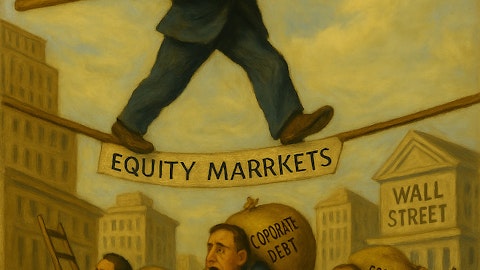

Jim Cramer, host of Mad Money, expressed frustration on Monday with how quickly many professionals in the investment world abandon high-quality stocks. He remarked that it is astonishing anyone manages to make money in equities at all, given how easily people give up on what he sees as the best long-term opportunities.

“My premise has long been [that] Wall Street and its media acolytes constantly encourage you to trade stocks, and you’re going to end up trading out of the best stocks of any era. As a result, you end up missing the biggest moves in these stocks because you know what? They occur when you least expect them, like today.”

READ ALSO: 26 Stocks Jim Cramer Offered Insights On and Jim Cramer Was Focused on These 13 Stocks.

Cramer explained that major stock moves often happen when investors least expect them, but because so many people are unwilling to stay invested through both good times and bad, they miss out. He said that instead of promoting long-term ownership, the financial establishment reinforces the idea that it is nearly impossible for ordinary investors to succeed with individual stocks. As a result, many people are funneled into index funds, not because they prefer them, but because they have been convinced that identifying and holding onto great individual names is beyond reach.

“Anyway, the bottom line: It’s incredibly difficult to make money in any market if all you’re going to do is trade… The public’s stuck in index funds because they’ve been scared away from individual stocks. But as NVIDIA and Apple proved once again today, individual stocks are where the biggest money is, provided you got the fortitude to stick around and you aren’t addicted to buying high and selling low, the ultimate result of endless trading.”

Our Methodology

For this article, we compiled a list of 14 stocks that were discussed by Jim Cramer during the episode of Mad Money aired on September 22. We listed the stocks in the order that Cramer mentioned them. We also provided hedge fund sentiment for each stock as of the second quarter of 2025, which was taken from Insider Monkey’s database of over 900 hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

Jim Cramer Shared His Opinions on These 14 Stocks

14. DuPont de Nemours, Inc. (NYSE:DD)

Number of Hedge Fund Holders: 49

DuPont de Nemours, Inc. (NYSE:DD) is one of the stocks Jim Cramer shared his opinions on. Cramer highlighted that the company is splitting soon and commented:

“I saw it firsthand last week when we got the update from DuPont, which is splitting into two companies: a fast-growing electronics business and a very steady industrials, healthcare, and water business. These are two excellent companies. It can bring out a lot of value once they start trading separately. We’ve told members of the Investing Club that the sum of the parts could be as high as $100.

And that is a huge gain given that the stock currently trades at 78 bucks and change. The spinoff comes in November. That’s not that far away, which is, but it’s too far away for this market to deal with, conceivably two Fed meetings away, which is just too hard. The bias against the industrials is so strong that money’s been pouring out of this group all year, even as I suspect that many companies in the cohort will end up beating expectations. The Fed’s cutting rates, so historically, this will be a good time to buy, not sell this cohort. It’s a little nuts.”

DuPont de Nemours, Inc. (NYSE:DD) develops advanced materials and solutions for semiconductors, electronics, automotive, aerospace, healthcare, and industrial applications. The company also provides specialty products, including adhesives, silicones, photopolymers, digital inks, and water filtration technologies.

13. Ambarella, Inc. (NASDAQ:AMBA)

Number of Hedge Fund Holders: 38

Ambarella, Inc. (NASDAQ:AMBA) is one of the stocks Jim Cramer shared his opinions on. Responding to a caller’s question about the stock, Cramer commented:

“You know, it’s been around for a long time. It’s finally make, getting there, but I think it reflects all the good news already. I’m going to have to say no to that one.”

Ambarella, Inc. (NASDAQ:AMBA) designs semiconductor solutions integrating AI processing, advanced imaging, and ultra-HD video compression into low-power system-on-chips. The company’s products support automotive safety, IoT security, robotics, and consumer applications like drones, body cameras, and virtual reality devices. The company announced its fiscal Q2 2026 earnings on August 28, reporting an EPS of $0.15, outperforming estimates by $0.10. Ambarella, Inc.’s (NASDAQ:AMBA) revenue was almost 50% up year-over-year at $95.5 and beat estimates by $5.5 million.

For the third quarter, the company expects revenue between $100 million and $108 million, gross margin on a non-GAAP basis at 60.0% and 61.5%, and expects operating expenses on a non-GAAP basis between $54 million and $57 million.

12. AST SpaceMobile, Inc. (NASDAQ:ASTS)

Number of Hedge Fund Holders: 30

AST SpaceMobile, Inc. (NASDAQ:ASTS) is one of the stocks Jim Cramer shared his opinions on. A caller asked for Cramer’s opinion on the stock, and he remarked:

“Well… you heard the word space. Now I know this is, people are going to say, what the heck has Cramer spoken? Well, actually, I’ve been right about every single one of these, as you know. But what really does matter to me is, is that this is your spec. You’re allowed to have a spec. I say it… all you gotta do is have one spec. You’re allowed it. You can’t have two unless you’re very, very young. And that ASTS is a perfect spec.”

AST SpaceMobile, Inc. (NASDAQ:ASTS) develops the BlueBird satellite constellation to deliver space-based cellular broadband directly to smartphones. Its SpaceMobile service enables connectivity for commercial, government, and remote users beyond terrestrial network coverage. When a caller inquired about the company in a June episode, Cramer replied:

“Listen, sunshine, that stock is up like 50 points… yeah, this stock is straight up from 20s to the 50s. What we have to do is tomorrow we gotta ring the register a little bit and say to ourselves, congratulations, and go buy yourself something fabulous, okay? Because you just hit it out of the park.”

11. Gilat Satellite Networks Ltd. (NASDAQ:GILT)

Number of Hedge Fund Holders: 14

Gilat Satellite Networks Ltd. (NASDAQ:GILT) is one of the stocks Jim Cramer shared his opinions on. When a caller asked about the stock during the lightning round, Cramer said:

“Again, anything satellite, anything air, anything that is like this, whether it be flying cars, it doesn’t matter, one headline and this thing flies. I am going to tell you that even though that’s a 52-week high, you can still buy the stock of Gilat Satellite.”

Gilat Satellite Networks Ltd. (NASDAQ:GILT) provides satellite broadband solutions and manufactures equipment such as terminals, antennas, amplifiers, and modems. In addition, the company delivers defense, broadcast, and mobility communications systems, along with managed network, connectivity, and telecom infrastructure services. On September 11, according to the company, it became the first company to market an AI-powered Network Management System (NMS) with Model Context Protocol (MCP), that allows secure integration of advanced AI models. The new NMS-MCP supports applications like AI-driven network monitoring and dynamic configuration for software-defined satellite systems, and is aimed at boosting efficiency and simplifying operations.

10. The Chemours Company (NYSE:CC)

Number of Hedge Fund Holders: 48

The Chemours Company (NYSE:CC) is one of the stocks Jim Cramer shared his opinions on. A caller asked for guidance on the stock, and Cramer replied:

“You know, I think it’s chronically undervalued, but I have to tell you, because people continue to think that it’s got problems with forever chemicals, I don’t think it does. I think they put them behind it, but I’m not going to touch it because the plaintiffs’… that powerful.”

The Chemours Company (NYSE:CC) delivers specialty chemicals across industries. The company’s portfolio includes refrigerants, pigments, resins, coatings, and advanced materials used in coatings, electronics, packaging, energy, transportation, and medical applications. On September 23, Mizuho analyst John Roberts increased Chemours’ price target to $19 from $16 while maintaining an Outperform rating. The analyst noted that per- and polyfluoroalkyl substance settlement progress is favorable and that stronger market valuations support the higher target.

9. Energy Fuels Inc. (NYSE:UUUU)

Number of Hedge Fund Holders: 24

Energy Fuels Inc. (NYSE:UUUU) is one of the stocks Jim Cramer shared his opinions on. Answering a caller’s query about the stock during the lightning round, Cramer commented:

“Okay, I’m going to give you this straight on, on Energy Fuels. Remember what I said about Oklo when it was at 33, I said, I will not go against any uranium or nuclear stock. This one’s at its 52-week high, and I still would not go against it, and I’ve been behind this one a long, long time.”

Energy Fuels Inc. (NYSE:UUUU) explores, develops, and sells uranium properties while also producing vanadium, rare earth elements, and heavy mineral sands, including ilmenite, rutile, zircon, and monazite. On August 21, the company announced that it produced its first kilogram of dysprosium oxide at 99.9% purity at its White Mesa Mill in Utah, surpassing commercial standards and marking the first U.S. disclosure of actual high-purity Dy production volumes. The company plans to continue pilot-scale output at two kilograms per week until 15 kilograms are produced before shifting to terbium oxide, with initial samples expected in Q4 2025.

8. Rivian Automotive, Inc. (NASDAQ:RIVN)

Number of Hedge Fund Holders: 38

Rivian Automotive, Inc. (NASDAQ:RIVN) is one of the stocks Jim Cramer shared his opinions on. During the lightning round, when a caller asked about the stock, Cramer said:

“Here’s the problem… They spent a lot of money on that factory. I think that if we’re, if we have a slowdown, and the Fed doesn’t bail us out, I think you’re going to find that stock, you can buy that stock lower. So I say, wait, wait, wait. Don’t pull the trigger here… It’s up on a spike.”

Rivian Automotive, Inc. (NASDAQ:RIVN) designs, manufactures, and sells electric trucks, SUVs, and commercial vans, alongside accessories and software services. Additionally, it operates fast-charging networks, offers fleet management solutions, and sells directly to consumer and commercial customers. In a July episode of Squawk on the Street, Cramer mentioned the company and said:

“I think that you need a commitment, like the VW commitment to Rivian is extraordinary. And it still hasn’t, still Rivian is back to where it was [inaudible]. That’s an open-ended check from one of the biggest, the biggest car company.”

7. Chevron Corporation (NYSE:CVX)

Number of Hedge Fund Holders: 76

Chevron Corporation (NYSE:CVX) is one of the stocks Jim Cramer shared his opinions on. During the episode, a caller inquired if the stock is a buy, sell, or hold, and Cramer remarked:

“It’s just a, it’s just a hold. The reason I say that even though I think that Mike Wirth’s doing a great job as CEO, is that I’m not a, I don’t, I’m not a believer in the energy stocks. I actually sold the only energy stock from my Charitable Trust, not that long ago, because I just don’t think that they have the kind of growth that I want out of owning a stock. We like growth stocks here. We have a predilection for it because that’s how big money is made.”

Chevron Corporation (NYSE:CVX) engages in oil and gas exploration, production, and liquefied natural gas operations while also refining, marketing, and transporting petroleum products. The company further develops renewable fuels, petrochemicals, plastics, and additives through its integrated energy and chemical businesses.

6. Chipotle Mexican Grill, Inc. (NYSE:CMG)

Number of Hedge Fund Holders: 68

Chipotle Mexican Grill, Inc. (NYSE:CMG) is one of the stocks Jim Cramer shared his opinions on. A caller asked what catalyst might drive the stock higher: an improved consumer environment or a specific update in the upcoming earnings report. Cramer replied:

“Well, I think it’s a combination… and it’s two things. One is that we absolutely have to have lower commodity prices because I think that a lot of their commodities, particularly beef, are really, really hurting. And then the second that you need is you got to have a clear roadmap for growth. And right now, I don’t see that. It has to happen or else people are not going to buy the stock.”

Chipotle Mexican Grill, Inc. (NYSE:CMG) operates restaurants and it burritos, bowls, tacos, salads, and related menu items, along with delivery through its app and website. When a caller asked for Cramer’s advice on the stock during the September 10 episode, he replied:

“Oh boy, alright. There’s a lot of fundamental stories going on in the restaurant industry that is making it so it’s hard to buy any of these, and a lot has to do with the price of beef. I keep thinking that cattle is going to break down. That is a big cost that they have, and you know what? I thought it was going to break. I talked to my friend Carley Garner; she felt that it’s going to break, but what happened? This thing, which goes into so much of Chipotle’s food, is just no quit. So until cattle really breaks, I’m going to have to say, let’s just keep it on the radar screen.”

5. The Boeing Company (NYSE:BA)

Number of Hedge Fund Holders: 101

The Boeing Company (NYSE:BA) is one of the stocks Jim Cramer shared his opinions on. The company was mentioned during the episode, and here’s what Mad Money’s host had to say:

“If you bought Boeing on weakness during the strike last fall, you’d now have a nearly 36% gain. These guys have been running circles around the unions for decades. I don’t see that changing anytime soon… Long story short, Boeing’s now officially a Charitable Trust holding thanks to the stock’s recent pullback. So you should know the core case for owning the stock. The company’s gradually ramping up production for its key aircraft models, the 7377… and remains mostly on track with these efforts. Boeing’s balance sheet is much, much better than it was after the huge recapitalization effort late last year.

And now there’s a line of sight to positive free cash flow in the near-term future with the promise of $10 billion worth of free cash flow or more per year once the company gets its production levels up to its previously stated targets. Meanwhile, regardless of how you feel about the President’s trade agenda, it’s been phenomenal for Boeing with some huge aircraft orders coming from the Middle East, Korea, and the UK. Potential of a massive deal still to come from China, assuming those trade talks don’t fall apart. On top of everything else, we’re getting, finally getting reasons to be cautiously positive on Boeing’s defense business.

The bottom line: Put it all together and I think Boeing’s simply become too good to ignore, especially after the stock’s recent hard pullback… and why you’ve got my blessing to begin a position tomorrow.”

The Boeing Company (NYSE:BA) designs, manufactures, and services commercial airplanes, defense systems, satellites, and space technologies. In addition, the company provides logistics, maintenance, training, and digital solutions for both commercial and government customers.

4. Conagra Brands, Inc. (NYSE:CAG)

Number of Hedge Fund Holders: 38

Conagra Brands, Inc. (NYSE:CAG) is one of the stocks Jim Cramer shared his opinions on. Inquiring about the stock, a caller noted the company’s upcoming earnings report, recent decline in share price, and attractive dividend. Cramer commented:

“No, you see, we want growth in stocks. We don’t want dividends, particularly that are that high, because maybe something’s wrong. We like to buy stocks for growth. That’s really the only elixir that will protect you from inflation and will protect…. your portfolio from underperforming. Just pure growth, and Conagra doesn’t have it.”

Conagra Brands, Inc. (NYSE:CAG) produces and markets packaged food products across retail and foodservice channels. Its portfolio includes well-known brands such as Slim Jim, Marie Callender’s, Duncan Hines, Healthy Choice, Birds Eye, Reddi-wip, and BOOMCHICKAPOP. During a lightning round in one of July episodes, a caller asked about the stock and Cramer responded:

“Very tough, very tough situation. Conagra’s got 7% inflation. They got problem with tin cans. They can’t, it’s killing them… The margins aren’t that good. The brands aren’t enabling them to be able to take any price. I have to tell you, the one thing that was important was that, on the conference call, they did say that they think they have no problem paying the dividend. A company that has to answer about whether it has a problem paying the dividend or not is a company that I say [don’t buy, don’t buy, don’t buy].”

3. Reddit, Inc. (NYSE:RDDT)

Number of Hedge Fund Holders: 74

Reddit, Inc. (NYSE:RDDT) is one of the stocks Jim Cramer shared his opinions on. A caller asked if the stock’s 10% decline offered a good reentry point after Cramer’s earlier $45 buy recommendation and the stock’s strong rally. He replied:

“Look, I think you own some. I don’t think you need to, I would not, as you know from the club, I would not buy more and violate my basis unless it is down more than it is. I like it. No need to buy more. That’s what I told a lot of people at Total Wine & More… You got it. You got it. Just stay in it.”

Reddit, Inc. (NYSE:RDDT) operates an online platform that hosts interest-based communities where users share content, exchange ideas, and connect through discussions, images, videos, and links. When a caller asked for a potential re-entry point into the stock during the September 2 episode, Cramer replied:

“Okay, Steve Huffman is the most self-effacing of great CEOs of this generation. I like the stock so much. I thought it would come in, so I could buy it for the Charitable Trust… It hasn’t, it’s down five today. I do believe, I thought I could get it at 180, 170… Hold on to the stock. It’s a winner.”

2. NVIDIA Corporation (NASDAQ:NVDA)

Number of Hedge Fund Holders: 235

NVIDIA Corporation (NASDAQ:NVDA) is one of the stocks Jim Cramer shared his opinions on. Cramer discussed the company’s latest deal with OpenAI and said:

“NVIDIA, the ultimate own it, don’t trade it, stock is another one. For weeks now, we’ve been bombarded with questions about demand for NVIDIA’s chips because of concerns about China… Then today, NVIDIA announced a deal with OpenAI to build data centers with a capacity of 10 gigawatts worth of power. Do you know that’s enough power to, to take care of 8 million homes? NVIDIA will invest a hundred billion dollars in OpenAI as part of the transaction… 10 billion per gigawatt. OpenAI is privately held, but when you get a deal like this, it will boost the value when it comes public. And I figure NVIDIA will continue to make fortunes from this investment. Sam Altman, the CEO of OpenAI… [said] endlessly in a CNBC exclusive… about the need for computing power to truly get what’s needed out of artificial intelligence, and only NVIDIA has the power that’s needed. The value of their nine-year partnership is now self-evident. This announcement brightened the entire data center food chain… I say, really, who cares about China? Only the people who traded the stock and are no longer in it, not those who owned it. Oh, it’s discouraging.”

NVIDIA Corporation (NASDAQ:NVDA) delivers computing, graphics, and networking technologies, including GPUs, AI platforms, cloud services, and automotive solutions.

1. Apple Inc. (NASDAQ:AAPL)

Number of Hedge Fund Holders: 156

Apple Inc. (NASDAQ:AAPL) is one of the stocks Jim Cramer shared his opinions on. Cramer reiterated that the stock should “not be traded, just owned.” He commented:

“I figured they’d only reward disciplined investors who stick with Apple as long as it offers the best products. That’s been the thesis, and these are still the best products. Apple kept the faith of the committed investor, including my Charitable Trust, where I’ve demonstrated my fidelity for years… But I was up against a negative narrative… It owned the media, subjecting you to a constant barrage of pessimism about Apple that would make all but the most stalwart owners, or maybe the coolest ones, check out of the stock…

This morning, the Apple bulls at last took charge of the story. The stock shot up more than 4% in response… Unfortunately, as I explained in my book, the constant deluge of negativity that passes for research on Apple scared most people away. I hope it didn’t scare you away from the stock. So I don’t know how many people ultimately got to the promised land of profits. Those who say trade it, don’t own it, got blown out. Once again, another reason why the classic growth stocks, as I say over and over, should not be traded, just owned.”

Apple Inc. (NASDAQ:AAPL) designs and sells iPhones, Macs, iPads, wearables, and accessories, alongside services like AppleCare, iCloud, App Store, and Apple Pay. The company also provides subscription platforms, including Apple Music, Apple TV+, Apple Arcade, and Apple News+.

While we acknowledge the potential of Apple Inc. (NASDAQ:AAPL) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than AAPL and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.