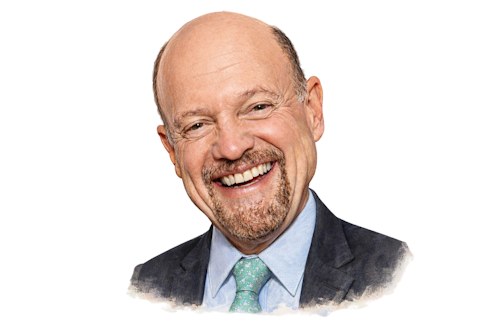

Jim Cramer, the host of Mad Money, said Monday that earnings season is what is really moving stocks right now.

We knew the airlines would have to cancel a lot of flights thanks to the blizzard on Friday. They did. So what? The stocks were therefore mostly unchanged, having discounted the storm in advance… How about the stock of Generac, a company that makes emergency generators? It fell after rallying last week and at one point today, plummeted 11 points because the storm failed to knock out as much power as expected. These were discounted events. So, it’s not that the S&P doesn’t respect everything that happened this weekend. It’s that the S&P is made up of 500 stocks, and the stocks that play the largest role in the index, the Magnificent Seven, simply don’t react much at all to the emotions of the moment.

READ ALSO: Jim Cramer Discussed These 19 Stocks and Market Shortages and Jim Cramer Shared His Weekly Game Plan: 22 Stocks in Focus.

Cramer said the market is in earnings season, which he describes in his book How to Make Money in Any Market as the period when stocks track company fundamentals most closely. During this time, he said that prices tend to align with how a business actually performed, and it focuses on sales and earnings from the most recent quarter, expectations for the next quarter, and projections for the rest of the year.

So let me give you the bottom line: I hope one day, one day, we get away from using the futures overnight and making judgments on them and instead just have people go to Kalshi and make bets on the opening of the market. Then again, if the futures weren’t allowed to be traded, and all the money poured into Kalshi, you and I know what would happen. Very quickly, the bets would dry up. Who wants to lose money every single weekend? Leave that to those who bet on the NFL.

Our Methodology

For this article, we compiled a list of 9 stocks that were discussed by Jim Cramer during the episode of Mad Money aired on January 26. We listed the stocks in the order that Cramer mentioned them. We also provided hedge fund sentiment for each stock as of the third quarter of 2025, which was taken from Insider Monkey’s database of 978 hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 427.7% since May 2014, beating its benchmark by 264 percentage points (see more details here).

Jim Cramer Put These 9 Stocks Under the Microscope

9. NVIDIA Corporation (NASDAQ:NVDA)

Number of Hedge Fund Holders: 234

NVIDIA Corporation (NASDAQ:NVDA) is one of the stocks Jim Cramer put under the microscope. Cramer showed bullish sentiment toward the stock during the episode, as he said:

You know what didn’t matter at all to these bears, though? I got tremendous assurance that there could be some very big Chinese sales on the horizon. Jensen’s in China. That matters. To me, he sounded sanguine. He urged that no one take the sales for granted. I think that’s terrific. I also think that the companies that keep on announcing the reliance on their own chips, Google, Amazon, and today, Microsoft, continue to be gigantic customers of NVIDIA. And the demand away from the hyperscalers is enormous and growing.

In the end, all that matters will be the numbers, but it’s nagging at me that people seem to have so little faith in NVIDIA after all that’s been accomplished here. In fact, the stock went down today despite Jensen’s reassurances of strong demand. Reassurances that have repeatedly drawn me to the stock, not repulsed me, as that seems to be the case for so many others these days. As has been the situation so many times these last two decades, I think the sellers will be wrong. Jensen’s biggest problem is how to keep customers satisfied with their small allocations. The CoreWeave deal helps address that problem. My word of advice to the sellers after talking to Jensen today: own NVIDIA, don’t trade it. That’s the best way to play NVIDIA.

NVIDIA Corporation (NASDAQ:NVDA) develops accelerated computing and AI platforms, GPUs for gaming and professional use, cloud services, robotics and embedded systems, and automotive technologies.

8. CoreWeave, Inc. (NASDAQ:CRWV)

Number of Hedge Fund Holders: 62

CoreWeave, Inc. (NASDAQ:CRWV) is one of the stocks Jim Cramer put under the microscope. Cramer highlighted NVIDIA’s investment in the company, as he commented:

… NVIDIA announced that it invested another $2 billion in CoreWeave, buying 22.9 million shares at $87.20 per share. It was a fantastic verification for CoreWeave, demonstrating that it’s the preferred provider of NVIDIA chips. These are hard to procure. If you’re a big hyperscaler, you’re going to get a serious allocation. If you’re not, though, you know who to go to now. You can set up with NVIDIA by getting it through CoreWeave. This morning on Squawk on the Street, we got to interview CoreWeave founder and CEO, Michael Intrator, as well as Jensen Huang himself, coming from China to talk to us about the deal…

David (co-anchor David Faber) then asked the question on many minds of many skeptics, which is, isn’t this deal just one more example of vendor financing? NVIDIA gives CoreWeave $2 billion. Then CoreWeave turns around and buys product from NVIDIA… Would Michael Intrator take the money and spend it right back as part of a lazy Susan deal? You know what? I think that’s preposterous. That would presume that Jensen’s trying to make his quarter by spending money to get business. He has more business than he knows what to do with. That would presume that Intrator needs the cash, or he couldn’t buy the chips. But Intrator’s had no problem financing his purchases. Not only that, but CoreWeave has been selling its old chips for more than they paid for them because the market’s so tight. Many thought that the chips would be worthless after five years of depreciation. That was totally wrong. So why did NVIDIA do the deal? I think it wants to show the marketplace that CoreWeave is a great partner.

CoreWeave, Inc. (NASDAQ:CRWV) runs a cloud platform designed to power and scale GenAI workloads with high-performance compute, storage, networking, and managed services.