A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30th, so let’s proceed with the discussion of the hedge fund sentiment on Ulta Beauty, Inc. (NASDAQ:ULTA).

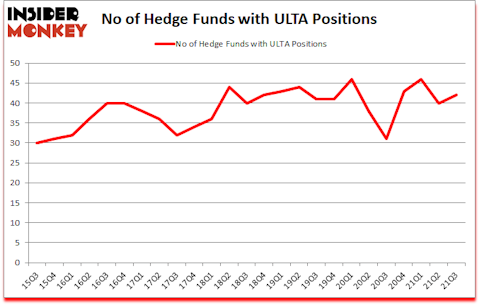

Is Ulta Beauty, Inc. (NASDAQ:ULTA) a buy right now? Money managers were in a bullish mood. The number of bullish hedge fund positions rose by 2 recently. Ulta Beauty, Inc. (NASDAQ:ULTA) was in 42 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 46. Our calculations also showed that ULTA isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

Sander Gerber of Hudson Bay Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind we’re going to view the fresh hedge fund action regarding Ulta Beauty, Inc. (NASDAQ:ULTA).

Do Hedge Funds Think ULTA Is A Good Stock To Buy Now?

At Q3’s end, a total of 42 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from one quarter earlier. On the other hand, there were a total of 31 hedge funds with a bullish position in ULTA a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Robert Joseph Caruso’s Select Equity Group has the number one position in Ulta Beauty, Inc. (NASDAQ:ULTA), worth close to $234.6 million, corresponding to 0.8% of its total 13F portfolio. Sitting at the No. 2 spot is Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $231.2 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions comprise Ken Griffin’s Citadel Investment Group, Ken Griffin’s Citadel Investment Group and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Teewinot Capital Advisers allocated the biggest weight to Ulta Beauty, Inc. (NASDAQ:ULTA), around 4.23% of its 13F portfolio. Kettle Hill Capital Management is also relatively very bullish on the stock, dishing out 3.95 percent of its 13F equity portfolio to ULTA.

As one would reasonably expect, key money managers have jumped into Ulta Beauty, Inc. (NASDAQ:ULTA) headfirst. Laurion Capital Management, managed by Benjamin A. Smith, initiated the most valuable position in Ulta Beauty, Inc. (NASDAQ:ULTA). Laurion Capital Management had $16.4 million invested in the company at the end of the quarter. Kamyar Khajavi’s MIK Capital also made a $8.1 million investment in the stock during the quarter. The following funds were also among the new ULTA investors: Andrew Dalrymple and Barry McCorkell’s Aubrey Capital Management, Sander Gerber’s Hudson Bay Capital Management, and Raymond J. Harbert’s Harbert Management.

Let’s now take a look at hedge fund activity in other stocks similar to Ulta Beauty, Inc. (NASDAQ:ULTA). We will take a look at Trip.com Group Limited (NASDAQ:TCOM), Insulet Corporation (NASDAQ:PODD), AMC Entertainment Holdings Inc (NYSE:AMC), DraftKings Inc. (NASDAQ:DKNG), FirstEnergy Corp. (NYSE:FE), Broadridge Financial Solutions, Inc. (NYSE:BR), and SK Telecom Co., Ltd. (NYSE:SKM). All of these stocks’ market caps resemble ULTA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TCOM | 36 | 1794035 | -5 |

| PODD | 32 | 1318310 | -6 |

| AMC | 17 | 252354 | -4 |

| DKNG | 28 | 1326732 | 2 |

| FE | 38 | 1479736 | 2 |

| BR | 17 | 229119 | -10 |

| SKM | 6 | 108281 | -2 |

| Average | 24.9 | 929795 | -3.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.9 hedge funds with bullish positions and the average amount invested in these stocks was $930 million. That figure was $936 million in ULTA’s case. FirstEnergy Corp. (NYSE:FE) is the most popular stock in this table. On the other hand SK Telecom Co., Ltd. (NYSE:SKM) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Ulta Beauty, Inc. (NASDAQ:ULTA) is more popular among hedge funds. Our overall hedge fund sentiment score for ULTA is 84.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and still managed to beat the market by 5.6 percentage points. Hedge funds were also right about betting on ULTA, though not to the same extent, as the stock returned 6.4% since the end of September (through November 30th) and outperformed the market as well.

Follow Ulta Beauty Inc. (NASDAQ:ULTA)

Follow Ulta Beauty Inc. (NASDAQ:ULTA)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Largest Fast Food Companies Is The World

- 15 Biggest Steel Companies In The World

- 11 largest oil reserves by country in the world in 2021

Disclosure: None. This article was originally published at Insider Monkey.