KLA Corporation (NASDAQ:KLAC) is among Goldman Sachs’ top semiconductor stock picks. On January 15, Wells Fargo upgraded its rating on KLA Corporation (NASDAQ:KLAC) from Equal Weight to Overweight, and lifted the price target from $1,250 to $1,600. The basis for the action was the investment bank’s confidence that KLA can continue to grow strongly in the wafer fabrication equipment (WFE) market. This growth, the bank stated, will be possible due to momentum in 2nm process technology, which it expects to persist throughout 2026.

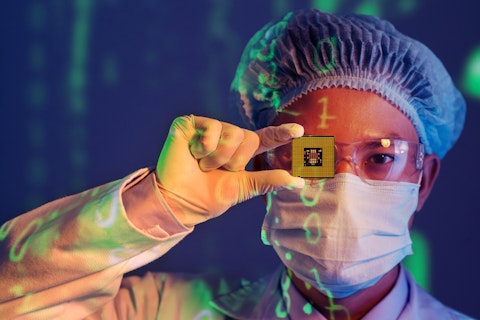

Dragon Images/Shutterstock.com

Wells Fargo pointed to elevated inspection sample rates tied to 2nm production, which, according to their analysis, suggests customers will use more KLA inspection tools as chip nodes shrink. The bank also highlighted additional growth levers beyond 2nm momentum, including strong performance in 5nm and 3nm with a high-performance computing mix. In other words, the analysts said, demand for scanning and inspection tools tied to advanced chips is robust across leading nodes.

That very day, on January 15, Morgan Stanley raised its rating for KLA shares from Equalweight to Overweight. It paired this with a massive bump in the price target from $1,214 to $1,694. Morgan Stanley made the revision because of changes in its valuation for KLA. The bank boosted 2026 EPS estimates by 7% and 2027 by 14%. Accordingly, the bank projected KLA’s revenue to expand by 16% in 2026 and 19% in 2027, well above consensus estimates of 10% and 9%.

Morgan Stanley heavily weighted the estimate hikes toward foundry logic; it raised 2026 and 2027 estimates by 10% and 18% respectively. In comparison, memory-related increases were 4% and 10%.

KLA Corporation (NASDAQ:KLAC) is a semiconductor equipment company. It develops process control and yield management systems used in the fabrication of integrated circuits. The company’s primary offerings include inspection, metrology, and data analytics tools that help chipmakers identify defects and improve manufacturing efficiency.

While we acknowledge the potential of KLAC to grow, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than KLAC and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: Top 10 Materials Stocks to Buy According to Analysts and 10 Best Organic Food and Farming Stocks to Buy Now.

Disclosure: None. This article is originally published at Insider Monkey.