I believe Microsoft Corporation (NASDAQ:MSFT) is getting closer to finally being recognized by Mr. Market, which will lead to capital appreciation that should have come a long time ago. I already know that this may not be a very popular belief, as I have already received many negative comments regarding my bullishness and bullish writings on Microsoft in the past.

While I agree with many bears that Microsoft may be a broken stock as of now, I strongly disagree that it will remain one permanently. Before I dive deeper into my reasoning why, let’s examine a few other “broken stocks” of the past.

A sideways trading medical giant…

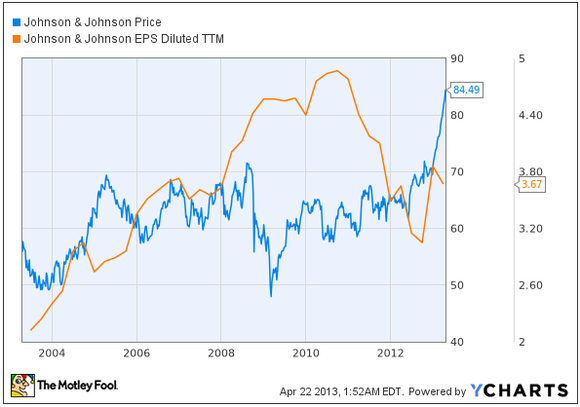

Like Microsoft Corporation (NASDAQ:MSFT), Johnson & Johnson (NYSE:JNJ) once traded sideways and range-bound:

Notice something? While the stock price stayed in a relatively tight range for close to a decade (barring the financial crisis), its earnings went steadily upwards. The company’s price didn’t catch up until recently, in the latter part of 2012. Please note that the drop-off in EPS in 2012 was largely due to $1.24 per share in non-recurring items — which if backed out — would give the company a normalized EPS of $5.10, which keeps its uptrend in earnings constant.

In other words, Johnson & Johnson constantly increased earnings and still is, but it took a while for Mr. Market to notice the broken nature of this blue chip medical stock. Johnson & Johnson (NYSE:JNJ)’s annual EPS estimate going forward is $5.42, which gives the company a forward P/E of around 15.

Wal-Mart Stores, Inc. (NYSE:WMT) disease?

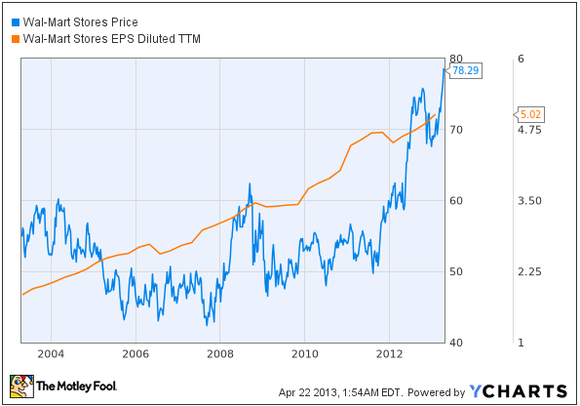

Another offender of trading sideways, producing hardly any value capital appreciation wise, was Wal-Mart.

Wal-Mart did nothing price-wise for investors for a decade, despite solid, increasing earnings. The company even had a disease named after it by Forbes contributor Adam Hartung, who pointed out that the company was obsessed about execution and did little to move the needle for shareholders.

Like Johnson & Johnson, the company’s earnings power was eventually recognized by the market in 2012, however, and finally corresponded by breaking out in a higher share price. Wal-Mart Stores, Inc. (NYSE:WMT) is also expected to continue to increase earnings at a good pace, with an annual EPS estimate of $5.34 going forward.

So how does this relate to Microsoft?

Like Johnson & Johnson and Wal-Mart, Microsoft has done nothing (unless bought solely for its dividend) for investors for over a decade. Its price has remained range-bound, but earnings have shot straight up, if you consider normalized earnings. Like Johnson & Johnson (NYSE:JNJ), Microsoft’s true earnings power was depressed by a one-time write-off. Microsoft Corporation (NASDAQ:MSFT)’s was related to a bad acquisition in the past that was swung to a more recent quarter.

Tony Bradley of PCWorld, for instance, thinks that Windows 8 sales may be the reason for the decline in PCs, but more so because Windows 8 is changing the definition of the PC. How do you classify a Surface, which is a blend between a tablet (not counted as a PC) and laptop (which counts as a PC in most estimates)? There are many other Windows 8 hybrid devices on the market produced by Microsoft’s OEM partners as well.

People tend to forget Windows 8 was designed to get Microsoft Corporation (NASDAQ:MSFT) into the world of touchscreens and mobile, and isn’t focused only on old-school PCs. According to CNN Money, Windows sales surged 23% in their most recent quarter. Microsoft’s annual EPS estimate going forward is $2.75.