The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Walmart Inc. (NYSE:WMT) from the perspective of those elite funds.

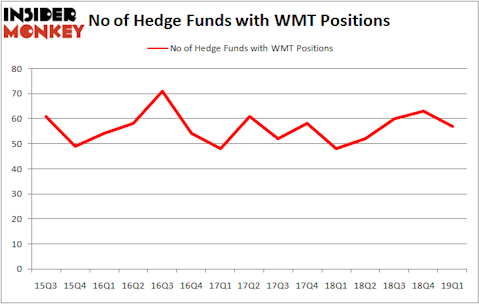

Is Walmart Inc. (NYSE:WMT) a healthy stock for your portfolio? Prominent investors are becoming less hopeful. The number of long hedge fund positions dropped by 6 lately. Our calculations also showed that WMT isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a glance at the latest hedge fund action regarding Walmart Inc. (NYSE:WMT).

What have hedge funds been doing with Walmart Inc. (NYSE:WMT)?

At the end of the first quarter, a total of 57 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -10% from the fourth quarter of 2018. On the other hand, there were a total of 48 hedge funds with a bullish position in WMT a year ago. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

More specifically, Bill & Melinda Gates Foundation Trust was the largest shareholder of Walmart Inc. (NYSE:WMT), with a stake worth $1131.6 million reported as of the end of March. Trailing Bill & Melinda Gates Foundation Trust was Fisher Asset Management, which amassed a stake valued at $956 million. AQR Capital Management, Adage Capital Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Because Walmart Inc. (NYSE:WMT) has experienced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there exists a select few hedgies that slashed their positions entirely heading into Q3. Interestingly, John Lykouretzos’s Hoplite Capital Management dropped the biggest stake of the 700 funds followed by Insider Monkey, worth about $55.7 million in stock. Gregg Moskowitz’s fund, Interval Partners, also sold off its stock, about $34.9 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 6 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Walmart Inc. (NYSE:WMT) but similarly valued. These stocks are Nestle SA (OTCMKTS:NSRGY), Royal Dutch Shell plc (NYSE:RDS), Bank of America Corporation (NYSE:BAC), and The Procter & Gamble Company (NYSE:PG). This group of stocks’ market values are similar to WMT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NSRGY | 4 | 1617628 | 0 |

| RDS | 33 | 1708020 | 0 |

| BAC | 96 | 29064383 | -3 |

| PG | 56 | 9567973 | -4 |

| Average | 47.25 | 10489501 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 47.25 hedge funds with bullish positions and the average amount invested in these stocks was $10490 million. That figure was $4393 million in WMT’s case. Bank of America Corporation (NYSE:BAC) is the most popular stock in this table. On the other hand Nestle SA (OTCMKTS:NSRGY) is the least popular one with only 4 bullish hedge fund positions. Walmart Inc. (NYSE:WMT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on WMT as the stock returned 5.3% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.