1. NVIDIA Corp (NASDAQ:NVDA)

Number of Hedge Fund Investors: 186

Jim Cramer in a latest program yet again repeated his thesis on NVIDIA Corp (NASDAQ:NVDA), saying “own it don’t trade it.” Cramer said when the second quarter of this year started, there was a “widely-held” belief that the stock had “moved too much” and it was time to do some selling.

“I heard that several times a day during our network.”

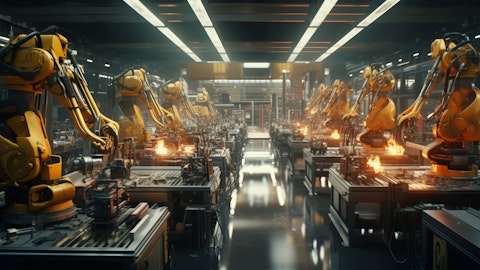

Cramer said that despite its $3 trillion market cap, NVIDIA Corp (NASDAQ:NVDA) is “unrivaled in its ability to usher in this new industrial revolution.”

Cramer said that he’s been lauding for NVIDIA Corp (NASDAQ:NVDA) for over a decade.

Dan Ives is one of the biggest NVDA bulls on the Street. Recently, responding to Newstreet Research’s downgrade of NVDA, Ives on Twitter wrote:

“We cannot disagree more with this negative Nvidia call as discussed on @LastCallCNBC last night as the AI Revolution is just starting in our view being led by Nvidia and the Godfather of AI Jensen in this 9 pm party.”

There is no shortage of Wall Street analysts calling NVIDIA Corp (NASDAQ:NVDA) a top dog in the AI race. Recently, Oppenheimer’s Rick Schafer joined the NVIDIA Corp (NASDAQ:NVDA) chorus, raising the chipmaker’s price target to $150 from $110 following the 10-1 stock split.

NVIDIA Corp (NASDAQ:NVDA) is one of the stocks accounting for a huge chunk of the total market returns, thanks to its AI-fueled rally that seems to have no end in sight. NVIDIA Corp (NASDAQ:NVDA) shares have gained about 206% over the past one year.

NVIDIA Corp’s (NASDAQ:NVDA) latest product announcements and its plans revealed at the Computex 2024 show that NVIDIA Corp (NASDAQ:NVDA) has much more in its arsenal to power its growth engine. Analysts like NVIDIA Corp’s (NASDAQ:NVDA) shift to new AI architecture known as Rubin (R100) and think its powerful H100 and Blackwell chips easily beat competitors.

NVIDIA Corp (NASDAQ:NVDA) will start shipping H200 in the second half of this year. At its GTC conference NVIDIA Corp (NASDAQ:NVDA) revealed three accelerators – B200, GB200 and GB200 NVL72. All of these products provide growth catalysts for NVIDIA Corp (NASDAQ:NVDA) shares and justify its P/E multiple of 71, given NVIDIA Corp’s (NASDAQ:NVDA) growth expectation of over 100% this year and 32% next year. Based on 2026 EPS estimate set by Wall Street, NVIDIA Corp (NASDAQ:NVDA) is trading at a forward P/E multiple of 35.74, which makes the stock’s valuation attractive given the growth catalysts it has.

L1 Capital International Fund stated the following regarding NVIDIA Corporation (NASDAQ:NVDA) in its Q2 2024 investor letter:

“Simply not owning NVIDIA Corporation (NASDAQ:NVDA) was a key contributor to the relative underperformance of the Fund against its Benchmark. The Wall Street Journal even published a recent article with the title ‘No Nvidia in Your Portfolio? You’re Just Toast’. While that is a little melodramatic, it is rare for one company to have such an outsized impact on index returns.

We readily admit that we underestimated the speed and scale with which Nvidia has been able to monetise its leading position in supporting the growth of AI. We have refreshed our financial analysis and while our valuation of the business has increased materially, we continue to view the current share price as providing an unattractive risk adjusted return in most scenarios. We appreciate the business has surprised to the upside in the past and we continue to follow Nvidia closely.”

While we acknowledge the potential of NVIDIA Corp (NASDAQ:NVDA), our conviction lies in the belief that under the radar AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than NVDA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Analyst Sees a New $25 Billion “Opportunity” for NVIDIA and Jim Cramer is Recommending These 10 Stocks in June.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below. You can also look at the 10 Best Residential Real Estate Stocks to Buy and the 10 Best Restaurant Stocks to Buy Today.