Oil and gas MLP LINN Energy LLC (NASDAQ:LINE) has become a battleground stock this year. Vicious short-sellers have called the company’s accounting aggressive, if not erroneous. Further, those who are negative on LINN assess its worth as low as $5.50 a unit. Needless to say, it’s been a rough year for investors in LINN, especially after it was disclosed that the SEC would now be looking into its books.

One of LINN’s 19,000 producing oil and natural gas wells. (Photo courtesy of LINN Energy)

I firmly believe that Linn Energy LLC (NASDAQ:LINE) will successfully navigate the SEC inquiry, which once resolved should end the attacks against the company. In anticipation of that happening, I want to take advantage of the weakness created to add to my position in the company. In fact, I can point to two other major reasons why I think LINN and its affiliate LinnCo LLC (NASDAQ:LNCO) are both compelling values worth buying today.

Getting the facts straight

While Jim Cramer has backed off his bullishness, many other investors are staying the course. Among them is none other than Leon Cooperman, the chairman and CEO of Omega Advisors. In a recent letter to the editor of Barron’s, which has been particularly bearish on Linn Energy LLC (NASDAQ:LINE), Cooperman called the negative articles “distortions about LINN”. He further states that these articles are “twisting facts to suggest that there is something untoward about” how LINN accounts for its hedges.

Real, tangible value

While short-sellers would have you believe that Linn Energy LLC (NASDAQ:LINE)’s worth is just in the single digits, many other highly qualified analysts disagree. In fact, most Wall Street analysts believe LINN is worth about $40 per unit. Even in a worst-case scenario, it’s hard to put a value on LINN that’s lower than it’s currently trading. This is best summed up in a note by Stiefel to its investors:

If the Berry Petroleum Company (NYSE:BRY)/LinnCo LLC (NASDAQ:LNCO) deal falls through and the company NEVER makes additional accretive acquisitions (extremely doubtful in our opinion), we believe LINN’s units are worth approximately $22 using a discounted cash flow analysis. However, if the Berry/LinnCo acquisition falls through but the company maintains a conservative acquisition program through 2020, we estimate LINN’s units to be worth $32 to $35. If we assume the Berry deal is completed in 4Q13, we estimate LINN’s units intrinsic value to be $35-$40 based on a future discounted cash flow analysis and assuming a conservative future acquisition program.

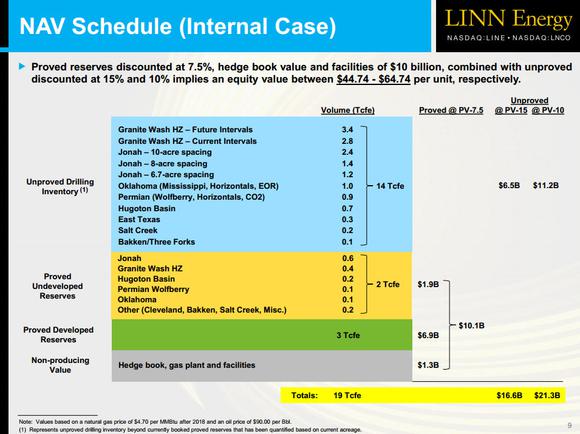

Further, internal and third-party valuations of Linn Energy LLC (NASDAQ:LINE) range from $37.34 per unit on the low end and up to $65.74 per unit on the upper end of the scale. These values for LINN standalone without the benefit of adding Berry Petroleum Company (NYSE:BRY). That’s because the company has a substantial unproved drilling inventory that’s estimated to hold up to 14 trillion cubic feet equivalent of reserves, which adds significant potential value to LINN:

Source: LINN Energy investor presentation

The only way you can get value for Linn Energy LLC (NASDAQ:LINE) anywhere near where short-sellers have it pegged is if natural gas prices stay at last year’s depressed prices… forever. Seeing how natural gas prices are already substantially higher, with potential future demand drivers coming from electrical generation, exports, and natural gas vehicles, I think it’s safe to say that there is a lot more value in LINN’s asset base than the shorts give it credit for.

My trade

While I already own units of Linn Energy LLC (NASDAQ:LINE) and shares of LinnCo LLC (NASDAQ:LNCO), both combined make up less than 2% of my well-diversified portfolio. That’s why I plan to buy shares and write puts striking at $20 on both companies to bring my overall exposure up to 5% of my portfolio. I feel very strongly that the attacks on LINN are unjustified and that its real value will eventually win out.

The article Why I’m Buying This Embattled Energy Company originally appeared on Fool.com and is written by Matt DiLallo.

Fool contributor Matt DiLallo owns shares of LINN Energy, LLC and LinnCo, LLC. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.