Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Valeant and SunEdison, have not done well during the last 12 months due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average. The top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters. S&P 500 Index returned only 7.6% during the same period and less than 49% of its constituents managed to beat this return. Because their consensus picks have done well, we pay attention to what elite funds and billionaire investors think before doing extensive research on a stock. In this article, we take a closer look at J M Smucker Co (NYSE:SJM) from the perspective of those elite funds.

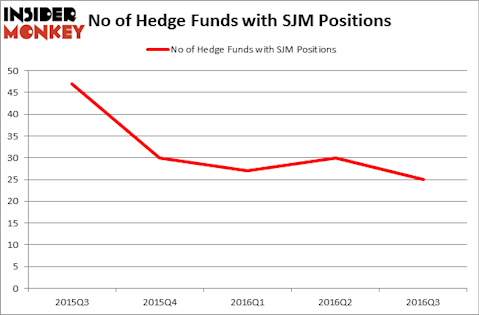

J M Smucker Co (NYSE:SJM) investors should be aware of a decrease in activity from the world’s largest hedge funds recently. SJM was in 25 hedge funds’ portfolios at the end of September. There were 30 hedge funds in our database with SJM holdings at the end of the previous quarter. At the end of this article we will also compare SJM to other stocks including Sasol Limited (ADR) (NYSE:SSL), Tata Motors Limited (ADR) (NYSE:TTM), and Amphenol Corporation (NYSE:APH) to get a better sense of its popularity.

Follow J M Smucker Co (NYSE:SJM)

Follow J M Smucker Co (NYSE:SJM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Goodluz/Shutterstock.com

How have hedgies been trading J M Smucker Co (NYSE:SJM)?

Heading into the fourth quarter of 2016, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a fall of 17% from the previous quarter. Hedge fund ownership of SJM has now fallen by nearly 50% in the last year, a troubling trend. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ariel Investments, managed by John W. Rogers, holds the most valuable position in J M Smucker Co (NYSE:SJM). Ariel Investments has a $147.7 million position in the stock, comprising 1.8% of its 13F portfolio. Coming in second is AQR Capital Management, led by Cliff Asness, holding a $119.4 million position. Some other hedge funds and institutional investors that are bullish consist of Jim Simons’ Renaissance Technologies, Joel Greenblatt’s Gotham Asset Management and Bernard Horn’s Polaris Capital Management.

Seeing as J M Smucker Co (NYSE:SJM) has experienced a decline in interest from hedge fund managers, it’s safe to say that there is a sect of fund managers that elected to cut their entire stakes last quarter. It’s worth mentioning that Principal Global Investors’ Columbus Circle Investors dropped the biggest position of the 700 funds watched by Insider Monkey, worth about $14.3 million in stock. Ricky Sandler’s fund, Eminence Capital, also sold off its stock, about $10.6 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 5 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to J M Smucker Co (NYSE:SJM). These stocks are Sasol Limited (ADR) (NYSE:SSL), Tata Motors Limited (ADR) (NYSE:TTM), Amphenol Corporation (NYSE:APH), and Republic Services, Inc. (NYSE:RSG). This group of stocks’ market values match SJM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SSL | 9 | 23488 | -2 |

| TTM | 22 | 844281 | 10 |

| APH | 21 | 322812 | 2 |

| RSG | 21 | 485314 | -4 |

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $419 million. That figure was $411 million in SJM’s case. Tata Motors Limited (ADR) (NYSE:TTM) is the most popular stock in this table. On the other hand Sasol Limited (ADR) (NYSE:SSL) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks J M Smucker Co (NYSE:SJM) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio, being cautious of the recent selling of it.

Disclosure: None