World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

Robert Half International Inc. (NYSE:RHI) has seen an increase in hedge fund interest in recent months. Our calculations also showed that RHI isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

Let’s check out the new hedge fund action encompassing Robert Half International Inc. (NYSE:RHI).

Hedge fund activity in Robert Half International Inc. (NYSE:RHI)

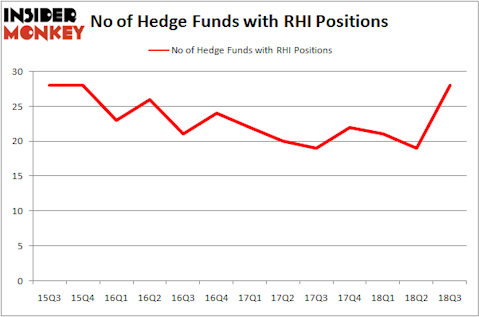

Heading into the fourth quarter of 2018, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 47% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards RHI over the last 13 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

The largest stake in Robert Half International Inc. (NYSE:RHI) was held by AQR Capital Management, which reported holding $329.9 million worth of stock at the end of September. It was followed by Millennium Management with a $58.7 million position. Other investors bullish on the company included Columbus Circle Investors, Millennium Management, and GLG Partners.

Consequently, key hedge funds were breaking ground themselves. Millennium Management, managed by Israel Englander, assembled the biggest call position in Robert Half International Inc. (NYSE:RHI). Millennium Management had $26.3 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also made a $14.4 million investment in the stock during the quarter. The other funds with brand new RHI positions are Matthew Tewksbury’s Stevens Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s now review hedge fund activity in other stocks similar to Robert Half International Inc. (NYSE:RHI). We will take a look at Allegion plc (NYSE:ALLE), Qiagen NV (NASDAQ:QGEN), Equity Lifestyle Properties, Inc. (NYSE:ELS), and Formula One Group (NASDAQ:FWONK). This group of stocks’ market caps match RHI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ALLE | 15 | 554077 | 3 |

| QGEN | 24 | 415251 | 2 |

| ELS | 14 | 528054 | 0 |

| FWONK | 39 | 2195969 | 0 |

| Average | 23 | 923338 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $923 million. That figure was $541 million in RHI’s case. Formula One Group (NASDAQ:FWONK) is the most popular stock in this table. On the other hand Equity Lifestyle Properties, Inc. (NYSE:ELS) is the least popular one with only 14 bullish hedge fund positions. Robert Half International Inc. (NYSE:RHI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard FWONK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.