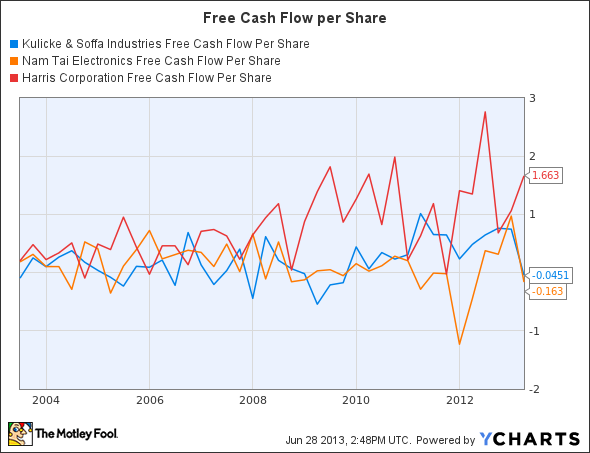

Buying free cash flow at a discount is a great way to find value. Below are three firms capable of producing free cash flow and are trading at low valuations. Still, free cash flow is not a silver bullet. Doing due diligence is very important to ensure that you are not buying a lemon where their earnings and free cash flows are behind them.

KLIC Free Cash Flow Per Share data by YCharts

Kulicke and Soffa Industries Inc. (NASDAQ:KLIC) is a cyclical business within a cyclical business, but that doesn’t automatically make it a bad investment. Selling to semiconductor manufacturers can be volatile, but in the long run there is a steady demand for electronics and semiconductor powered devices. Kulicke and Soffa Industries is a leader in a number of markets from automatic ball bonders, heavy wire wedge bonders, wafer level stud bump bonders to capillaries. Right now its wire bonding business is growing, as firms are buying new machines to reduce their use of gold and increase their use of copper.

This company will have a difficult 2013, with earnings per share (EPS) expected to fall -67.33% to $0.74. In 2014 its earnings are expected to bounce back up to $1.45. The market isn’t excited about its expected drop in earnings, and has priced it with an expected 2013 forward price to earnings (P/E) ratio around 15. The company has a strong balance sheet with a total debt to equity ratio of 0 and a quick ratio of 8.8. Overall Kulicke and Soffa Industries Inc. (NASDAQ:KLIC) is attractive for investors willing to look beyond 2013.

With a P/E ratio around 3.4 and a total debt to equity ratio of 0.01, Nam Tai Electronics, Inc. (NYSE:NTE) looks like a great deal. The reality isn’t as sanguine. The company runs outsourcing factories for electronic components in China. The industry is very price competitive and the firm’s small market cap below $300 million makes it difficult to take advantage of economies of scale. Nam Tai Electronics is focused on manufacturing liquid crystal displays modals, but business could be better.

Financially the company is questionable. Its gross margin of 11.4% and profit margin of 6.1% leave little room for error. While its return on investment of 20.4% looks strong, the firm has been unable to consistently produce free cash flow. This company is trading at attractive valuations, but it is stuck in a hyper-competitive market and its future earnings are difficult to predict.

Harris Corporation (NYSE:HRS) is a different story. This company sells complex communication and electronic equipment to a number of government divisions and the private sector. The recent contraction in U.S. government spending will impact the firm and it is expected to see its earnings fall by -10.62% in 2013. By 2014, its earnings are expected to stabilize. In the long run the contraction in U.S. government spending is a blessing for the company, as it is being forced to look overseas and diversify itself. The growing Brazilian and Saudi Arabian defense markets have helped to boost its international presence and diversify.

Harris Corporation (NYSE:HRS)’ ROI of 5.6% and profit margin of 3.8% are thin, but the firm is a work in progress. With a total debt to equity ratio of 1.15 the company’s balance sheet is not perfect, but its earnings are stable enough to support some debt. The firm’s future is encouraging, and its $1.48 yearly dividend gives more reason to invest.

How do these firms compare to the broad market?

Buying the S&P Depository Receipts is a simpler option than buying individual stocks, but there is opportunity to be found in a company like Kulicke and Soffa Industries Inc. (NASDAQ:KLIC). While this ETF offers a yield around 2%, a forward P/E ratio around 15, and a price to book ratio around 2.3, investors willing to look at Kulicke and Soffa Industries’ 2014 earnings can find better value. Right now the company is trading a price to book ratio around 1.3. Looking beyond the broad market requires some effort, but it can be very rewarding.