Intel Corporation (NASDAQ:INTC) fell into the red after slashing its revenue forecast for the first quarter by $1 billion as the company continues to struggle with declining demand for personal computers. Challenging macroeconomic, as well as currency conditions, continue to mount more pressure on the giant chip maker. Fox Business’, Adam Shapiro, believes the only way out of the current debacle for investors is investing in companies that are not affected by currency fluctuations.

The macro environment has remained suppressed in the recent months forcing many people to shy away from upgrading their PCs the way they used to. The Dollar, on the other hand, continues to clock record highs against the Euro a key market for Intel Corporation (NASDAQ:INTC)’s PCs. Meaning the company will always end up with reduced income when converting earnings in Euro’s to dollars.

“I am not going to tell you what company you are going to buy the dollar is not going to get any cheaper over the next year or two. You should be looking at a company, which is not going to have to translate foreign currency back in the U.S dollar because you are going to take a big hit. That’s what is hitting Intel as well,” said Mr. Shapiro.

Intel Corporation (NASDAQ:INTC)’s problems, on the other hand, have been compounded by its late entry into the mobile business an area where QUALCOMM, Inc. (NASDAQ:QCOM) continues to reap big. The growth in popularity for smartphones and tablets has only gone to hurt Intel’s PC business as many people opt not to upgrade their old models at the expense of shifting to the small handheld devices.

Any investor should not be considering investing in the chip business, says Price Futures Group senior market analyst, Phil Flynn, as the situation could get worse going forward. Instead of investing in Intel Corporation (NASDAQ:INTC), Portfolio Wealth Advisors Co-founder, Lee Munson, believes NXP Semiconductors NV (NASDAQ:NXPI) would be the best option as it is not exposed to the effects of declining PC demand.

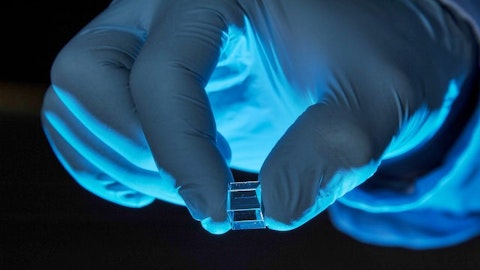

“What they have done is they have this similar to vertically integrated ecosystem, but it’s all about the internet of things and selling chips that have to do with high security. Security is a big issue it’s a big topic of conversation on Wall Street. So if you can find a chipmaker that does not have those legacy issues of making PCs and going to high security and all this little devices with smaller specialty chips. I think you’ve got out a winner,” said Mr. Munson.

Watch the latest video at video.foxbusiness.com

I just made 84% in 4 days by blindly imitating a hedge fund’s stock pick. I will tell you how I pulled such a huge return in such a short time but let me first explain in this FREE REPORT why following hedge funds’ stock picks is one of the smartest things you can do as an investor. We launched our quarterly newsletter 2.5 years ago and not one subscriber has, since, said “I lost money by EXACTLY following your stock picks”. The reason is simple. You can beat index funds by creating a DREAM TEAM of hedge fund managers and investing in only their best ideas. I just made 84% in 4 days by blindly imitating one of these best ideas. CLICK HERE NOW for all the details.