The financial regulations require hedge funds and wealthy investors that exceeded the $100 million holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on December 31st. We at Insider Monkey have made an extensive database of more than 887 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Vericel Corp (NASDAQ:VCEL) based on those filings.

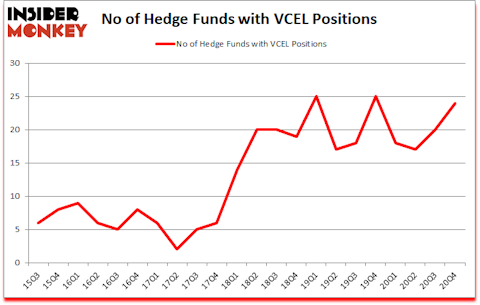

Is VCEL stock a buy? Vericel Corp (NASDAQ:VCEL) has seen an increase in enthusiasm from smart money of late. Vericel Corp (NASDAQ:VCEL) was in 24 hedge funds’ portfolios at the end of December. The all time high for this statistic is 25. Our calculations also showed that VCEL isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In the eyes of most stock holders, hedge funds are perceived as unimportant, old investment vehicles of years past. While there are greater than 8000 funds trading at present, Our experts look at the moguls of this group, about 850 funds. These investment experts preside over most of the hedge fund industry’s total capital, and by keeping track of their unrivaled equity investments, Insider Monkey has found several investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website.

Noam Gottesman of GLG Partners

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, auto parts business is a recession resistant business, so we are taking a closer look at this discount auto parts stock that is growing at a 196% annualized rate. We go through lists like the 15 best micro-cap stocks to buy now to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to analyze the fresh hedge fund action encompassing Vericel Corp (NASDAQ:VCEL).

Do Hedge Funds Think VCEL Is A Good Stock To Buy Now?

At Q4’s end, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 20% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in VCEL over the last 22 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

The largest stake in Vericel Corp (NASDAQ:VCEL) was held by Great Point Partners, which reported holding $27.8 million worth of stock at the end of December. It was followed by Pura Vida Investments with a $21.4 million position. Other investors bullish on the company included Iron Triangle Partners, Parkman Healthcare Partners, and Kent Lake Capital. In terms of the portfolio weights assigned to each position Kent Lake Capital allocated the biggest weight to Vericel Corp (NASDAQ:VCEL), around 5.41% of its 13F portfolio. SilverArc Capital is also relatively very bullish on the stock, designating 5.05 percent of its 13F equity portfolio to VCEL.

Now, some big names have jumped into Vericel Corp (NASDAQ:VCEL) headfirst. Kent Lake Capital, managed by Benjamin Natter, established the most outsized position in Vericel Corp (NASDAQ:VCEL). Kent Lake Capital had $11.4 million invested in the company at the end of the quarter. Devesh Gandhi’s SilverArc Capital also made a $8.7 million investment in the stock during the quarter. The following funds were also among the new VCEL investors: Noam Gottesman’s GLG Partners, Renaissance Technologies, and Principal Global Investors’s Columbus Circle Investors.

Let’s now review hedge fund activity in other stocks similar to Vericel Corp (NASDAQ:VCEL). These stocks are ICF International Inc (NASDAQ:ICFI), NBT Bancorp Inc. (NASDAQ:NBTB), Carpenter Technology Corporation (NYSE:CRS), Lindsay Corporation (NYSE:LNN), Crestwood Equity Partners LP (NYSE:CEQP), New York Mortgage Trust, Inc. (NASDAQ:NYMT), and Travere Therapeutics, Inc. (NASDAQ:TVTX). This group of stocks’ market values match VCEL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ICFI | 13 | 36137 | 1 |

| NBTB | 11 | 11618 | 3 |

| CRS | 14 | 53798 | -2 |

| LNN | 14 | 198093 | -2 |

| CEQP | 2 | 1718 | 0 |

| NYMT | 19 | 35575 | 0 |

| TVTX | 27 | 590113 | 3 |

| Average | 14.3 | 132436 | 0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.3 hedge funds with bullish positions and the average amount invested in these stocks was $132 million. That figure was $133 million in VCEL’s case. Travere Therapeutics, Inc. (NASDAQ:TVTX) is the most popular stock in this table. On the other hand Crestwood Equity Partners LP (NYSE:CEQP) is the least popular one with only 2 bullish hedge fund positions. Vericel Corp (NASDAQ:VCEL) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for VCEL is 81.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 12.3% in 2021 through April 19th and still beat the market by 0.9 percentage points. Hedge funds were also right about betting on VCEL as the stock returned 77.4% since the end of Q4 (through 4/19) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Vericel Corp (NASDAQ:VCEL)

Follow Vericel Corp (NASDAQ:VCEL)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.