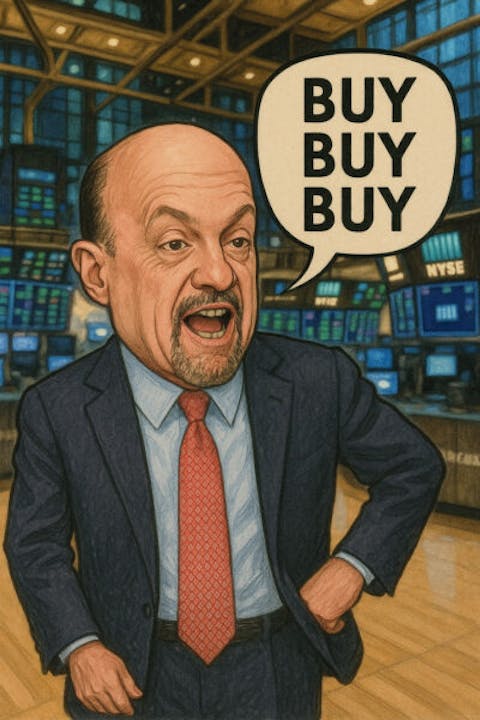

Starbucks shares are down 8% so far this year as investors parse the company’s struggles in China and progress on its turnaround plan. Jim Cramer in a program on CNBC in May commented on SBUX selloff following the company’s quarterly results that missed on earnings and revenue.

“I see the name Starbucks Corp (NASDAQ:SBUX) stock down five and change and I’m boiling. I got—I’m steamed. Not the company or the CEO Brian Niccol or even the coffee. No, I was steamed because of the stupid sellers who are furiously dumping the stock as fast as they could. Sell, sell. There’s Brian Niccol. How dare they. The market opened up hideously off an awful gross domestic product number this morning—showed the economy actually shrinking. Oh my god. 3% in the first quarter. So Starbucks Corp (NASDAQ:SBUX) was just part of the red ink that drenched us.

Why? Because of Niccol, that’s why. You see, I find that when you have a bankable jockey — and Brian’s the man who previously turned around Chipotle — the operator took the chain from the brink of food contamination death and moved the stock up 776% during his tenure versus 109% for the S&P. Well, you gotta ride him. Niccol. You gotta ride him. A Starbucks Corp (NASDAQ:SBUX) newfound glory coming.”

ClearBridge Large Cap Growth Strategy stated the following regarding Starbucks Corporation (NASDAQ:SBUX) in its Q1 2025 investor letter:

“Drilling further down, we have been engaging with management teams of portfolio companies with production outside the U.S. to understand supply change fungibility and the ability to pass through costs to end customers. We are specifically monitoring risks to the consumer sector from tariffs because consumers have already borne the burden of several years of cost inflation pressuring wallets and some areas of spending, like dining outside the home, have easy substitutes. That said, beverage holdings Starbucks Corporation (NASDAQ:SBUX) and Monster both held up well during the quarter. Starbucks is undergoing an earnings reset under new CEO Brian Nicoll that is being well received by investors. Monster, meanwhile, benefited from price increases and strength in its international business.”

While we acknowledge the potential of SBUX, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than SBUX and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires.

Disclosure: None. This article is originally published at Insider Monkey.