Mawson Infrastructure Group, Inc. (NASDAQ:MIGI) Q4 2022 Earnings Call Transcript March 25, 2023

Operator: Greetings. And welcome to the Mawson Infrastructure Group Fourth Quarter and Year End 2022 Earnings Results Call. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Tim Broadfoot, Chief Corporate Officer. Thank you, Tim. You may begin.

Tim Broadfoot: Thank you, and hello, everyone. Welcome to Mawson Infrastructure Group, Inc.’s annual and fourth quarter 2022 earnings call. Joining me today on today’s call are our Founder and CEO, James Manning; our COO, Liam Wilson; and our CFO, Ariel Sivikofsky. We look forward to taking you through the investor presentation today. Firstly, I need to bring to your attention a short disclaimer around forward-looking statements. Please be aware today we will be making forward-looking statements. These statements are based on current expectations and assumptions and are subject to risks that could cause actual results to differ materially from those expected. We may also make forward-looking statements as part of our Q&A at the conclusion of this presentation.

We will also discuss certain non-GAAP financial measures about the performance during today’s presentation and Q&A. You can find the reconciliation of GAAP financial measures at the end of our presentation, which is available on our website. Please be sure to refer to the cautionary text regarding forward-looking statements contained in this presentation on slide two, as well as the risk factors in our annual report on Form 10-K filed on March 23, 2023, under the subheading Risks Relating to Our Business. With that, I will hand it across to our CEO, James Manning.

James Manning: Thanks, Tim, and welcome, everybody. Q4 was a transitory period for Mawson as we closed the sale of the Georgia facility to CleanSpark and moved all our assets into our Pennsylvania facility expansion. During this time, our industry, in particular and the economy more broadly faced a little macro headwinds. Mawson has converted these headwinds with a continued focus on our diversified and total revenue model, particularly trade revenue shares; one being self-mining; two being hosting collocation; and three, our market-leading Energy Markets program. I want to provides a significant support to the company’s revenue and price profit through Q4 and through 2022. Some key highlights from the period include, the closing of our Georgia sale for over $40 million; completion of the build-out for Phase 1 of Midland, PA to 120 megawatts of capacity; securing some additional sites for growth, including firming up our 120-megawatt facility in Sharon, PA; and entry into a binding sale agreement for the Texas facility for $8.5 million, enabling us to continue our strategic focus on the PA region.

With that summary, I am going to hand over to Ariel Sivikofsky, our CFO, to run through the financials for the year.

Ariel Sivikofsky: Thanks, James, and thank you to everybody who has joined the call. Touching on some highlights of the full year results of 2022, Mawson has generated record revenue for year-to-date of $84.3 million, up 92% year-on-year; gross profit of $36.6 million, up 8% year-on-year; non-GAAP EBITDA of $30.4 million, up 70% year-on-year; and Bitcoin produced for self-mining increased 66% to 1,343 coins. Importantly, with the largest depreciation shared afforded to us, we have almost no tax burden in this EBITDA number. Pleasingly, our hosting colocation business also generated solid growth, rising 1,464% from 2021 to $13.3 million in 2023. In addition, to this Mawson had a new source of revenue in 2023, being the Energy Markets program that generated $13.7 million in revenue at a gross margin of 91%.

Mawson received $20.6 million of proceeds from the sale of the Georgia facility in quarter four, with additional share-based payments hitting the balance sheet subsequent to year end. These funds have been partially used to reduce debt as shown on the balance sheet with debt reduction payments of $11.93 million in quarter four. Some other balance sheet highlights from the quarter include; an addition of $11.3 million in assets associated with energy contracts referred to here as derivative assets; a $3.2 million increase in marketable securities; and a $5.4 million increase in assets held for sale. At the end of 2022, our net assets were $76.1 million, based on shares on issue as at March 6, 2023, of $14.1 million, our net assets per share sit at $5.34 per share versus a share price of $2.50.

Turning to our income statement, some other highlights from 2022 versus 2021 include; a 37% reduction in our selling, general and administrative expenses from the first half of 2022 to the second half of 2020, a $12 million increase in year-on-year in hardware sales to $14.2 million in 2022. Critically and with the challenge of 2022 behind us, Mawson is focused on ensuring that we have a strong balance sheet for 2023. Through strategic asset sales, increases in our operations and the capital raise in 2022 we are well placed to grow in 2023. I will now hand over to Chief Operating Officer, Liam Wilson, to provide an operational update.

Liam Wilson: Thanks, Ariel. As James touched on it earlier, Mawson has developed a diversified and highly flexible operating model. Through 2022, we saw this model pay dividends as extreme weather events, coupled with global social issues caused power prices to peak worldwide. Our infrastructure-first approach was highly favorable through 2022. Due to these events and the operating model, Mawson had the ability to 2022 included an average of 0.8 exahash online for the year with the top of 1.63 exahash online to self-mining reached in June 2022. We look forward to our self-mining ramping up significantly through Q2 and Q3 as our 120-megawatt Midland, PA facility and the first 12 megawatts of our 120-megawatt facility in Sharon, PA, come online.

We are actively watching the market for purchasing opportunities to add to and upgrade our self-mining fleet. The second arm of our diversified model hosting continued to pay dividends during 2022, which further justified our mining hosting split, a record $13.3 million of hosting revenue was earned through 2022, which run at a 24% margin. Mawson views hosting a stable revenue and an option to hedge against full Bitcoin exposure and we will continue to look for favorable and appropriate hosting partners in the future. Our third revenue stream, the Energy Markets program was a resounding success story of 2022. $13.7 million in revenue was earned during a period when our competitors would have otherwise been offline. This program ran at a 91% margin.

On top of this, our grid stability contribution was significant, particularly during the pre-holiday period winter storm, which hit across the U.S. In Q4, Mawson exited the Australian facility at Condon. This decision was made so that Mawson could focus all of our attention on Pennsylvania and Ohio. We firmly believe the climatic conditions in these areas are perfect for mining and hosting. They also provide the opportunity to participate in the Energy Markets program. With regards to the climate, winters are cold with some rare freezing events, summers are mild with very few extremely warm days. What you are left with is highly favorable air cooled mining weather to 99% of the year. Mawson now has our eyes firmly on what can be achieved in 2023 and this is underpinned by our secured energy pipeline.

Our infrastructure-first model and existing strategic relationships have given Mawson first access to multiple attractive sites and we look forward to announcing further growth in the near future. We will continue to search for deal on and develop sites, which we believe will be highly lucrative for either self-mining, hosting or a mix, and we will look to add to our Energy Markets program where applicable as well. Mawson’s ESG program is something we are incredibly proud of and we will continue to look for opportunities to further the program through 2023. Our proximity to the Beaver Valley nuclear station is a strategic advantage and we are very proud of our 100% nuclear certification. During 2022, we were welcome to the Midland, PA, community and we are extremely proud to have contributed to the arts, education and healthcare facilities with grants.

On top of this, we have been active supporters in the Sandersville community prior to our sale for three years and have recently become involved in the Sharon, PA, community. With that, I will pass back to James. Thanks, James.

James Manning: Well said, Liam. Continuing on an important part of our success today and to the future is our employee and team. Our operational team is led by our COO, Liam Wilson, driving the operational performance of the company. Craig Hibbard, our CDO, is overseeing the development of our portfolio facilities in the United States. We then have our corporate team consisting of Tom Hughes in General Counsel; Tim Broadfoot, our CCO; Dan Tuzzio, our CTO; and Ariel Sivikofsky, our CFO. This team brings a wealth of experience and knowledge and knowhow from many industries that give ultimately sales now and into the coming years. With this combination of personnel and structure, we are confident and excited to take on any challenges into 2022.

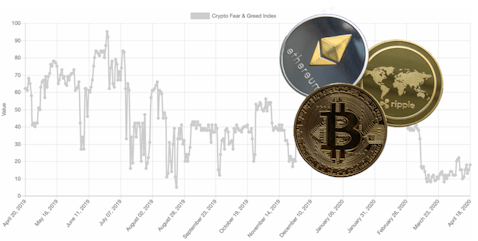

Finally, we want to be sold to the market price of our share versus several other metrics. 2022 for Mawson shareholders observed a material decline in the share price. Having take into consideration the current market price versus our peers and other external factors, such as, Bitcoin, we prepared the final slide to help everyone to reflect upon the value proposition we at Mawson see in the share price. In summary, 2022 was a pivotal year from the Mawson team. We simultaneously expanded our large scale on low-cost Pennsylvania facilities, which today stand at 240 megawatts of capacity or approximately 8 exahash of computing power. We also completed the sale of one of our non-core facility to CleanSpark approximately $40 million. And we intend to expand our Pennsylvania facilities with self-mining and hosting throughout 2023 and into 2024, and look forward to sharing more information on this expansion in early Q2 this year.

With that, I just want to take a moment to thank shareholders for their continued support of Mawson and we look forward to answering any questions and giving you updates in the future. Thank you.

Tim Broadfoot: Thank you, gentlemen. With this presentation now complete. We wanted to take this opportunity to thank all of our employees, suppliers and shareholders for their ongoing support in 2022 and into 2023. We will now answer any questions.

See also 12 Best Holding Company Stocks To Invest In and 12 Best Bid Data Stocks To Buy.

Q&A Session

Follow Mawson Infrastructure Group Inc. (NASDAQ:MIGI)

Follow Mawson Infrastructure Group Inc. (NASDAQ:MIGI)

Receive real-time insider trading and news alerts

Operator: Thank you. Thank you. Our first question is from Josh Siegler with Cantor Fitzgerald. Please proceed with your question.

Josh Siegler: Yes. Hi, guys. Thanks for taking my question today. I think for my first one, I’d love to get an update on what you are seeing in terms of hosting demand and the progress you have made in finding a hosting partner moving forward? Thank you.

James Manning: Hi, Josh. Good to hear from you. I might pass that one to Liam, who’s sort of been dealing with the day-to-day hosting inquiries. He would be best positioned to answer that.

Liam Wilson: Thanks, Josh. Thanks for the question. I guess the simplest answer is, there’s a ton of inquiry coming through. We are seeing plenty of the large miners looking for hosting now that the other facilities through the market have dropped off through 2022 and we are seeing plenty of new demand for hosting come through from players that we previously hadn’t heard of before. So in short, there’s a large pipeline of hosting customers ready. With regards to us nailing down a hosting partner, we are going through some pretty stringent day-to-day with a number of parties at the moment and we hope to be announcing some exciting news on hosting in the near future, but we are in the final stages of that now.

Josh Siegler: Understood. That’s helpful color. And then I’d love to circle back to the build-out of Sharon, and kind of what CapEx are you assuming will be required to finish construction of that site?

Liam Wilson: James, do you want to a take that.

James Manning: Hi, Josh. Yes. Yeah. You are more than delighted .

Liam Wilson: Thanks. Josh, the first 12 megawatts for that facility are already fully funded. So that’s the first six NDCs, the transformers and all the polls and wires to get that online. The balance of the 108 megawatts, we will be looking for a partner to execute that site.

Josh Siegler: All right. Understood. Thank you.

Operator: Thank you. Our next question is from Kevin Dede with H.C. Wainwright. Please proceed with your question.

Kevin Dede: Hi, James. Thanks for taking my call. Your objectives look pretty appetizing and I was wondering what all was behind them? We are 50 megawatts now, hoping to go to 4.5 exahash and then 8 exahash on a mix of self-mining and hosting. Can you give us a little more detail on how you expect that mix to break down?

James Manning: Sure. So what I’d say is, we are at 50 megawatts online and within sort of the next 30 days, we expect to be 120 megawatts online. So that’s the first one. So think about us is 50 megs is probably not giving us full credit where credit is due to the balance of the facility built out at Midland, the whole 120 meg of infrastructure there and we are just in commissioning phase on that. So we probably need to — we were intending to come to market and when we start turning those cans on over the next couple of weeks. But the containers are on site, the substation is built and we are in the testing phase of commissioning. So to think about it as more 120 megs online is probably close to the mark where we are. So, and that’s, obviously, being funded and built out to-date.

The next one is Sharon, which we are, obviously, as Liam alluded to is, currently already been — and the process being finalized from a construction perspective, but is also fully funded. So we are more like 132 megawatts, 135 megawatts of built out infrastructure. That obviously gives us a good head start on total infrastructure build and where we are. I think on one of the slides, we alluded to, I think, it’s slide 10, you will see there’s sites one, two, or three. There are some other sites that we have got a very low CapEx, but in some site we can turn on another almost 50 megawatts there very quickly after a very, very little small capital outlay. And we have got those sites locked up already with some LOIs and some binding agreements.

So we are well down the track of having the infrastructure in place and the infrastructure is funded. So I think that’s the important piece. So then really what it leaves us with is picking the mix between do we self-mine or do we host, and I think, that was part of the question you asked, and really that’s about us trying to optimize both profitability and risk as a company. And so we are looking for strong counterparties in hosting that we feel comfortable with that continue to obviously pay bills on time, fund their relative proportion of any CapEx or provide a security around that and be good profitable counterparties or failing that we are looking at what’s the mix of self-mining and we would like to do a bit of both, ultimately. And really, it’s just it’s about balancing — do we have a really strong hosting partner.

We are more like a just the data center business, but we also like the profitability of Bitcoin mining. So we are just trying to find that balance there. And really, that’s a delicate balance that we manage based on decisions around when the facility is going to be ready, what our CapEx is and what the cost of that had additional infrastructure might be or mining rigs are and what the market is and what the return of payback profile is ultimately around that stuff. So you will see in our release that we have got the equipment we have just moved over from Australia. We have got some equipment we have moved up from George. So we have geared to turn on fundamentally and with that turn on gear we get closer to the 2 exahash mark. So we have got geared to bring on in our existing facilities as we bring out here on, then we will look forward to what’s the additional gear and what’s that mix moving forward.

Kevin Dede: Very helpful, James. Thank you. Would you mind going through, I guess, sort of two different calculations. One is the choice to sell out of Texas versus buying two facilities in Ohio and the other is balancing energy sales versus consumption for mining and hosting?

James Manning: Yeah. I am really happy to go through both of those. So, maybe last year, as a group, we did a — we sat down, we had a real soul searching and strategy session. And as a company and as a Board, we established a clear strategy about where we want it to be located, what we wanted to be focused on and how we wanted to operate the business. And the big outcome of that was we really wanted to be focused in a region. We wanted to be — we do on our execs traveling all over the U.S. and managing multiple sites, which are multiple days of trips between each one. So we decided we really like Pennsylvania. We like the PJM energy market, we found the pricing there to be competitive with the Texas market and has huge climate benefits.

So the idea was, although we would originally committed to going to Texas, we decided we want to lead the Texas market. We realized that we could sell those Texas assets in the market and refocus our energy really up in the Ohio, Pennsylvania region, where that our power is competitive and the climate is a little bit more forgiving. So that was the real focus of why we wanted to move ultimately up into that region. So does that answer that portion of your question, Kevin?

Kevin Dede: Yeah. That helps a lot James. Yeah. Thank you.

James Manning: And what was the other component, sorry?

Kevin Dede: Yeah. Just as you look at Pennsylvania and developing the sites in Ohio, how do you — how would you recommend we look at your prospects and deciding how you will allocate. I would — you will have what 240 in PA and what about 50 in Ohio? How will you balance use of that power between your energy market strategy versus your host and self-mining strategy?

James Manning: So, I guess, ultimately, we are always optimizing that for the greatest gross profit margin. So because we don’t have a hurdle strategy. We sell our Bitcoin. Everything we do, we are about maximizing profitability ultimately. And so if it’s most lucrative ultimately to be selling energy back to the market, we will look to do that. If it’s more lucrative to the mining Bitcoin, we will be doing that. And we have an internal model and algorithm, which we look at daily, which ultimately helps drive that decision. So I know that’s not great from a modeling perspective for you, Kevin, but what we are looking to do is ultimately be as profitable as we can be as a business. So we really make — we make the jump between Energy Markets revenue mining or hosting ultimately to make the most margin as possible.

Kevin Dede: Okay. The just peeling the onion back a little bit on Josh’s question on hosting partners. Could you give us an idea of what you are looking for, and I guess, sort of your partner — we are expectation your partners flexibility given the flexibility that you want to have in making that energy consumption decision and then if

James Manning: Yeah. It’s a

Kevin Dede: you are able to find something that can fit that bill, how do you compensate them?

James Manning: Yeah. So it’s a great question. Most of our contracts are open book cost plus power contracts. So that has some huge advantages, because we are not — I guess we are not exposed to price risk like you saw core was where they had unprofitable power inputs with fixed price power. And I think you have seen some other hosting companies come across with similar arrangements where they are committed to a cost per kilowatt hour of power and their prices spiked and they subsequently they subsequently filed, I guess, ultimately. So we have always been transparent in our pricing model. So we do a cost plus model where we have got a charge green infrastructure recovery. We have got a margin component for the business and then, obviously, power is power.

So we are very transparent with our customers on that. And we think that’s while they are our customers, we think that forms a partnership type arrangement, where they get the benefits of seeing it. Wind power spikes, typically, people don’t want to be operating because they are on a cost basis. So they are very happy to turn off. And that’s built into, I guess, how we see what our margins are as part of what we consider our margin to our customer, we ultimately say we get the benefit of — we might get the benefit of any curtailment on any new hosting contract that we get. So we think they are important parts of our contract negotiation and making sure the relationship is right ultimately. And it’s about getting that mix right with our customers, because they don’t want to pay high power prices and we need to manage that.

Kevin Dede: Okay. Yeah. For fear of hog in the call, James, last question, given your and Liam’s view of the climate in Ohio and Pennsylvania, I get the sense that you are not going to explore immersion and dealing with those few hot days or am I not making the right assumption there?

James Manning: Look, we have got a viable emerging product. The reality is on a cost per megawatt basis, it doesn’t compete with it to build this stuff out at the moment and until those economics changes, especially with what has historically been through 2022 depressed oil prices, it’s very hard to make the economic stack. But I think if you are sitting in — if you are sitting in a half of climate, then you have to explore that and there’s a very logical reason to do that. But I think it’s all a trade-off between OpEx and CapEx, and I guess, given where we are, we are pretty comfortable with that OpEx CapEx balance. I’d also say that typically when you see the hottest days in somewhere like PA or Ohio, you wake up and realize that they are also the highest keep pricing of power and so switching off for those few hours in a day for the few days in a year makes a lot of economic sense as well.

So when you consider, overall, we just don’t see given the region and climate we are operating in that it makes a huge amount of economic sense.

Kevin Dede: Perfect. Yeah. Thanks for that color. Appreciate it, James.

James Manning: Not a problem.

Operator: Thank you. Don’t have further

James Manning: So we don’t have any calls left — questions on calls. Sorry, I have got a couple more came in and then I have got some email questions as well. So we have got one here from Bert , who’s a

Operator: Okay.

James Manning: great supporting shareholder, are you?

Unidentified Analyst: Hello. You guys hear me okay.

James Manning: Great to hear from you.

Unidentified Analyst: Yeah. So, first, congrats on closing out the year very strongly with, obviously, a lot of moving pieces. I just want to clarify a few things. You talked about the Texas agreement, $8.5 million. Did you talk about the closing expectation and time of that? Is that within a few months or a few weeks? How should we think about that?

James Manning: Yeah. I think we would expect that to close in April at this point in time.

Unidentified Analyst: Okay. Okay. So that $8.5 million of cash that it’s obviously not reflected in Q4 yet, but it will be on most like a second quarter sounds like. And just clarification on the CleanSpark earn-out shares other than what you show on Q4 2022 there were other considerations received in Q1 2023 in the form of stock. So either you sold them and they became cash or they sit as the stock on your balance sheet as of now, is that a fair assumption?

James Manning: Correct. I am happy to confirm that we have sold the vast majority of all those CleanSpark shares.

Unidentified Analyst: Okay. So basically there is a pretty substantial strength in form of cash on the balance sheet that it’s not even showing in Q4 yet, so…

James Manning: Yeah. The position strengthened between, I guess, 31 December and today, we are in a much stronger position overall.

Unidentified Analyst: That’s great to hear. Then my question is on your targets. You are basically targeting 200 megawatts for average capacity going from 24 on self-mining and 0.8 to 0.7 and from a revenue perspective, $43 million to $200 million or $199 million to be more specific in this year alone. Could you walk me through — I mean, those are obviously pretty substantial increases, could you walk me through how you are going to get there? I mean I could see what’s going to happen with Midland very in the short order, as you talked about in the call, and obviously, you already have the hosting demand from your existing partner. And I imagine while you guys were taking calls, Bitcoin pricing going up 60% to 70% since the beginning of the year and your focus on infrastructure only gives you a stronger and to be able to negotiate those contracts.

So I could see what’s going to happen in Midland and share them, but maybe talk me through about how you get to a 200-megawatt average for the year, which would assume that, obviously, your exit rate for the end of the year is higher than that number for that to be an average. So could you maybe give more granular information on that, how are we going to execute on that?

James Manning: Sure. I will let Liam take this one.

Liam Wilson: Sure. Thanks, Bert, for the question. I think the first thing to consider is that Maw — the Midland facility is about to turn on another 70 megawatts. So when we look at Mawson at the moment, we are looking at 50 megs to Kevin’s question earlier on. The reality is that in a couple of weeks, realistically, we are going to be at 120 megawatts and then 132 megawatts straight away after that. So the ramp-up is rapid over the next period. Post that we have the sites that we have mentioned in the deck and then we have a number of other sites which we have various levels of commitment on. All the sites that Mawson looks at, and Kevin, this is probably an answer to you too, but all the sites at Mawson looks at do not require substation work.

So these smaller sites that we look for, we look for sites that don’t require substation work, and the reason we look for those is that; A, it dramatically reduces the CapEx; B, it dramatically cuts down the time needed to actually get those facilities online. So for some of the facilities that we are looking at, at the moment, from the time that we actually do the initial walk-through to getting power online is somewhere within 90 days. So that’s how we get to the — what could be perceived as quite eye-opening numbers, but it’s very — it’s actually very easy for Mawson to ramp up there. And so once we get off the mark with our 70-megawatt expansion at Midland, the 12-megawatt expansion in Sharon, I think, you will see Mawson quickly roll numerous other facilities, which do not require; A, a ton of CapEx; and B, a ton of time to get done.

Unidentified Analyst: Perfect. Thanks for that clarification. And I am also assuming that you are between what you ship from Australia and what you have on hand, you are sitting on a fairly sizable amount of exahash that you can immediately or in a very short period of time connect in Pennsylvania here in weeks or months, and obviously, your hosting partner is already ready and able to come up on their end. So you have visibility into how you are growing both sides of that business, at least in the kind of a short order, is that a correct assumption?

Liam Wilson: Yeah. That’s correct. As we have somewhere in the…

James Manning: That’s definitely the case.

Liam Wilson: Yeah. We have somewhere in the vicinity of 1.5 exahash to 1.6 exahash of equipment ready to go, to be turned on, that self-mining gear and then we have the remainder of our hosting partners, the balance of their gear ready to go as well. So, we have got hitting that initial number for Mawson, I think, it was 4.5 exahash. We don’t feel that’s not going to be a struggle at all?

Unidentified Analyst: Okay. And another question here, obviously, last year, you have created a brand new business with 91% margin. I forgot the revenues in the $12 million to $14 million range, which is very substantial that gives you the flexibility. Does the Ohio sites that you are talking about, are they going to — I am familiar with what’s going on in Pennsylvania, but are the Ohio side could be in part of the similar plan as well or not necessarily?

James Manning: I will take that one

Liam Wilson: Yeah. For our

James Manning: So, yeah, that was

Liam Wilson:

James Manning: So you are right, Bert. This — the Energy Markets revenue has been a phenomenal success for us. We saw even $4 million worth of revenue in December. Ohio we will have a similar program and we are really excited about that. So the short answer is, yes. And I think the more important thing is, given that we are going to go from 50 megawatts worth of infrastructure to build up, 120 and 132 — 120 in Midland and 132 in Sharon coming online in the near-term. we will be able to grow that revenue stream as well. So the Energy Markets revenue has the opportunity to grow substantially as well.

Unidentified Analyst: Yeah. I mean that’s exciting. I am just looking at your deck, you guys just put out talking about 400 megawatts. I mean that’s 8 times the size of, if you get there on what you had and you were able to generate $12 million or so of EBITDA. So that’s certainly exciting. My last question is another slide that you put in on your deck that I am just looking at, talking about the discount to your net asset value, and obviously, by selling the sites that you are not using and converting that into your core competency you are navigating that very successfully. But what I didn’t realize is that the stock was $15 equivalent when Bitcoin was basically where it was today and I imagine that was on its — Bitcoin was on its way down from the mid-60%s to 30% when market sentiment was lower versus you have a completed flip of a positive market sentiment right now.

So long, I mean, it’s a long question, but what in your opinion is creating that disconnect, you have some analyst coverage already that they were on the call today and they do a great job following you. What do you think is a disconnect on everything else being equal, Bitcoin pricing $30,000 and you are sitting at an 80% discount to that or 70% discount to that on your share price today?

James Manning: Thanks, Bert. I mean, yeah, it’s a long question and I think it’s a complex set of answers to which I don’t know all of them. Ultimately, I think, 2022 is tough for us. I think there was a lot of concern about our hosting part of being Celsius, but they continue to pay, they continue pay on time and we have got the food security, but I think a lot of people got very concerned about that. And I think everyone has seen that that’s less of a concern than everyone realizes it is and we continue to get paid and we continue to operate the facility with them. So we are pretty comfortable around that. Look, obviously, are miners had a tough year last year, but I think we just got — we got put into the unlocked section of the market, unfortunately.

And I don’t think it’s a fair price reflection. I think there’s a big disconnect between, ultimately, where we think value is and when the market takes value is and I think the discount to NTA is evident of it. I think pound-for-pound, we have put on more infrastructure with less capital than just about anyone else in the market. So I think we have been good stewards of capital and we have delivered on what we said we would deliver and I just don’t think we have been rewarded in share price actions for that accordingly. If we raise a similar amount of capital of the other group — peer group, I think, you sit between number one and number two today. So I think you call out a problem that is one that’s hard for us, but we don’t control capital markets ultimately.

But what we can do is focus on being a profitable business and getting a higher return on our capital and squeezing every last drop out of what we have on our balance sheet to get the most greatest return and great profitability that we had.

Unidentified Analyst: Sure. Understood. And obviously you guys have a high level of inside ownership as well. So certainly, you have skid in the game. But keep up to great work and it’s pretty exciting and what you have planned for 2023 and execution should take care of, hopefully, the share price and value for shareholders. Thank you. That’s all I have.

James Manning: Thanks, Bert.

Operator: Thank you.

James Manning: We have one more from Kevin Dede, I believe.

Operator: Kevin, you may proceed with your question.

Kevin Dede: Thank you. Thanks for taking me back, James. I appreciate it. I want to get back to your infrastructure-first strategy in your view of development and sale. And I think this came up in discussion a couple of times last year as you guys work through the discussion of the Georgia facility sale. And I am wondering how close you are keeping that to your strategic thinking at this juncture or whether or not maybe you are shifting back to maybe would I perceived as the original Mawson when it was Cosmos where you were building to take over the world. So maybe you could kind of reset our thinking there?

James Manning: Yeah. Thanks, Kevin. I think, look, we are doing a little bit of both and what we recognize is we are very good very good builders ultimately. We understand how to build the infrastructure. We understand how to build it at scale, build it efficiently, have good cost per megawatt. And in many sense, we think there’s an opportunity as part of our hosting business to expand that business, as well as where we see strategic opportunities to either partner with hosting customers or sell and manage those sites for a profit. So, importantly for us, we recognize where we are in our capital stack and where we are in the market. So we can only do so much. But I think we are very well regarded within the industry and a lot of counterparties would like to deal with us.

So we see good deal flow and good sight flow and the ability to take some of those on potentially build — identify contract, develop them and then move them on is an attractive option to us as well, where we can do that for a customer or do it on our own balance sheet and recycle some of those transactions. So we are very much looking at all angles ultimately, Kevin. But the focus is on building a larger sustainable business with recurring revenues and you don’t get recurring revenues ultimately just selling fights. So it’s about doing a combination of the hosting, the mining and the energy program. And then optimizing the portfolio as we go. So as we acquire some of these sites, maybe we identify some sites in the portfolio once built, would be better operated by a third-party and we can focus on the next slide that we identify.

So we are very realistic about what we can build and run given our capital structure. And I think they pulled it out. We are probably the largest or one of the largest high concentration of management team that owns, managing them with a high concentrated ship of ownership in the business. And because of that, we are really focused on that return on capital and return on equity. So we very much don’t want to see — keep a delusion for capital growth sake. So we are very focused on making sure we have got the right return profile.

Kevin Dede: Great answer, James. Thank you.

James Manning: But that is

Kevin Dede: Thanks for taking the time. Yeah. Yeah. Yeah. It was a great answer with the focus on return on capital. I appreciate hearing that.

James Manning: Perfect. I have just got a couple of written queries questions. I am just going to take a couple of those before we wrap up. I know we are getting a bit longer than too from a time perspective. So I have got the first one here, I have got from Dave. You have a large amount of infrastructure capacity in Pennsylvania. What’s the total amount of exahash you could have across these sites, assuming you use the latest generation assets. My math has it at over 8 exahash based on the latest generation in NXP. I might let Liam run that, and thanks, Dave, for your message.

Liam Wilson: Thanks, James. Thanks, Dave, for the question. So for 132 megawatts, we could expect to get roughly just under 39,000 units online. I am just working out the math now. But if you are looking — if you are using an XP then that would be 5.4 exahash on the 132 megawatts. If we look at the two public sites, which are shown in Midland at 240 megawatts, which is their nameplate capacity, then you are just under 71,000 units and you are actually at 9.9 exahash if you run the XPs. If you run just a standard S19, you are at 7.8 exahash or 9.9 if you run the XP. So that’s what those numbers are looking like, 71,000 units is approximately what we consider in our sites at the moment.

James Manning: Great. Thanks, Liam.

Liam Wilson: Thanks, James.

James Manning: Next one is from Josh — next one is from John. I read in the analyst report, CLSK have a ROFR on MIGI USA assets. When does this expire, i.e., how long do they have on this, my memory, it was 12 months from September this year. Given the recent M&A in the space with how they et cetera could this become relevant? Thanks. I might take that one. Yeah. There was a structure with a first rate of refusal, first right of offer with CLSK over select assets in the USA. It’s part of that, those rights expire at six months and September was the date. So some of them are just coming up to expiry and some have a longer tail, which is the 12-month tail. So you are correct in that, but it was six months and 12 months sale. Look, I can’t talk for CLSK.

We have great respect to Zach and his team over there. They have obviously acquired our Georgia facility, which we think we have built a world-class facility there and I am sure they would like to have a look at our other facilities in due course. But I don’t want to preempt or cause any speculation on that. But there’s obviously a lot of M&A potentially on the cards this year and in the industry and Mawson wants to be part, be at the table playing with everyone and we will obviously make sure that if anything is occurring in that space, we are out there talking to everyone and making sure we are looking at the right deals with counterparties to see if there’s any other opportunity to create value for shareholders. And I think, back to Kevin’s point, it’s all the focus on return on capital.

So and making sure we squeeze every last drop out of it. So we are very much focused on identifying anything we can to create extra value. I have got a mail. I have got one from Aaron. What’s the current debt and liability situation. I might pass that one to Ariel to take off.

Ariel Sivikofsky: Hi. It’s Ariel from — CFO of Mawson. Welcome to everybody. The current debt just speeding off the balance sheet is $35.5 million. It’s a combination of trade payables and borrowings. Borrowings being about $23 million at year end and trade payables about 10.5%.

James Manning: Thanks, Aaron, for that question. And then, I might — I have got one last question, which was, your low cost of energy in Pennsylvania, what is the power and how long do you have this in place? From my analysis of the sector, this is among the lost in the industry, it’s green nuclear power, if I recall. Thanks, Andrew. The Pennsylvania power, we have got a combination of PG and market power and we would comb — and a hedge. So our hedges locked in at 3.68 and then the PJM market is spot market power. Currently in the market, PJM power is in the high-teens per megawatt to the mid-$20 per megawatt. So between $0.01 per megawatt hour and $0.02 per megawatt hour. And it’s very competitive power and that’s why I say it’s competitive power anywhere else within the USA.

We have a hedge for approximately — that’s approximately four years left to run on it. And you are right, it is 100% green power, it’s nuclear and it’s all zero carbon. So that’s a very important point for us from an ESG perspective is that we are on zero carbon power and we believe that it’s really important for the entire industry to be moving towards that, because it will ultimately result in us being considered as a sustainable business and a sustainable industry. So we would like to think that we are leading the charge on that and it’s important part of our investment criteria from an ESG lens is when we are looking at new sites, what’s the generational mix of the power and what they are going to do. And it’s not to say we won’t look at a site with some negative generation, but we will always need to look at a site and say, what’s the path to being carbon neutral in this site.

So, and that’s what makes sites important for us in our site selection. I think with that, I’d like to wrap up the — wrap up today’s presentation. I’d really like to thank all our shareholders for their continued support. I’d like to thank the people that participated in this call for their great questions and getting too many real curve balls today. So, with that, I’d like to sign off and thank everyone and look forward to keeping everyone in the loop for 2023 as we continue to grow. Thank you.

Operator: This concludes today’s conference. You may disconnect your lines at this time. Thank you for your participation.

Follow Mawson Infrastructure Group Inc. (NASDAQ:MIGI)

Follow Mawson Infrastructure Group Inc. (NASDAQ:MIGI)

Receive real-time insider trading and news alerts