Pelican Bay Capital Management, an investment management company, released its third-quarter 2025 investor letter. A copy of the same can be downloaded here. PBCM Concentrated Value Strategy returned 7.8% in the quarter, compared to a 5.3% return for the Russell 1000 Value Index. YTD, the fund returned 11.2% compared to 11.6% for the index. In addition, please check the fund’s top five holdings to know its best picks in 2025.

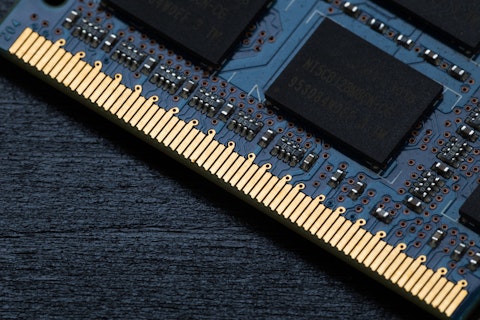

In its third-quarter 2025 investor letter, PBCM Concentrated Value Strategy highlighted stocks such as Micron Technology, Inc. (NASDAQ:MU). Micron Technology, Inc. (NASDAQ:MU) designs, develops, manufactures, and distributes memory and storage products globally. The one-month return of Micron Technology, Inc. (NASDAQ:MU) was 23.42%, and its shares gained 118.98% of their value over the last 52 weeks. On November 7, 2025, Micron Technology, Inc. (NASDAQ:MU) stock closed at $237.92 per share, with a market capitalization of $267.057 billion.

PBCM Concentrated Value Strategy stated the following regarding Micron Technology, Inc. (NASDAQ:MU) in its third quarter 2025 investor letter:

“Technology stocks were also outperformers in Q3. Micron Technology, Inc. (NASDAQ:MU) benefited from a second consecutive quarter of excellent gains, jumping another 36% after last quarter’s 42% increase. On a year-to-date basis, Micron is up 99%. Investors have recognized that the inference and agentic applications of AI computing are poised to drive significant orders for the High Bandwidth Memory (HBM) that Micron produces. To learn more about the need for HBM memory please refer to our Q4 letter from 2024.”

Godlikeart/Shutterstock.com

Micron Technology, Inc. (NASDAQ:MU) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 94 hedge fund portfolios held Micron Technology, Inc. (NASDAQ:MU) at the end of the second quarter, compared to 96 in the previous quarter. In the fiscal Q4 2025, Micron Technology, Inc. (NASDAQ:MU) reported revenue of $11.3 billion, up 22% sequentially and up 46% year over year. While we acknowledge the risk and potential of Micron Technology, Inc. (NASDAQ:MU) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Micron Technology, Inc. (NASDAQ:MU) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Micron Technology, Inc. (NASDAQ:MU) and shared the list of must-buy US stocks to buy. In addition, please check out our hedge fund investor letters Q3 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.