Cullen Capital Management, LLC, operating under the name Schafer Cullen Capital Management, Inc. (SCCM), has released its “SCCM Enhanced Equity Income Fund” second-quarter investor letter. A copy of the letter can be downloaded here. US equities surged in the second quarter, with the S&P 500 gaining 10.9% while the Russell 1000 Value was up 3.8%. The composite underperformed both of its benchmarks in the second quarter, returning -1.2% (net) compared to a 1.9% return by the S&P 500 Buy-Write Index (BXM) and a 3.7% return by the SPDR Bloomberg High Yield Bond ETF (JNK). In addition, you can check the fund’s top 5 holdings to determine its best picks for 2025.

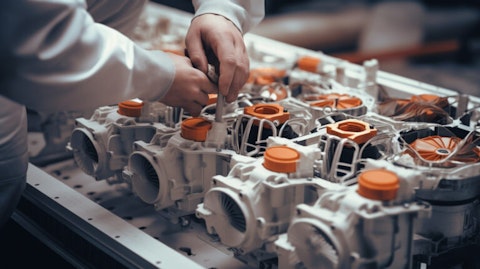

In its second-quarter 2025 investor letter, SCCM Enhanced Equity Income Fund highlighted stocks such as Johnson Controls International plc (NYSE:JCI). Johnson Controls International plc (NYSE:JCI) engages in engineering, manufacturing, commissioning, and retrofitting building products and systems. The one-month return of Johnson Controls International plc (NYSE:JCI) was 0.39%, and its shares gained 46.73% of their value over the last 52 weeks. On August 29, 2025, Johnson Controls International plc (NYSE:JCI) stock closed at $106.89 per share, with a market capitalization of $69.947 billion.

SCCM Enhanced Equity Income Fund stated the following regarding Johnson Controls International plc (NYSE:JCI) in its second quarter 2025 investor letter:

“Johnson Controls International plc (NYSE:JCI) – Our position in JCI was called away and not repurchased. The stock had been a long-term holding but appreciated substantially over the past year, benefiting from its exposure to data center construction and from its own internal operational improvements. Moreover, investors are excited about new CEO Joakim Weidemanis and his vision to improve the service offering. While we continue to believe in the company’s strong and improving fundamentals, the valuation now reflects that positive outlook. Given the price appreciation, the stock’s P/E multiple has expanded to 29x and the dividend yield has fallen to 1.4%.”

Johnson Controls International plc (NYSE:JCI) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 75 hedge fund portfolios held Johnson Controls International plc (NYSE:JCI) at the end of the second quarter, which was 59 in the previous quarter. While we acknowledge the risk and potential of Johnson Controls International plc (NYSE:JCI) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Johnson Controls International plc (NYSE:JCI) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Johnson Controls International plc (NYSE:JCI) and shared the list of best manufacturing stocks to buy according to hedge funds. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.