We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards Sequential Brands Group Inc (NASDAQ:SQBG) , and what that likely means for the prospects of the company and its stock.

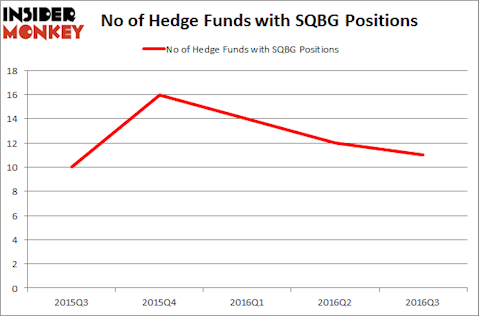

SQBG has seen a decrease in enthusiasm from smart money of late. There were 11 hedge funds in our database with SQBG holdings at the end of September, versus 12 in the prior quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Entercom Communications Corp. (NYSE:ETM), JinkoSolar Holding Co., Ltd. (NYSE:JKS), and Matrix Service Co (NASDAQ:MTRX) to gather more data points.

Follow Sqbg Inc. (NASDAQ:SQBG)

Follow Sqbg Inc. (NASDAQ:SQBG)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

wavebreakmedia/Shutterstock.com

With all of this in mind, we’re going to view the new action surrounding Sequential Brands Group Inc (NASDAQ:SQBG).

Hedge fund activity in Sequential Brands Group Inc (NASDAQ:SQBG)

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from the previous quarter. On the other hand, there were a total of 16 hedge funds with a bullish position in SQBG at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Buckingham Capital Management, led by David Keidan, holds the most valuable position in Sequential Brands Group Inc (NASDAQ:SQBG). Buckingham Capital Management has a $21.3 million position in the stock, comprising 2.7% of its 13F portfolio. The second most bullish fund manager is 683 Capital Partners, led by Ari Zweiman, which holds a $14.7 million position; the fund has 1.6% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions encompass Richard Driehaus’s Driehaus Capital, Mark N. Diker’s Diker Management and Adam Wright and Gary Kohler’s Blue Clay Capital. We should note that two of these hedge funds (683 Capital Partners and Diker Management) are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.