At Insider Monkey, we pore over the filings of nearly 873 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of June 30th. In this article, we will use that wealth of knowledge to determine whether or not Shopify Inc (NYSE:SHOP) makes for a good investment right now.

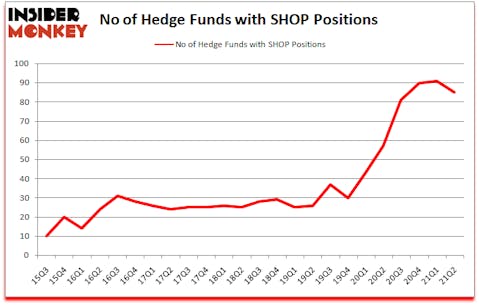

Shopify Inc (NYSE:SHOP) has seen a decrease in hedge fund sentiment of late. Shopify Inc (NYSE:SHOP) was in 85 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 91. There were 91 hedge funds in our database with SHOP positions at the end of the first quarter. Our calculations also showed that SHOP isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). We have been able to outperform the passive index funds by tracking the moves of corporate insiders and hedge funds, and we believe small investors can benefit a lot from reading hedge fund investor letters and 13F filings.

Cathie Wood of ARK Investment Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s check out the new hedge fund action surrounding Shopify Inc (NYSE:SHOP).

Do Hedge Funds Think SHOP Is A Good Stock To Buy Now?

At the end of the second quarter, a total of 85 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in SHOP over the last 24 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Lone Pine Capital was the largest shareholder of Shopify Inc (NYSE:SHOP), with a stake worth $2385.1 million reported as of the end of June. Trailing Lone Pine Capital was ARK Investment Management, which amassed a stake valued at $1781.4 million. Citadel Investment Group, SCGE Management, and Tiger Global Management LLC were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Voleon Capital allocated the biggest weight to Shopify Inc (NYSE:SHOP), around 40.18% of its 13F portfolio. Strategy Capital is also relatively very bullish on the stock, setting aside 26.77 percent of its 13F equity portfolio to SHOP.

Since Shopify Inc (NYSE:SHOP) has faced a decline in interest from the smart money, it’s safe to say that there exists a select few fund managers that elected to cut their positions entirely in the second quarter. Intriguingly, Dan Loeb’s Third Point dropped the biggest position of the 750 funds watched by Insider Monkey, worth an estimated $132.8 million in stock. Benjamin A. Smith’s fund, Laurion Capital Management, also said goodbye to its stock, about $41.9 million worth. These transactions are intriguing to say the least, as total hedge fund interest fell by 6 funds in the second quarter.

Let’s also examine hedge fund activity in other stocks similar to Shopify Inc (NYSE:SHOP). These stocks are United Parcel Service, Inc. (NYSE:UPS), T-Mobile US, Inc. (NASDAQ:TMUS), Texas Instruments Incorporated (NASDAQ:TXN), Costco Wholesale Corporation (NASDAQ:COST), McDonald’s Corporation (NYSE:MCD), Morgan Stanley (NYSE:MS), and Medtronic plc (NYSE:MDT). This group of stocks’ market caps resemble SHOP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UPS | 52 | 2188804 | 8 |

| TMUS | 100 | 8020682 | 2 |

| TXN | 50 | 2468540 | 8 |

| COST | 54 | 4321174 | -2 |

| MCD | 66 | 2714779 | -1 |

| MS | 69 | 5347633 | -10 |

| MDT | 68 | 3390607 | 3 |

| Average | 65.6 | 4064603 | 1.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 65.6 hedge funds with bullish positions and the average amount invested in these stocks was $4065 million. That figure was $13978 million in SHOP’s case. T-Mobile US, Inc. (NASDAQ:TMUS) is the most popular stock in this table. On the other hand Texas Instruments Incorporated (NASDAQ:TXN) is the least popular one with only 50 bullish hedge fund positions. Shopify Inc (NYSE:SHOP) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for SHOP is 62. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24.1% in 2021 through September 20th and beat the market again by 6.9 percentage points. Unfortunately SHOP wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on SHOP were disappointed as the stock returned -1.8% since the end of June (through 9/20) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Shopify Inc. (NASDAQ:SHOP)

Follow Shopify Inc. (NASDAQ:SHOP)

Receive real-time insider trading and news alerts

Suggested Articles:

- 11 Easiest Countries To Adopt A Baby

- Billionaire Lee Cooperman’s Top 10 Stock Picks

- 15 Biggest Canadian Software Companies

Disclosure: None. This article was originally published at Insider Monkey.