L1 Capital, an investment management firm, released its “L1 Capital International Fund” (unhedged) third quarter 2025 investor letter. A copy of the letter can be downloaded here. In the September quarter, a few sectors and a few companies dominated the market. The fund returned 2.6% in the September quarter compared to 6.1% for the benchmark (MSCI World Net Total Return Index in AUD). In addition, you can check the fund’s top 5 holdings to know its best picks in 2025.

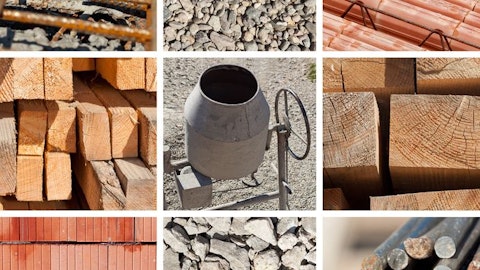

In its third-quarter 2025 investor letter, L1 Capital International Fund highlighted stocks such as Eagle Materials Inc. (NYSE:EXP). Eagle Materials Inc. (NYSE:EXP) is a heavy construction material and light building materials supplier. The one-month return of Eagle Materials Inc. (NYSE:EXP) was 11.41%, and its shares lost 17.64% of their value over the last 52 weeks. On December 11, 2025, Eagle Materials Inc. (NYSE:EXP) stock closed at $225.12 per share, with a market capitalization of $7.305 billion.

L1 Capital International Fund stated the following regarding Eagle Materials Inc. (NYSE:EXP) in its third quarter 2025 investor letter:

“Investments in Eagle Materials Inc. (NYSE:EXP) and Veolia were fully divested. Eagle Materials has been a long-term holding of the Fund and a top three contributor to the Fund’s returns since inception. Eagle Materials is a domestic U.S. business predominantly manufacturing cement and wallboard. We continue to believe the business is well-managed with strategic reserves and sustainable competitive advantages. Our concern is with the new residential housing cycle. Housing affordability has been meaningfully impacted by rising house prices and higher mortgage rates. Recently, mortgage rates have reduced slightly, but affordability remains challenged. Consumer confidence has also fallen and the response of potential new home buyers to slightly lower mortgage rates has been muted. We are concerned by the increasing gap between single family new residential housing starts, and single family new residential housing completions. Housing completions have held up reasonably well, but as certain as night follows day, completions will fall if housing starts remain under pressure. Wallboard is a building materials product predominantly used in the completion stage of building a new home. As housing completions reduce, volumes for wallboard will likely be under pressure, increasing the probability of wallboard pricing pressure. Cement price increases have also been muted recently. Accordingly, following a bounce in the Eagle Materials share price during the quarter, we determined other companies provided more attractive investment opportunities at this time. Eagle Materials remains on our Bench.”

Eagle Materials Inc. (NYSE:EXP) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 38 hedge fund portfolios held Eagle Materials Inc. (NYSE:EXP) at the end of the third quarter, which was 36 in the previous quarter. In the second quarter of fiscal 2026, Eagle Materials Inc. (NYSE:EXP) recorded a revenue of $639 million, marking a 2% increase from the prior year. While we acknowledge the risk and potential of Eagle Materials Inc. (NYSE:EXP) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Eagle Materials Inc. (NYSE:EXP) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Eagle Materials Inc. (NYSE:EXP) and shared Madison Small Cap Fund’s views on the company. In addition, please check out our hedge fund investor letters Q3 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.