L1 Capital, an investment management firm, released its “L1 Capital International Fund” second quarter 2023 investor letter, a copy of the same can be downloaded here. In the June 2023 quarter, the fund returned 9.0% (net of fees) outperforming the benchmark’s (MSCI World Net Total Return Index in AUD) 7.5% return. The Fund and Benchmark’s Australian dollar reported quarterly returns increased as AUD depreciated 1.0% against the U.S. dollar and depreciated 0.9% against the Euro. The Fund returned 25.5% (net of fees), outperforming the Benchmark’s return of 22.4% by 3.1% (all in Australian dollars) for the year ended 30 June 2023. Please check the top five holdings of the fund to know its best picks in 2023.

L1 Capital International Fund highlighted stocks like Microsoft Corporation (NASDAQ:MSFT) in the second quarter 2023 investor letter. Headquartered in Redmond, Washington, Microsoft Corporation (NASDAQ:MSFT) is a multinational software company that develops, and licenses software, services, devices, and solutions. On July 26, 2023, Microsoft Corporation (NASDAQ:MSFT) stock closed at $337.77 per share. One-month return of Microsoft Corporation (NASDAQ:MSFT) was 0.81%, and its shares gained 22.20% of their value over the last 52 weeks. Microsoft Corporation (NASDAQ:MSFT) has a market capitalization of $2.511 trillion.

L1 Capital International Fund made the following comment about Microsoft Corporation (NASDAQ:MSFT) in its second quarter 2023 investor letter:

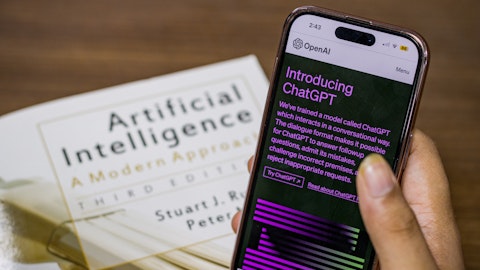

“Microsoft Corporation (NASDAQ:MSFT) is a clear and substantial beneficiary of AI – not only through its investment in OpenAI/ChatGPT but through the incorporation of AI into core Microsoft products and services, and increasingly through Azure (Microsoft’s cloud computing business) providing ‘AI-as-a-service’. At this stage we don’t know what the long-term financial benefits of AI will be to Microsoft, but we have confidence that it will be meaningful, that barriers to competition are increasing and that Microsoft is worth more today than it was 12 months ago. That said, Microsoft’s share price has increased 33% (in U.S. dollars) over the past year, and we no longer consider the company to be undervalued in our central base case. We have started to trim our investment in Microsoft, although it remains one of the Fund’s largest positions.”

RoSonic/Shutterstock.com

Microsoft Corporation (NASDAQ:MSFT) holds the first position on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 289 hedge fund portfolios held Microsoft Corporation (NASDAQ:MSFT) at the end of first quarter which was 259 in the previous quarter.

We discussed Microsoft Corporation (NASDAQ:MSFT) in another article and shared the list of stocks receiving price-target hike from analysts. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 20 Worst Countries to Live in Asia

- 25 Ugliest Cities in the World According to Internet

- 10 Best Growth Mutual Funds and Their Latest Top Picks

Disclosure: None. This article is originally published at Insider Monkey.