A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on The Walt Disney Company (NYSE:DIS).

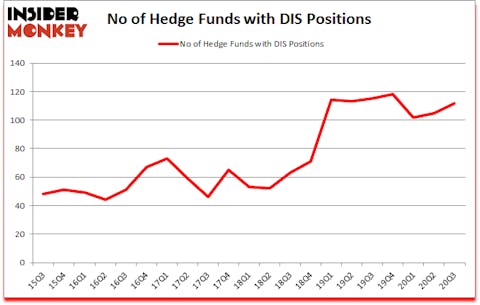

The Walt Disney Company (NYSE:DIS) has seen an increase in enthusiasm from smart money of late. The Walt Disney Company (NYSE:DIS) was in 112 hedge funds’ portfolios at the end of September. The all time high for this statistics is 118. Our calculations also showed that DIS ranked 14th among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 66 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 13% through November 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to analyze the fresh hedge fund action encompassing The Walt Disney Company (NYSE:DIS).

How are hedge funds trading The Walt Disney Company (NYSE:DIS)?

At third quarter’s end, a total of 112 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from one quarter earlier. By comparison, 115 hedge funds held shares or bullish call options in DIS a year ago. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Fisher Asset Management, managed by Ken Fisher, holds the number one position in The Walt Disney Company (NYSE:DIS). Fisher Asset Management has a $1.1784 billion position in the stock, comprising 1% of its 13F portfolio. On Fisher Asset Management’s heels is Coatue Management, led by Philippe Laffont, holding a $1.1699 billion position; the fund has 6.1% of its 13F portfolio invested in the stock. Some other peers with similar optimism comprise D. E. Shaw’s D E Shaw, Dan Loeb’s Third Point and Boykin Curry’s Eagle Capital Management. In terms of the portfolio weights assigned to each position Yost Capital Management allocated the biggest weight to The Walt Disney Company (NYSE:DIS), around 12.2% of its 13F portfolio. Pennant Capital Management is also relatively very bullish on the stock, dishing out 7.53 percent of its 13F equity portfolio to DIS.

Consequently, key money managers were leading the bulls’ herd. Tremblant Capital, managed by Brett Barakett, assembled the largest position in The Walt Disney Company (NYSE:DIS). Tremblant Capital had $120.9 million invested in the company at the end of the quarter. Renaissance Technologies also initiated a $101.4 million position during the quarter. The other funds with brand new DIS positions are Louis Bacon’s Moore Global Investments, Brandon Haley’s Holocene Advisors, and James Dinan’s York Capital Management.

Let’s now review hedge fund activity in other stocks similar to The Walt Disney Company (NYSE:DIS). These stocks are Netflix, Inc. (NASDAQ:NFLX), Intel Corporation (NASDAQ:INTC), The Coca-Cola Company (NYSE:KO), Comcast Corporation (NASDAQ:CMCSA), Merck & Co., Inc. (NYSE:MRK), Bank of America Corporation (NYSE:BAC), and Pfizer Inc. (NYSE:PFE). All of these stocks’ market caps resemble DIS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NFLX | 104 | 12878421 | -9 |

| INTC | 66 | 4342499 | -12 |

| KO | 60 | 22014756 | 1 |

| CMCSA | 82 | 8148816 | 2 |

| MRK | 80 | 6363637 | 4 |

| BAC | 88 | 26637282 | -3 |

| PFE | 66 | 2128534 | 0 |

| Average | 78 | 11787706 | -2.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 78 hedge funds with bullish positions and the average amount invested in these stocks was $11788 million. That figure was $8984 million in DIS’s case. Netflix, Inc. (NASDAQ:NFLX) is the most popular stock in this table. On the other hand The Coca-Cola Company (NYSE:KO) is the least popular one with only 60 bullish hedge fund positions. Compared to these stocks The Walt Disney Company (NYSE:DIS) is more popular among hedge funds. Our overall hedge fund sentiment score for DIS is 92. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 28.1% in 2020 through November 23rd but still managed to beat the market by 15.4 percentage points. Hedge funds were also right about betting on DIS as the stock returned 17.6% since the end of September (through 11/23) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Walt Disney Co (NYSE:DIS)

Follow Walt Disney Co (NYSE:DIS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.