The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Straight Path Communications Inc (NYSEMKT:STRP).

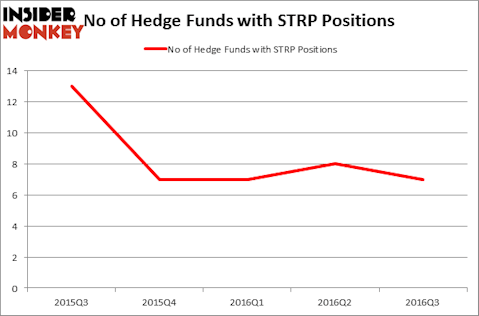

Is Straight Path Communications Inc (NYSEMKT:STRP) a good investment right now? Prominent investors seem to be in a slightly pessimistic mood, as the number of funds from our database long the stock inched down by one last quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Primero Mining Corp (NYSE:PPP), Idera Pharmaceuticals Inc (NASDAQ:IDRA), and Reading International, Inc. (NASDAQ:RDI) to gather more data points.

Follow Straight Path Communications Inc. (NYSE:STRP)

Follow Straight Path Communications Inc. (NYSE:STRP)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Sergey Nivens/Shutterstock.com

Keeping this in mind, let’s analyze the new action regarding Straight Path Communications Inc (NYSEMKT:STRP).

What does the smart money think about Straight Path Communications Inc (NYSEMKT:STRP)?

At Q3’s end, seven funds tracked by Insider Monkey were bullish on this stock, down by 13% from one quarter earlier. By comparison, also seven funds held shares or bullish call options in STRP heading into this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Archer Capital Management, led by Eric Edidin and Josh Lobel, holds the most valuable position in Straight Path Communications Inc (NYSEMKT:STRP). Archer Capital Management has a $16.6 million position in the stock, comprising 4.2% of its 13F portfolio. On Archer Capital Management’s heels is Kahn Brothers, led by Irving Kahn, holding a $5.5 million position; the fund has 1% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions contain Christopher Pucillo’s Solus Alternative Asset Management, Andy Rebak and Michael Scott’s Farmstead Capital Management, and Joe DiMenna’s ZWEIG DIMENNA PARTNERS. We should note that Archer Capital Management is among our list of the 100 best performing funds, which is based on the performance of their 13F long positions in non-microcap stocks.