Intel Corporation (NASDAQ:INTC) is one of the stocks Jim Cramer was focused on. Cramer said that the company can “execute” under the CEO Lip-Bu Tan.

“First, let me tell you these incredibly wild circumstances that explained why Intel even needed the cash so that NVIDIA could make the profit. At one time, Intel was by far the most important semiconductor company in the world. It owned the PC and server market, but it didn’t go into fast chips… Not only that, for years Intel ran circles around Advanced Micro Devices, but when Lisa Su took over at AMD and set her sights on taking Intel’s business, she succeeded beyond her wildest dreams… Intel feels lost at aea, dazed and confused.

A few years ago, Intel picked a new CEO, Pat Gelsinger, who vowed to stop losing share in PCs and servers while taking on NVIDIA in accelerated computing and artificial intelligence. Oh man, he spent fortunes far more than Intel could afford. Although he caught a break when the federal government gave Intel some big handouts from President Biden’s Chips Act, but it wasn’t enough. No, uh-uh… Gelsinger was ultimately fired. In came Lip-Bu Tan, possibly the greatest semiconductor venture capitalist in history… Once he came in, he had to end the runaway manufacturing train and raise cash in a hurry, and he’s proved quite adept at that…

Last night, he got that 5 billion from NVIDIA, $23 and 28 cents per share… Intel stock immediately zoomed from just under $25 to 30.57 tonight… Now that was a remarkable move. In return for the money, Intel got a new partner in its PC and server business, where more than 50 billion is up for grabs… Meanwhile, Intel stays in business and can thrive if it executes, and I think it can under Lip-Bu Tan.”

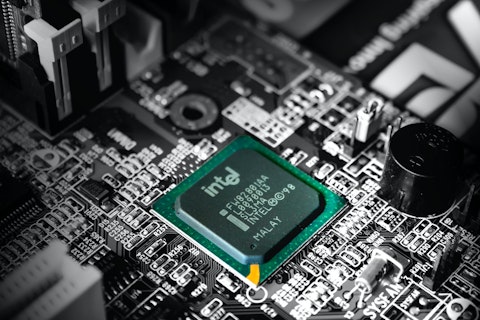

Photo by Slejven Djurakovic on Unsplash

Intel Corporation (NASDAQ:INTC) develops and manufactures semiconductor. It offers CPUs, GPUs, FPGAs, SoCs, memory, and networking products along with AI, edge, and autonomous driving solutions. In addition, the company provides software, design services, and advanced process technologies.

While we acknowledge the risk and potential of INTC as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than INTC and that has 10,000% upside potential, check out our report about this cheapest AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy Right Now.

Disclosure: None. This article is originally published at Insider Monkey.