We came across a bullish thesis on Monolithic Power Systems, Inc. on Monte Independent Investment Research’s Substack by Monte Investments. In this article, we will summarize the bulls’ thesis on MPWR. Monolithic Power Systems, Inc.’s share was trading at $928.35 as of December 1st. MPWR’s trailing and forward P/E were 23.82 and 42.73, respectively according to Yahoo Finance.

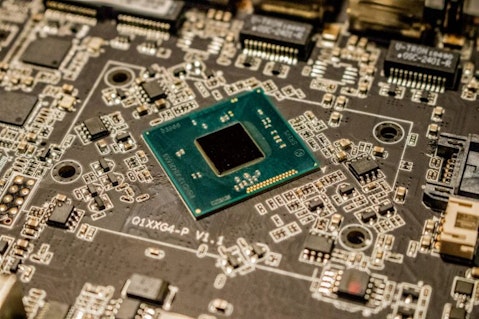

Monolithic Power Systems (NASDAQ: MPWR) is a leading provider of power-related analog semiconductors and mixed-signal integrated circuits, serving industrial, telecommunications, cloud computing, automotive, and consumer electronics markets. The company is well positioned to benefit from several secular growth trends, including data center expansion, industrial automation, and utility grid modernization.

Its enterprise data, storage, and computing segment has rapidly expanded, growing from 14% of revenue in 2022 to 52% by Q2 2025, reflecting strong demand for high-performance analog and mixed-signal ICs in servers, workstations, and AI applications. MPS primarily produces DC/DC and AC/DC converters, driver MOSFETs, power management ICs, current limit switches, and lighting control products, which are essential across computing, automotive, and industrial applications.

MPS operates a fabless model, outsourcing semiconductor fabrication to partners in China, Taiwan, South Korea, and Singapore, with testing, packaging, and assembly completed in-house or through collaborators. Sales are largely through third-party distributors and value-added resellers, though some direct OEM and ODM relationships exist, with the top two distributors contributing 51% of total revenue in 2024. China represents the company’s largest market, accounting for roughly 55% of net sales, and approximately half of MPS’s fixed capital is deployed there, highlighting its exposure to regional macroeconomic dynamics and trade tensions.

While some Q2 2025 revenue may have been pulled forward due to tariff uncertainties, the company is expected to continue receiving strong demand support from data center and industrial segments. Despite challenges in automotive EV sales and relaxed EU CO₂ targets, MPS’s diversified portfolio and global footprint position it for resilient growth, making it an attractive opportunity in the power semiconductor sector with multiple catalysts for revenue expansion and market share gains.

Previously we covered a bullish thesis on Monolithic Power Systems, Inc. (MPWR) by Hidden Market Gems in April 2025, which highlighted the company’s fabless operations, high margins, diversified customer base, and AI exposure. The stock has appreciated approximately 65.23% since coverage as fundamentals remained strong. Monte Investments shares a similar perspective but emphasizes rapid enterprise data growth and global operational footprint, offering a more detailed market outlook.

Monolithic Power Systems, Inc. is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 41 hedge fund portfolios held MPWR at the end of the second quarter which was 47 in the previous quarter. While we acknowledge the risk and potential of MPWR as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than MPWR and that has 10,000% upside potential, check out our report about this cheapest AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy NOW

Disclosure: None.