeywell’s business is even more stable than Motorola Solutions’. Over the last decade, it has had extremely little variance in its free cash flow margin, suggesting a predictable business with stable market share.

As a result of having high margins and plenty of capital, Honeywell International Inc. (NYSE:HON) has the firepower to undercut and outspend Motorola Solutions should it choose to aggressively pursue Motorola Solutions Inc (NYSE:MSI)’s market share. One way Honeywell could do this is by making key acquisitions. In fact, the company has accumulated so much goodwill from its acquisitions that intangibles are its single largest asset. Instead of buying back stock or paying a higher dividend, Honeywell often uses free cash flow to enter new markets or beef up its status in existing ones.

So keep a close eye on Honeywell’s M&A activity — if it acquires a company supplying similar technology to the U.S. government, such as Harris Corporation (NYSE:HRS), then Motorola’s profitability could be in jeopardy.

Harris sells a variety of communications technologies and other systems to both the government and private sector, including many of the same products and services that Motorola Solutions sells (e.g., portable radios). The company recently signed a number of new contracts with the U.S. government, including one with the National Institutes of Health that is potentially worth $20 billion.

Whereas Honeywell International Inc. (NYSE:HON) is an enormous company that can outspend Motorola Solutions Inc (NYSE:MSI) if it wants to attain market leadership, Harris is a little smaller than Motorola Solutions in sales, but earns similar — if not higher — margins.

In addition, the two companies earn similar returns on capital. This suggests that Motorola Solutions does not have a substantial moat when it comes to competing against other government contractors, though all government contractors benefit from barriers to entry.

As a result of its similarity in business model and in the types of contracts it bids for, Harris is the primary competitor that Motorola Solutions shareholders should keep an eye on.

Bottom Line

Motorola Solutions is not your Ben Graham-style value stock. Nothing about its price or enterprise value multiples suggest that it is cheap. However, by using its excess debt capacity to recapitalize the company, Motorola Solutions Inc (NYSE:MSI) is much cheaper than it currently appears. If it can hold off its competitors and secure more long-term contracts with the government, this stock will pay off for shareholders over the next two to three years.

The article A Good Value Despite High Multiples? originally appeared on Fool.com and is written by Ted Cooper.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.