The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 817 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30th, 2020. What do these smart investors think about Target Corporation (NYSE:TGT)?

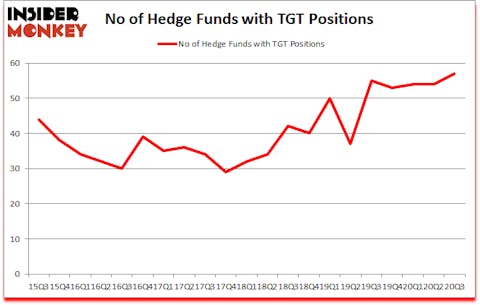

Is Target (TGT) a good stock to buy now? Investors who are in the know were taking an optimistic view. The number of bullish hedge fund bets rose by 3 lately. Target Corporation (NYSE:TGT) was in 57 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistics is 55. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that TGT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are several tools stock market investors put to use to appraise their stock investments. Some of the less known tools are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the top hedge fund managers can beat the S&P 500 by a significant amount (see the details here).

Daniel Sundheim of D1 Capital Partners

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to take a look at the latest hedge fund action surrounding Target Corporation (NYSE:TGT).

What have hedge funds been doing with Target Corporation (NYSE:TGT)?

At the end of September, a total of 57 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the second quarter of 2020. By comparison, 55 hedge funds held shares or bullish call options in TGT a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Renaissance Technologies, holds the biggest position in Target Corporation (NYSE:TGT). Renaissance Technologies has a $1.0751 billion position in the stock, comprising 1.1% of its 13F portfolio. The second most bullish fund manager is AQR Capital Management, managed by Cliff Asness, which holds a $531.4 million position; 0.9% of its 13F portfolio is allocated to the stock. Remaining professional money managers that are bullish consist of John Overdeck and David Siegel’s Two Sigma Advisors, Daniel Sundheim’s D1 Capital Partners and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Stormborn Capital Management allocated the biggest weight to Target Corporation (NYSE:TGT), around 7.43% of its 13F portfolio. Rip Road Capital is also relatively very bullish on the stock, designating 7.36 percent of its 13F equity portfolio to TGT.

As aggregate interest increased, key hedge funds have been driving this bullishness. Candlestick Capital Management, managed by Jack Woodruff, assembled the largest position in Target Corporation (NYSE:TGT). Candlestick Capital Management had $51.7 million invested in the company at the end of the quarter. Gregg Moskowitz’s Interval Partners also made a $38 million investment in the stock during the quarter. The other funds with brand new TGT positions are Steve Cohen’s Point72 Asset Management, Josh Donfeld and David Rogers’s Castle Hook Partners, and Richard Gerson and Navroz D. Udwadia’s Falcon Edge Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Target Corporation (NYSE:TGT). These stocks are Zoetis Inc (NYSE:ZTS), Stryker Corporation (NYSE:SYK), CVS Health Corporation (NYSE:CVS), Morgan Stanley (NYSE:MS), Canadian National Railway Company (NYSE:CNI), Rio Tinto Group (NYSE:RIO), and Sea Limited (NYSE:SE). This group of stocks’ market values match TGT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZTS | 58 | 2248300 | 0 |

| SYK | 48 | 1718729 | -2 |

| CVS | 61 | 1171666 | -4 |

| MS | 70 | 4166963 | 9 |

| CNI | 26 | 2224542 | -2 |

| RIO | 23 | 1276002 | 3 |

| SE | 95 | 7818359 | 13 |

| Average | 54.4 | 2946366 | 2.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 54.4 hedge funds with bullish positions and the average amount invested in these stocks was $2946 million. That figure was $3953 million in TGT’s case. Sea Limited (NYSE:SE) is the most popular stock in this table. On the other hand Rio Tinto Group (NYSE:RIO) is the least popular one with only 23 bullish hedge fund positions. Target Corporation (NYSE:TGT) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for TGT is 61.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 31.6% in 2020 through December 2nd and still beat the market by 16 percentage points. Hedge funds were also right about betting on TGT as the stock returned 12.5% since the end of Q3 (through 12/2) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Target Corp (NYSE:TGT)

Follow Target Corp (NYSE:TGT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.