Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed over the past few years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that hedge funds do have great stock picking skills, so let’s take a glance at the smart money sentiment towards VMware, Inc. (NYSE:VMW).

Is VMware, Inc. (NYSE:VMW) a buy right now? The best stock pickers are getting more optimistic. The number of long hedge fund bets advanced by 2 in recent months. At the end of this article we will also compare VMW to other stocks including The Hershey Company (NYSE:HSY), Fiserv, Inc. (NASDAQ:FISV), and Fidelity National Information Services (NYSE:FIS) to get a better sense of its popularity.

Follow Vmware Llc (NYSE:VMW)

Follow Vmware Llc (NYSE:VMW)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

kentoh/Shutterstock.com

With all of this in mind, let’s take a gander at the latest action regarding VMware, Inc. (NYSE:VMW).

Hedge fund activity in VMware, Inc. (NYSE:VMW)

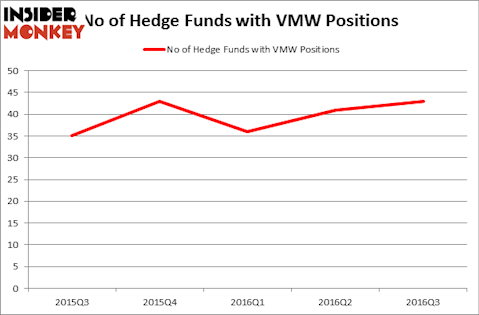

At Q3’s end, a total of 43 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from one quarter earlier. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, D E Shaw, managed by D. E. Shaw, holds the number one position in VMware, Inc. (NYSE:VMW). D E Shaw has a $358.4 million position in the stock, comprising 0.6% of its 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies, managed by Jim Simons, which holds a $142.9 million position; 0.3% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions contain John Paulson’s Paulson & Co, John Overdeck and David Siegel’s Two Sigma Advisors and Seth Klarman’s Baupost Group.