A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Tronox Ltd (NYSE:TROX).

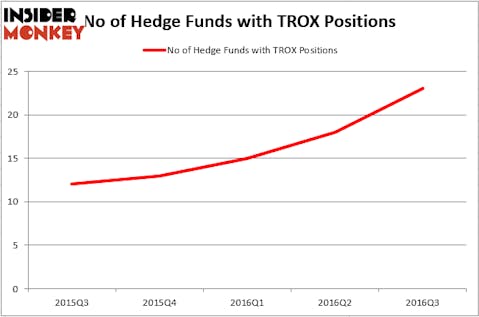

Tronox Ltd (NYSE:TROX) investors should pay attention to an increase in support from the world’s most successful money managers of late. There were 23 hedge funds in our database with TROX positions at the end of September. At the end of this article we will also compare TROX to other stocks including Redwood Trust, Inc. (NYSE:RWT), Ascena Retail Group Inc (NASDAQ:ASNA), and Caleres Inc (NYSE:CAL) to get a better sense of its popularity.

Follow Tronox Holdings Plc (NYSE:TROX)

Follow Tronox Holdings Plc (NYSE:TROX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Bloomua/Shutterstock.com

Keeping this in mind, let’s analyze the fresh action surrounding Tronox Ltd (NYSE:TROX).

What have hedge funds been doing with Tronox Ltd (NYSE:TROX)?

At the end of September, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, which represents an increase of 28% from the previous quarter. By comparison, 13 hedge funds held shares or bullish call options in TROX heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Debra Fine’s Fine Capital Partners has the biggest position in Tronox Ltd (NYSE:TROX), worth close to $50.2 million, corresponding to 5.2% of its total 13F portfolio. On Fine Capital Partners’s heels is Gregg J. Powers’ Private Capital Management, with a $23.1 million position; 3.4% of its 13F portfolio is allocated to the company. Some other peers with similar optimism comprise Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, Marc Lasry’s Avenue Capital, and Israel Englander’s Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, key hedge funds have been driving this bullishness. Scopus Asset Management, led by Alexander Mitchell, initiated the most valuable position in Tronox Ltd (NYSE:TROX). Scopus Asset Management had $4.7 million invested in the company at the end of the quarter. Neil Chriss’ Hutchin Hill Capital also made a $2.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Glenn Russell Dubin’s Highbridge Capital Management, Ken Griffin’s Citadel Investment Group, and David Costen Haley’s HBK Investments.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Tronox Ltd (NYSE:TROX) but similarly valued. These stocks are Redwood Trust, Inc. (NYSE:RWT), Ascena Retail Group Inc (NASDAQ:ASNA), Caleres Inc (NYSE:CAL), and Standard Motor Products, Inc. (NYSE:SMP). This group of stocks’ market values are closest to TROX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RWT | 11 | 141284 | 0 |

| ASNA | 28 | 174589 | 5 |

| CAL | 17 | 55425 | -4 |

| SMP | 10 | 145200 | -1 |

As you can see these stocks had an average of 17 investors with long positions and the average amount invested in these stocks was $129 million. That figure was $153 million in TROX’s case. Ascena Retail Group Inc (NASDAQ:ASNA) is the most popular stock in this table, while Standard Motor Products, Inc. (NYSE:SMP) is the least popular one with only 10 bullish hedge fund positions. Tronox Ltd (NYSE:TROX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Ascena Retail Group Inc (NASDAQ:ASNA) might be a better candidate to consider taking a long position in.

Disclosure: none