Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Range Resources Corp. (NYSE:RRC).

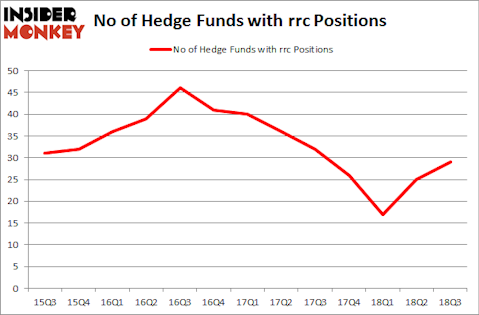

Range Resources Corp. (NYSE:RRC) was in 29 hedge funds’ portfolios at the end of the third quarter of 2018. RRC has seen an increase in hedge fund interest of late. There were 25 hedge funds in our database with RRC positions at the end of the previous quarter. Our calculations also showed that rrc isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are seen as underperforming, old financial tools of years past. While there are greater than 8,000 funds trading at present, Our experts choose to focus on the masters of this club, around 700 funds. These investment experts manage the lion’s share of all hedge funds’ total capital, and by watching their best investments, Insider Monkey has spotted many investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a peek at the recent hedge fund action regarding Range Resources Corp. (NYSE:RRC).

How are hedge funds trading Range Resources Corp. (NYSE:RRC)?

Heading into the fourth quarter of 2018, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 16% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in RRC over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, MacKenzie B. Davis and Kenneth L. Settles Jr’s SailingStone Capital Partners has the biggest position in Range Resources Corp. (NYSE:RRC), worth close to $707.6 million, amounting to 22.8% of its total 13F portfolio. The second most bullish fund manager is Millennium Management, led by Israel Englander, holding a $108.7 million call position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism include Ross Margolies’s Stelliam Investment Management, Ken Griffin’s Citadel Investment Group and Clint Carlson’s Carlson Capital.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Encompass Capital Advisors, managed by Todd J. Kantor, assembled the most outsized position in Range Resources Corp. (NYSE:RRC). Encompass Capital Advisors had $56 million invested in the company at the end of the quarter. Ross Margolies’s Stelliam Investment Management also initiated a $25.3 million position during the quarter. The other funds with new positions in the stock are Robert Polak’s Anchor Bolt Capital, Vince Maddi and Shawn Brennan’s SIR Capital Management, and Till Bechtolsheimer’s Arosa Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Range Resources Corp. (NYSE:RRC) but similarly valued. We will take a look at Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC), Paylocity Holding Corp (NASDAQ:PCTY), Cimpress NV (NASDAQ:CMPR), and TFS Financial Corporation (NASDAQ:TFSL). This group of stocks’ market caps are closest to RRC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TKC | 8 | 12928 | 0 |

| PCTY | 22 | 203032 | 1 |

| CMPR | 17 | 660721 | 0 |

| TFSL | 9 | 125395 | 1 |

| Average | 14 | 250519 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $251 million. That figure was $1.43 billion in RRC’s case. Paylocity Holding Corp (NASDAQ:PCTY) is the most popular stock in this table. On the other hand Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Range Resources Corp. (NYSE:RRC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.