In this article you are going to find out whether hedge funds think Vroom, Inc. (NASDAQ:VRM) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

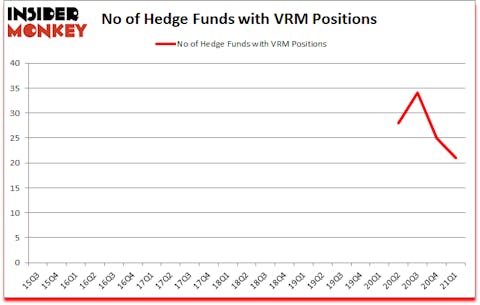

Is VRM a good stock to buy? Vroom, Inc. (NASDAQ:VRM) has seen a decrease in hedge fund interest lately. Vroom, Inc. (NASDAQ:VRM) was in 21 hedge funds’ portfolios at the end of March. The all time high for this statistic is 34. There were 25 hedge funds in our database with VRM holdings at the end of December. Our calculations also showed that VRM isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the eyes of most traders, hedge funds are seen as underperforming, outdated investment vehicles of years past. While there are greater than 8000 funds in operation at present, Our experts look at the masters of this club, around 850 funds. These investment experts manage the lion’s share of the hedge fund industry’s total asset base, and by tracking their unrivaled stock picks, Insider Monkey has determined numerous investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Chuck Schumer recently stated that marijuana legalization will be a Senate priority. So, we are checking out this under the radar stock that will benefit from this. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s take a look at the new hedge fund action encompassing Vroom, Inc. (NASDAQ:VRM).

Do Hedge Funds Think VRM Is A Good Stock To Buy Now?

Heading into the second quarter of 2021, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -16% from one quarter earlier. By comparison, 0 hedge funds held shares or bullish call options in VRM a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

The largest stake in Vroom, Inc. (NASDAQ:VRM) was held by Miller Value Partners, which reported holding $105.4 million worth of stock at the end of December. It was followed by Foxhaven Asset Management with a $78.5 million position. Other investors bullish on the company included Point72 Asset Management, Chilton Investment Company, and Balyasny Asset Management. In terms of the portfolio weights assigned to each position Yarra Square Partners allocated the biggest weight to Vroom, Inc. (NASDAQ:VRM), around 3.32% of its 13F portfolio. Miller Value Partners is also relatively very bullish on the stock, earmarking 2.73 percent of its 13F equity portfolio to VRM.

Due to the fact that Vroom, Inc. (NASDAQ:VRM) has witnessed bearish sentiment from the entirety of the hedge funds we track, we can see that there is a sect of hedgies who were dropping their full holdings last quarter. Intriguingly, Anand Parekh’s Alyeska Investment Group sold off the biggest investment of all the hedgies followed by Insider Monkey, totaling close to $11 million in stock, and Richard SchimeláandáLawrence Sapanski’s Cinctive Capital Management was right behind this move, as the fund dumped about $4.3 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 4 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Vroom, Inc. (NASDAQ:VRM) but similarly valued. We will take a look at Stitch Fix, Inc. (NASDAQ:SFIX), Varonis Systems Inc (NASDAQ:VRNS), Travel + Leisure Co. (NYSE:TNL), Shell Midstream Partners LP (NYSE:SHLX), Daqo New Energy Corp (NYSE:DQ), The Howard Hughes Corporation (NYSE:HHC), and Herbalife Nutrition Ltd. (NYSE:HLF). This group of stocks’ market values match VRM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SFIX | 28 | 465915 | -4 |

| VRNS | 32 | 381944 | 2 |

| TNL | 30 | 745794 | 1 |

| SHLX | 4 | 27451 | -3 |

| DQ | 17 | 129832 | -1 |

| HHC | 27 | 1619423 | 0 |

| HLF | 40 | 1994608 | -1 |

| Average | 25.4 | 766424 | -0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.4 hedge funds with bullish positions and the average amount invested in these stocks was $766 million. That figure was $345 million in VRM’s case. Herbalife Nutrition Ltd. (NYSE:HLF) is the most popular stock in this table. On the other hand Shell Midstream Partners LP (NYSE:SHLX) is the least popular one with only 4 bullish hedge fund positions. Vroom, Inc. (NASDAQ:VRM) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for VRM is 43.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 23.8% in 2021 through July 16th and surpassed the market again by 7.7 percentage points. Unfortunately VRM wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); VRM investors were disappointed as the stock returned -2.2% since the end of March (through 7/16) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Vroom Inc. (NASDAQ:VRM)

Follow Vroom Inc. (NASDAQ:VRM)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Magic Formula Stocks To Buy Now

- 10 Stocks to Buy to Profit from Post-COVID Economic Recovery

- 10 Best Wine Stocks to Invest in 2021

Disclosure: None. This article was originally published at Insider Monkey.