Over the last few years yoga pants have taken the country by storm as the apparel made its way into all aspects of life. At first primarily an athletic staple, yoga pants have become an everyday fashion option for many women. Lululemon Athletica inc. (NASDAQ:LULU), a major yoga-related retailer, reported its first quarter earnings earlier this week, and the company was able beat analyst expectations while announcing a 7% increase in same store sales.

However, shares slumped almost 18% as the company surprisingly announced that Chief Executive Officer Christine Day was stepping down from her position. Up to this point, Day has been very influential in Lululemon Athletica inc. (NASDAQ:LULU)’s success. As a result, a slew of investment analyst dropped estimates–an analyst from Sterne Agee downgraded the company to a “neutral” from a “buy” and cut its price target to $75 from $90, citing in part “a lack of information regarding the future leadership of Lulu (that) is of great concern.”

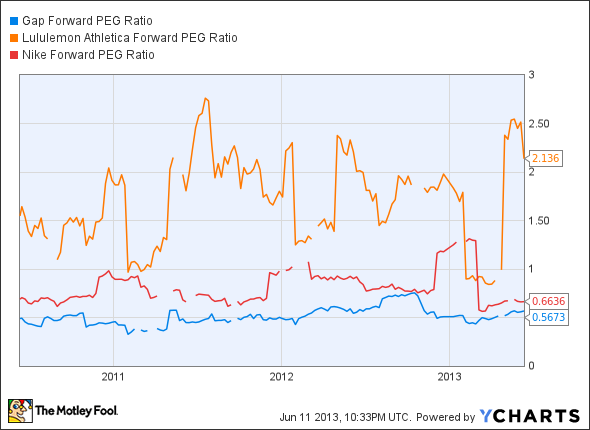

Lululemon Athletica inc. (NASDAQ:LULU), a high growth company, trades at forward multiples that are vulnerable should any fears set in. Going into earnings, the company was trading at a forward valuation over 40 times earnings–after Tuesday’s drop the company is now trading at a more conservative valuation of 34.5 times forward earnings. I believe that if innovation at Lululemon slows, a number of competitors stand ready to take the company’s market share, in turn further slowing growth and lowering forward valuations. I would like to highlight a couple of cheaper alternatives to Lululemon that are already starting to gain market share.

Lets first take look at Nike, an athletic superpower with its hands in all aspects of performance apparel. Nike sells its selection of yoga pants for around $60, compared to Lululemon Athletica inc. (NASDAQ:LULU), which retails the majority of its pants for about $100. Nike may have lower pricing power now, but I remain confident in the company’s ability to catch up in the yoga apparel industry. In addition, I feel more comfortable investing in a company that has established itself across a greater selection of merchandise. Analysts are expecting NIKE, Inc. (NYSE:NKE) to grow earnings by 27% this quarter and over 13% for the next two years. I would expect the company to further integrate its portfolio of proprietary material into its yoga apparel in the years ahead.

The Gap Inc. (NYSE:GPS) has been a great turnaround play over the last two years. This year alone shareholders have been treated to a return of over 35% on the back of strong earnings and renewed growth. The company has worked hard to reshape its image, and in the process created a great selection of yoga apparel. The company retails its yoga pants for about $50, almost half the cost of a pair from Lululemon. I fully understand the value of brand power, but still a 100% price difference is significant. Gap is trading at far more conservative forward multiple of of 15.42–rather inexpensive when you consider analysts are expecting the company to grow earnings at 16% this year. In addition, I like the international growth prospects ahead. The company to plans to open a net 80 stores this year, primarily in its Asia/Pacific business segment. An expansion into China should bode well for the company over the longer term.

Foolish Take

At these levels Lululemon Athletica inc. (NASDAQ:LULU) looks far to0 risky for my portfolio. The company could possibly be heading into a period of substantial growth slowdown as a result of internal affairs and outside competition. I would rather see investors choose companies like Nike and Gap, which are far less expensive and offer a more diversified line of products.

Nathaniel Matherson has no position in any stocks mentioned. The Motley Fool recommends Lululemon Athletica and Nike. The Motley Fool owns shares of Nike. Nathaniel is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

The article Who Doesn’t Like Yoga Pants? originally appeared on Fool.com and is written by Nathaniel Matherson.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.