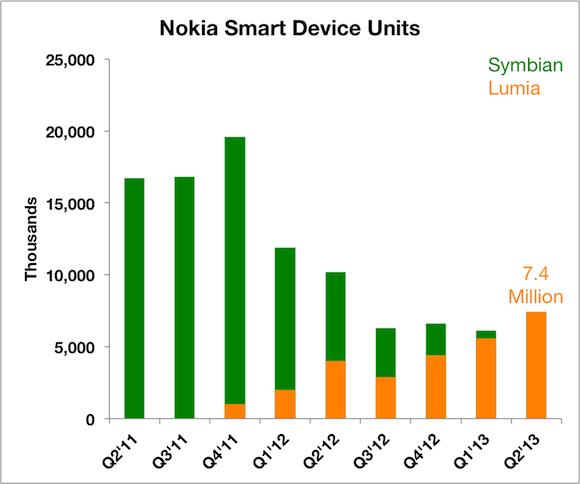

Nokia Corporation (ADR) (NYSE:NOK)’s Lumia lineup continues to perform decently in the face of a slow season for smartphone sales and intense competition. The company just reported 7.4-million unit shipments in the second quarter, a sequential increase from the 5.6 million Lumias shipped last quarter. However, that was still shy of the 8.1 million Lumias that analysts were calling for.

Nokia Corporation (ADR) (NYSE:NOK)’s transition to Microsoft Corporation (NASDAQ:MSFT) Windows Phone as its primary platform is now complete — Symbian is now completely out of the picture.

Source: Nokia.

As Lumia grows, so does Windows Phone’s position in the market. Microsoft Corporation (NASDAQ:MSFT)’s platform has now overtaken BlackBerry as the No. 3 operating system. The software giant is also expanding its carrier and OEM partnerships, possibly adding LG to the mix in the near future.

Both Nokia Corporation (ADR) (NYSE:NOK) and BlackBerry Ltd (NASDAQ:BBRY) have bet their turnarounds on next-generation operating systems and, in this respect, Nokia’s turnaround has progressed much farther than BlackBerry Ltd (NASDAQ:BBRY)’s. The Canadian vendor only sold 2.7 million BlackBerry 10 units last quarter, which thoroughly disappointed investors. Even if you include all of BlackBerry’s 6.8 million smartphone units, Nokia’s Lumia has BlackBerry Ltd (NASDAQ:BBRY) beat.

Better than bad doesn’t mean good

Unit volumes are just part of the overall picture, though, which remains dreary. Total revenue fell 24%, to $7.5 billion, which translated into a net loss attributable to shareholders of $297 million. Mobile phone shipments, including feature phones, were 53.7 million, while investors were hoping for 56.2 million.

The Nokia Siemens Network, or NSN, segment improved its adjusted operating profit significantly, to $429 million. Nokia is in the process of buying out Siemens AG (ADR) (NYSE:SI)‘ stake, which will allow it to keep more of the black ink to itself, but will also further add to Nokia’s debt burden at a time when it’s still facing a cash crunch. Operating cash flow was negative $256 million, and Nokia’s total cash position declined by $785 million.

With Nokia Corporation (ADR) (NYSE:NOK) shares opening in the red today, investors aren’t impressed with the overall results. It doesn’t take much to have a better chance than BlackBerry Ltd (NASDAQ:BBRY), though.

The article More Proof That Nokia Has a Better Shot Than BlackBerry originally appeared on Fool.com and is written by Evan Niu, CFA.

Fool contributor Evan Niu, CFA, has no position in any stocks mentioned. The Motley Fool owns shares of Microsoft.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.